4 min

14 nov. 2024

Indicateurs

Exponential Moving Averages: The Most Powerful Technical Indicator in Modern Trading

Exponential Moving Averages: The Most Powerful Technical Indicator in Modern Trading

In the complex world of trading, Exponential Moving Averages (EMA) stand out as one of the most reliable technical indicators. According to a study published in the Journal of Financial Markets (2023), EMA-based strategies outperform simple moving average strategies by 23% on average in crypto markets. This superiority is explained by their ability to react more quickly to price movements, a crucial advantage in increasingly volatile markets.

Lucas Inglese

Lucas Inglese

Trading instructor

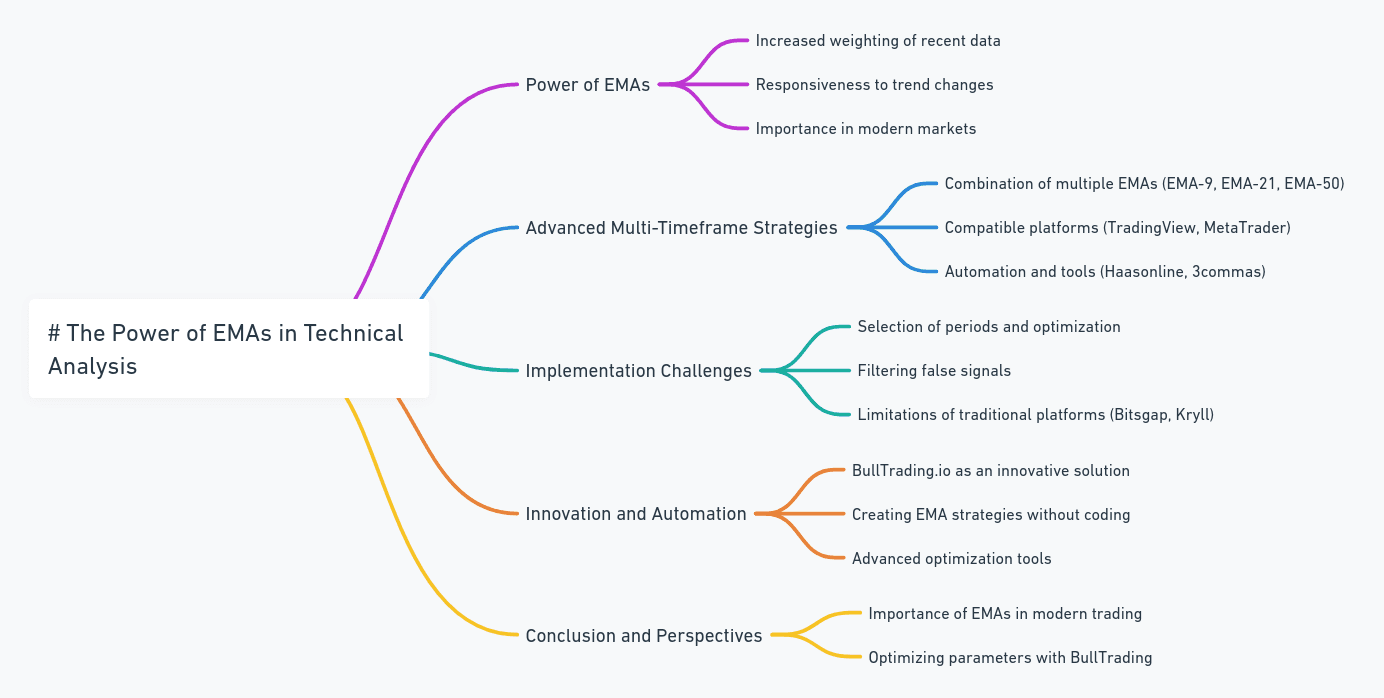

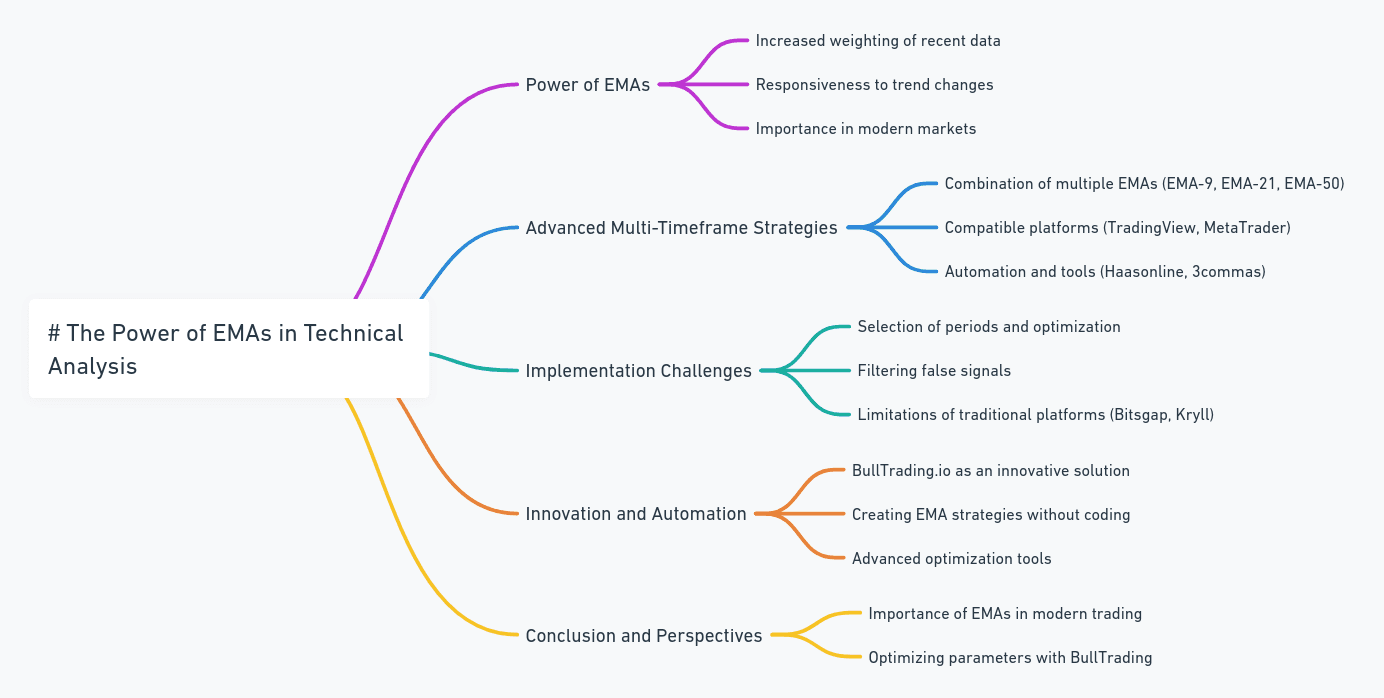

The Power of EMA in Technical Analysis

Exponential moving averages are distinguished by their increased weighting of recent data. Unlike simple moving averages that treat all periods equally, EMA gives more importance to recent prices, thus providing more reactive signals. For example, an EMA-20 will react nearly twice as fast as an SMA-20 to trend reversals. This feature is particularly valuable in modern markets where execution speed is paramount.

Advanced Multi-Timeframe Strategies

The combined use of EMAs across different periods enables creating sophisticated trading systems. The "Triple EMA" strategy (EMA-9, EMA-21, EMA-50) is particularly popular among institutional traders. Platforms like TradingView or MetaTrader allow implementing these strategies but often require programming skills for complete automation. Solutions like Haasonline or 3commas offer alternatives, but with significant limitations in terms of customization.

Implementation Challenges

Implementing EMA-based strategies presents several technical challenges. Period selection is crucial and requires rigorous optimization. False signals, particularly numerous in choppy markets, must be efficiently filtered. Traditional platforms like Bitsgap or Kryll offer partial solutions but often lack flexibility to adapt strategies to changing market conditions.

Innovation and Automation

Facing these challenges, BullTrading.io emerges as an innovative solution. The platform allows creating complex EMA strategies without programming while offering advanced optimization tools. For a deep understanding of practical implementation, I recommend watching "Master BullTrading's Chart Helper Tool! (Complete Tutorial)" which demonstrates how to visualize and perfect your EMA strategies.

Conclusion and Perspectives

Exponential moving averages remain a pillar of modern trading, but their effectiveness largely depends on the quality of their implementation. To start exploiting their potential, I invite you to discover "Optimize Trading Strategy Parameters Easily with BullTrading!" which will guide you in optimizing your EMA parameters for optimal results.

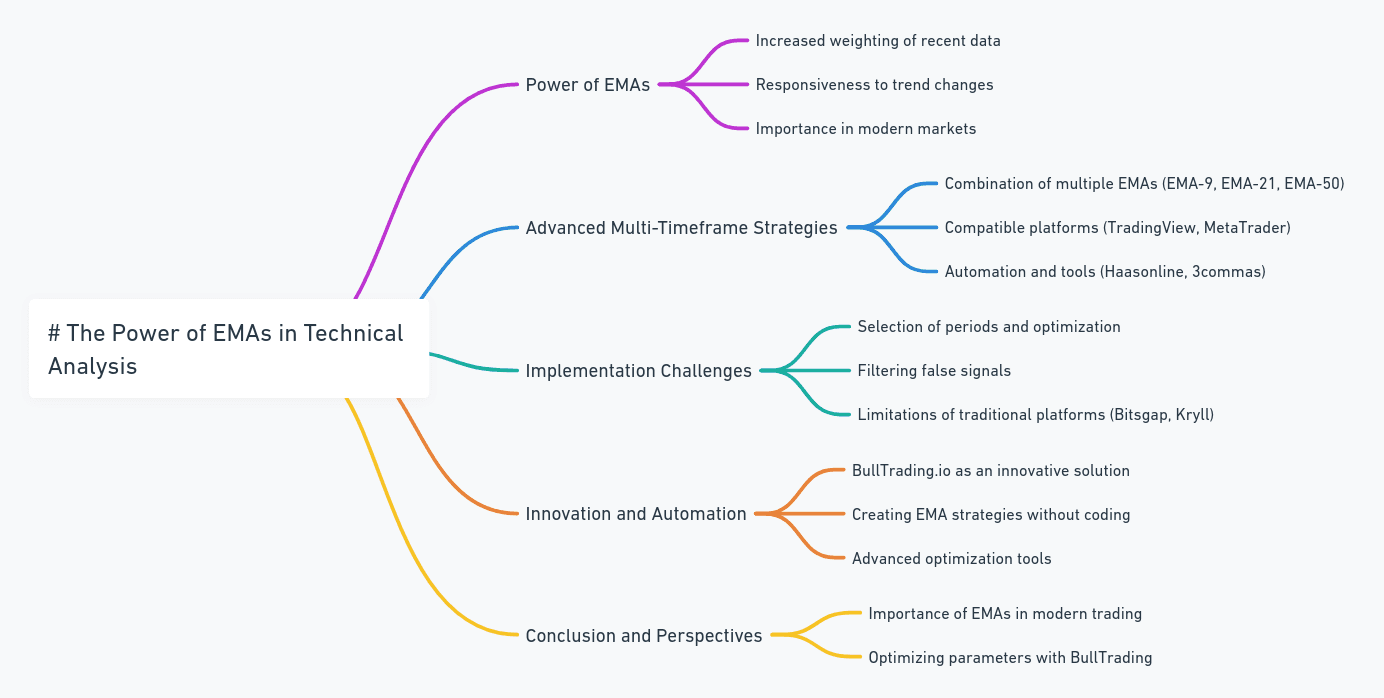

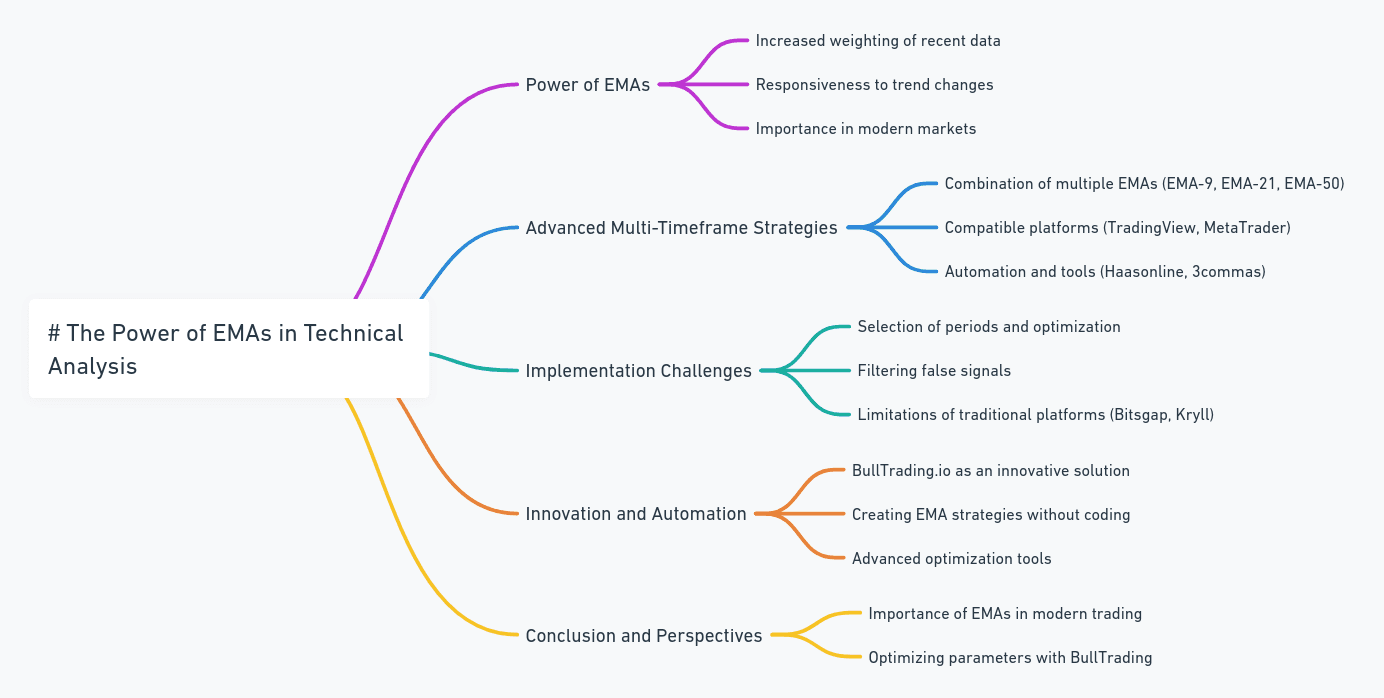

The Power of EMA in Technical Analysis

Exponential moving averages are distinguished by their increased weighting of recent data. Unlike simple moving averages that treat all periods equally, EMA gives more importance to recent prices, thus providing more reactive signals. For example, an EMA-20 will react nearly twice as fast as an SMA-20 to trend reversals. This feature is particularly valuable in modern markets where execution speed is paramount.

Advanced Multi-Timeframe Strategies

The combined use of EMAs across different periods enables creating sophisticated trading systems. The "Triple EMA" strategy (EMA-9, EMA-21, EMA-50) is particularly popular among institutional traders. Platforms like TradingView or MetaTrader allow implementing these strategies but often require programming skills for complete automation. Solutions like Haasonline or 3commas offer alternatives, but with significant limitations in terms of customization.

Implementation Challenges

Implementing EMA-based strategies presents several technical challenges. Period selection is crucial and requires rigorous optimization. False signals, particularly numerous in choppy markets, must be efficiently filtered. Traditional platforms like Bitsgap or Kryll offer partial solutions but often lack flexibility to adapt strategies to changing market conditions.

Innovation and Automation

Facing these challenges, BullTrading.io emerges as an innovative solution. The platform allows creating complex EMA strategies without programming while offering advanced optimization tools. For a deep understanding of practical implementation, I recommend watching "Master BullTrading's Chart Helper Tool! (Complete Tutorial)" which demonstrates how to visualize and perfect your EMA strategies.

Conclusion and Perspectives

Exponential moving averages remain a pillar of modern trading, but their effectiveness largely depends on the quality of their implementation. To start exploiting their potential, I invite you to discover "Optimize Trading Strategy Parameters Easily with BullTrading!" which will guide you in optimizing your EMA parameters for optimal results.

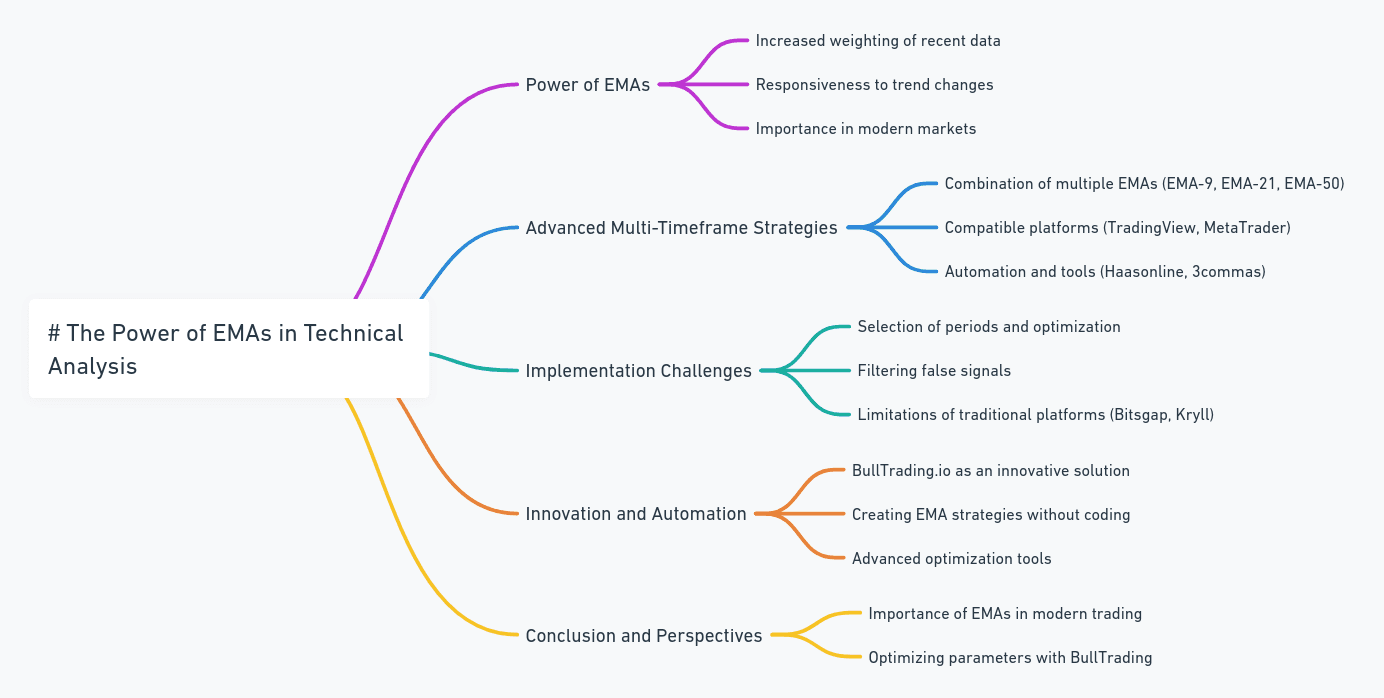

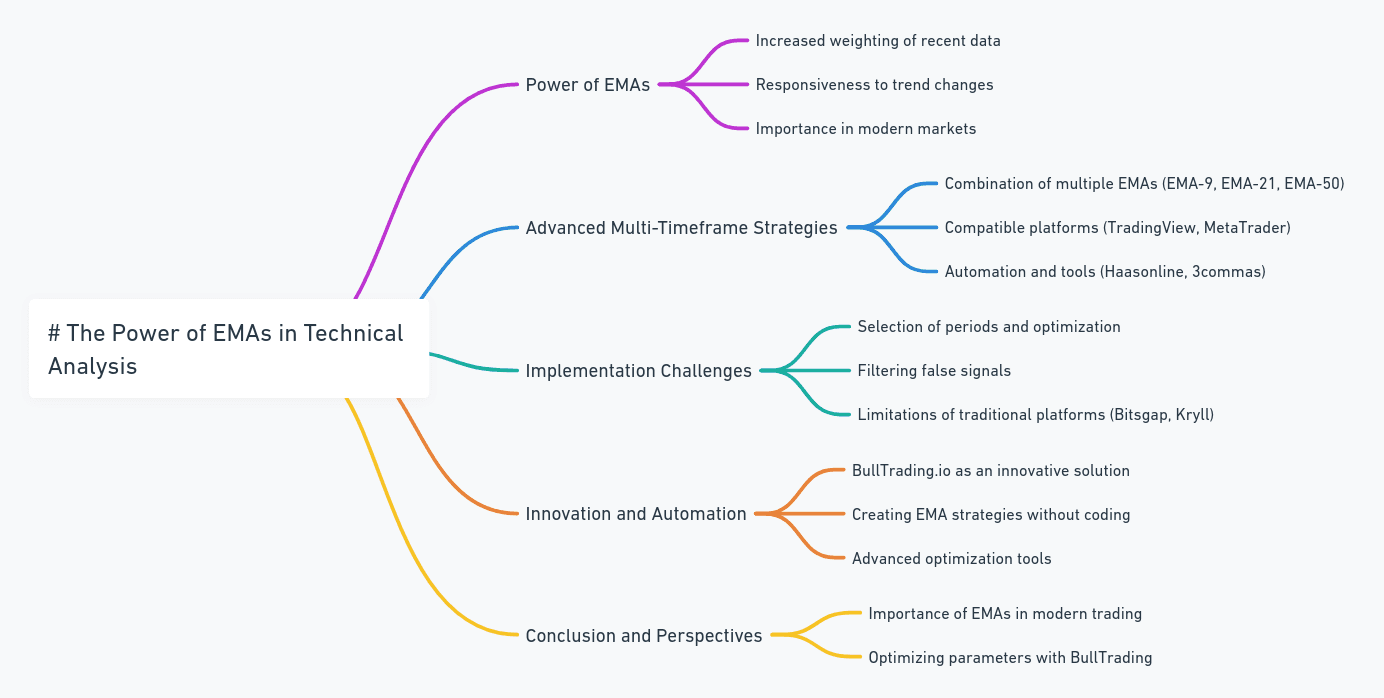

The Power of EMA in Technical Analysis

Exponential moving averages are distinguished by their increased weighting of recent data. Unlike simple moving averages that treat all periods equally, EMA gives more importance to recent prices, thus providing more reactive signals. For example, an EMA-20 will react nearly twice as fast as an SMA-20 to trend reversals. This feature is particularly valuable in modern markets where execution speed is paramount.

Advanced Multi-Timeframe Strategies

The combined use of EMAs across different periods enables creating sophisticated trading systems. The "Triple EMA" strategy (EMA-9, EMA-21, EMA-50) is particularly popular among institutional traders. Platforms like TradingView or MetaTrader allow implementing these strategies but often require programming skills for complete automation. Solutions like Haasonline or 3commas offer alternatives, but with significant limitations in terms of customization.

Implementation Challenges

Implementing EMA-based strategies presents several technical challenges. Period selection is crucial and requires rigorous optimization. False signals, particularly numerous in choppy markets, must be efficiently filtered. Traditional platforms like Bitsgap or Kryll offer partial solutions but often lack flexibility to adapt strategies to changing market conditions.

Innovation and Automation

Facing these challenges, BullTrading.io emerges as an innovative solution. The platform allows creating complex EMA strategies without programming while offering advanced optimization tools. For a deep understanding of practical implementation, I recommend watching "Master BullTrading's Chart Helper Tool! (Complete Tutorial)" which demonstrates how to visualize and perfect your EMA strategies.

Conclusion and Perspectives

Exponential moving averages remain a pillar of modern trading, but their effectiveness largely depends on the quality of their implementation. To start exploiting their potential, I invite you to discover "Optimize Trading Strategy Parameters Easily with BullTrading!" which will guide you in optimizing your EMA parameters for optimal results.

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required