4 min

13 nov. 2024

Éditeur

Monte Carlo Simulations: The Secret Weapon for Validating Trading Strategies

Monte Carlo Simulations: The Secret Weapon for Validating Trading Strategies

In the world of algorithmic trading, strategy validation often represents the breaking point between success and failure. According to a study published in the Journal of Trading (2022), over 73% of trading strategies that appear profitable in simple backtesting fail in real conditions. The reason? Insufficient validation that doesn't account for market variability. Monte Carlo simulations emerge as an essential solution for testing trading strategy robustness.

Lucas Inglese

Lucas Inglese

Trading instructor

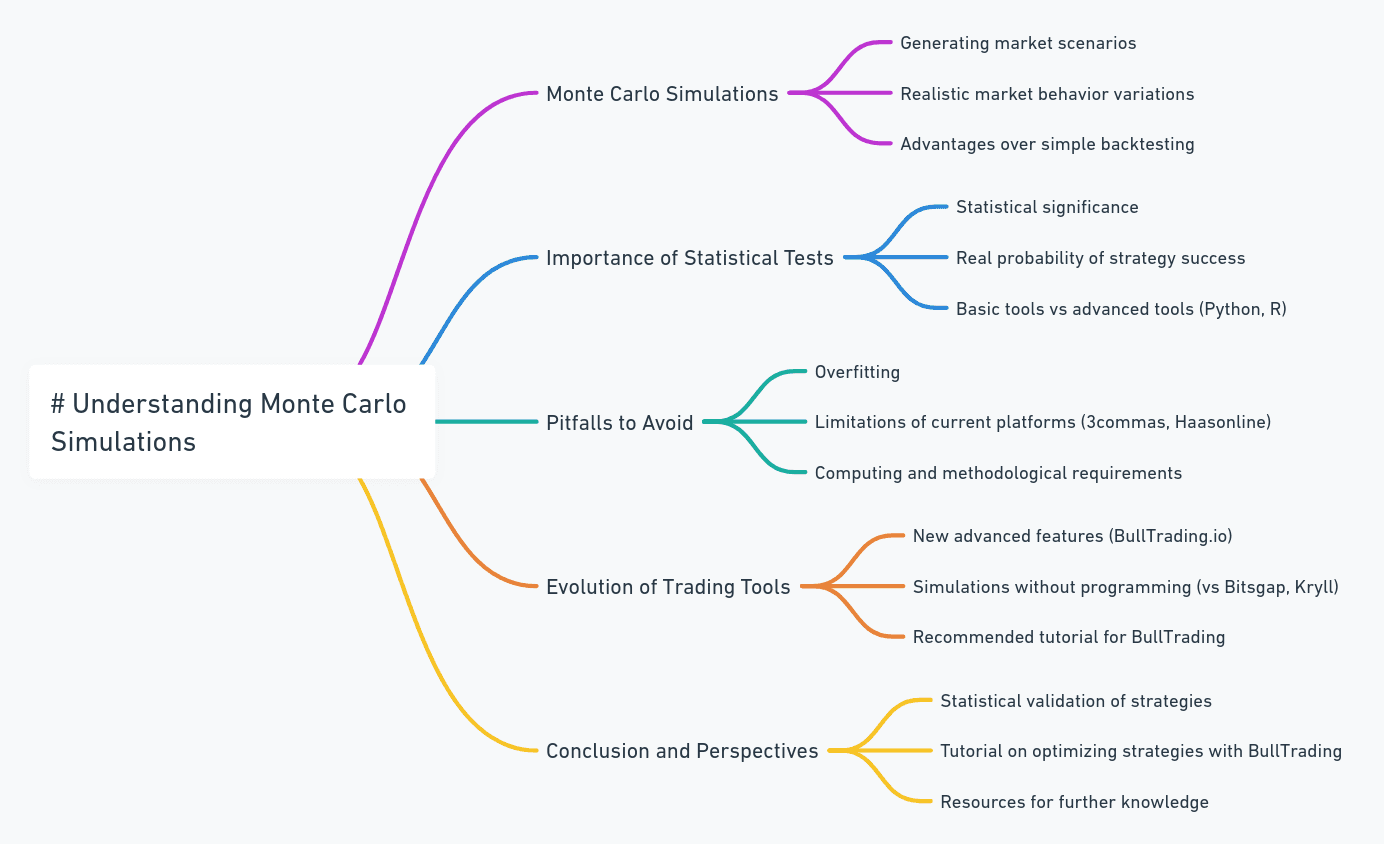

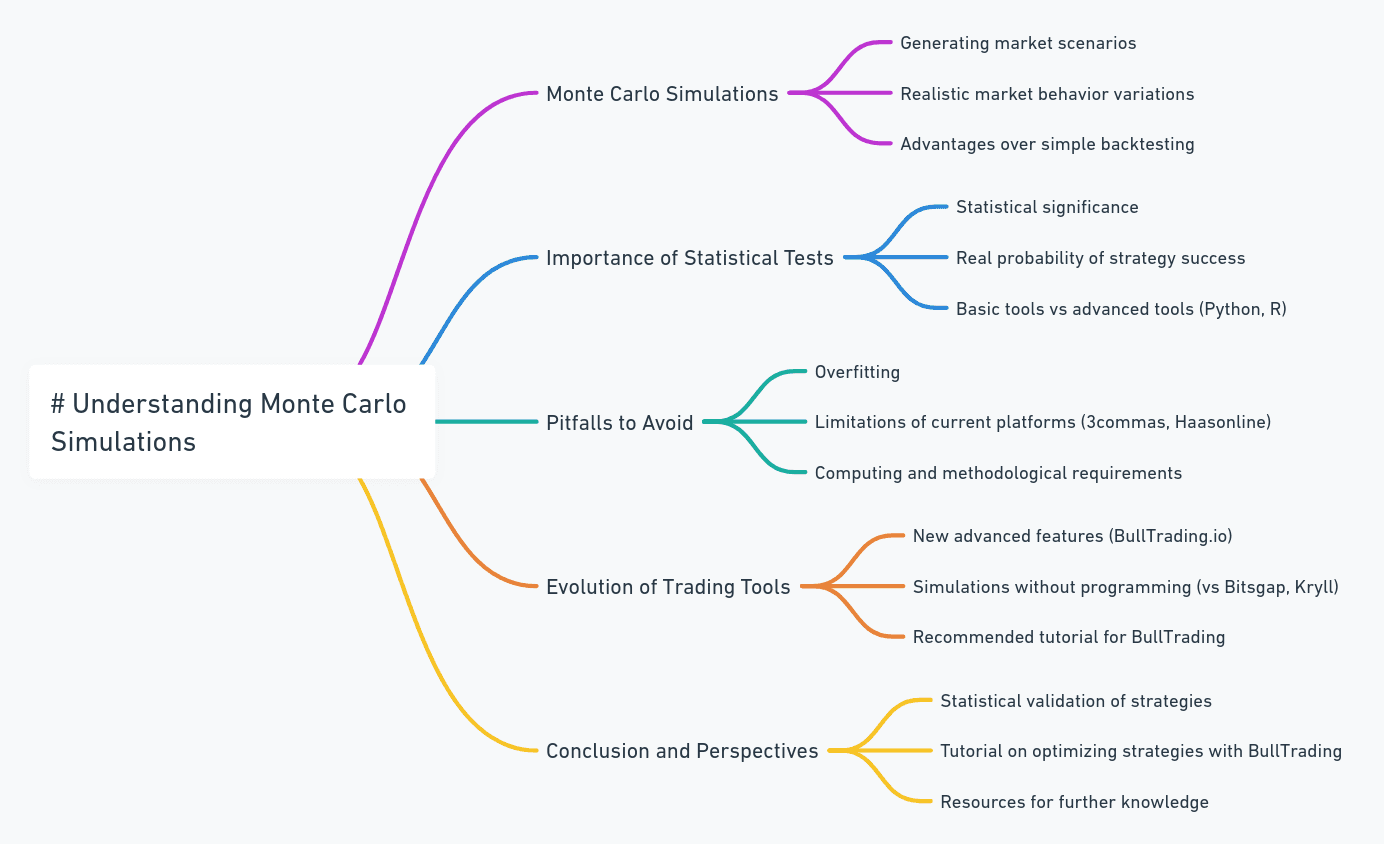

Understanding Monte Carlo Simulations

Monte Carlo simulations are powerful mathematical tools that allow for generating thousands of possible market scenarios. In trading, this method involves randomly modifying historical data to create realistic variations in market behavior. For example, a strategy tested on 1000 different simulations will give a much more accurate picture of its potential performance than a simple backtest on historical data. This approach often reveals hidden weaknesses that wouldn't be apparent otherwise.

The Importance of Statistical Testing

In quantitative trading, statistical significance is crucial. Traditional backtesting can show promising results by pure chance. Monte Carlo simulations allow calculating the real probability of success for a strategy. Platforms like TradingView or MetaTrader offer basic backtesting features but often lack advanced statistical tools. More technical traders turn to Python or R, requiring considerable programming skills.

Pitfalls to Avoid

Implementing Monte Carlo simulations presents several major challenges. Overfitting is the most dangerous: a strategy might seem perfect on historical data but fail on new data. Available solutions like 3commas or Haasonline offer backtesting tools, but their Monte Carlo simulation capabilities are often limited or non-existent. Additionally, managing multiple scenarios requires significant computational power and a rigorous methodology.

The Evolution of Trading Tools

Facing these challenges, modern algorithmic trading platforms are evolving rapidly. BullTrading.io stands out by natively integrating advanced backtesting and optimization features. For a detailed understanding of how to effectively test your strategies, I highly recommend watching "Backtest your Trading strategy with BullTrading! (Complete Tutorial)" which explains the methodology step by step.

Conclusion and Future Perspectives

Statistical validation of trading strategies is no longer optional in an increasingly complex market. To deepen your knowledge and start creating robust strategies, I invite you to discover "Optimize Trading strategy parameters easily with BullTrading!". This resource will guide you in optimizing and validating your trading strategies.

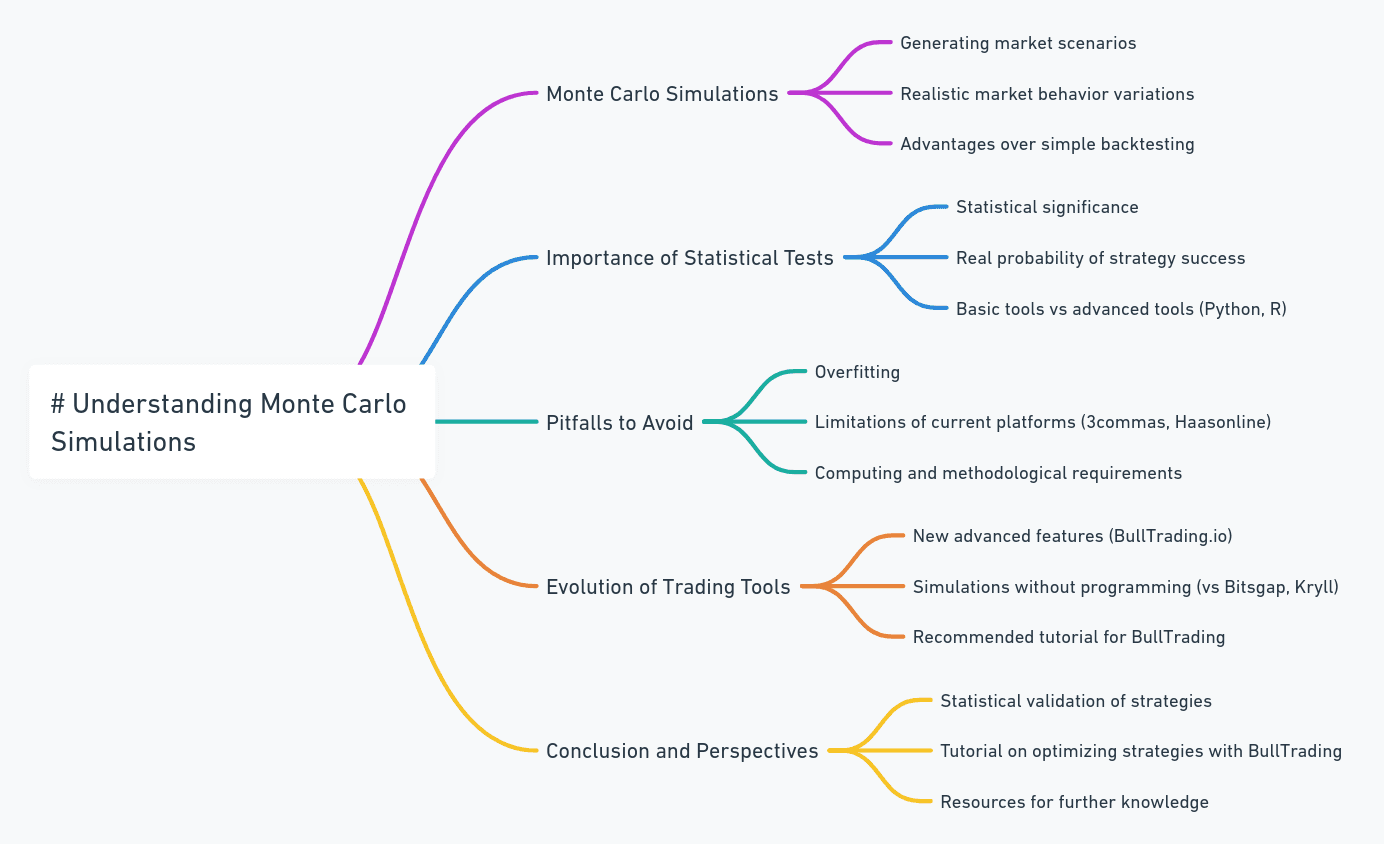

Understanding Monte Carlo Simulations

Monte Carlo simulations are powerful mathematical tools that allow for generating thousands of possible market scenarios. In trading, this method involves randomly modifying historical data to create realistic variations in market behavior. For example, a strategy tested on 1000 different simulations will give a much more accurate picture of its potential performance than a simple backtest on historical data. This approach often reveals hidden weaknesses that wouldn't be apparent otherwise.

The Importance of Statistical Testing

In quantitative trading, statistical significance is crucial. Traditional backtesting can show promising results by pure chance. Monte Carlo simulations allow calculating the real probability of success for a strategy. Platforms like TradingView or MetaTrader offer basic backtesting features but often lack advanced statistical tools. More technical traders turn to Python or R, requiring considerable programming skills.

Pitfalls to Avoid

Implementing Monte Carlo simulations presents several major challenges. Overfitting is the most dangerous: a strategy might seem perfect on historical data but fail on new data. Available solutions like 3commas or Haasonline offer backtesting tools, but their Monte Carlo simulation capabilities are often limited or non-existent. Additionally, managing multiple scenarios requires significant computational power and a rigorous methodology.

The Evolution of Trading Tools

Facing these challenges, modern algorithmic trading platforms are evolving rapidly. BullTrading.io stands out by natively integrating advanced backtesting and optimization features. For a detailed understanding of how to effectively test your strategies, I highly recommend watching "Backtest your Trading strategy with BullTrading! (Complete Tutorial)" which explains the methodology step by step.

Conclusion and Future Perspectives

Statistical validation of trading strategies is no longer optional in an increasingly complex market. To deepen your knowledge and start creating robust strategies, I invite you to discover "Optimize Trading strategy parameters easily with BullTrading!". This resource will guide you in optimizing and validating your trading strategies.

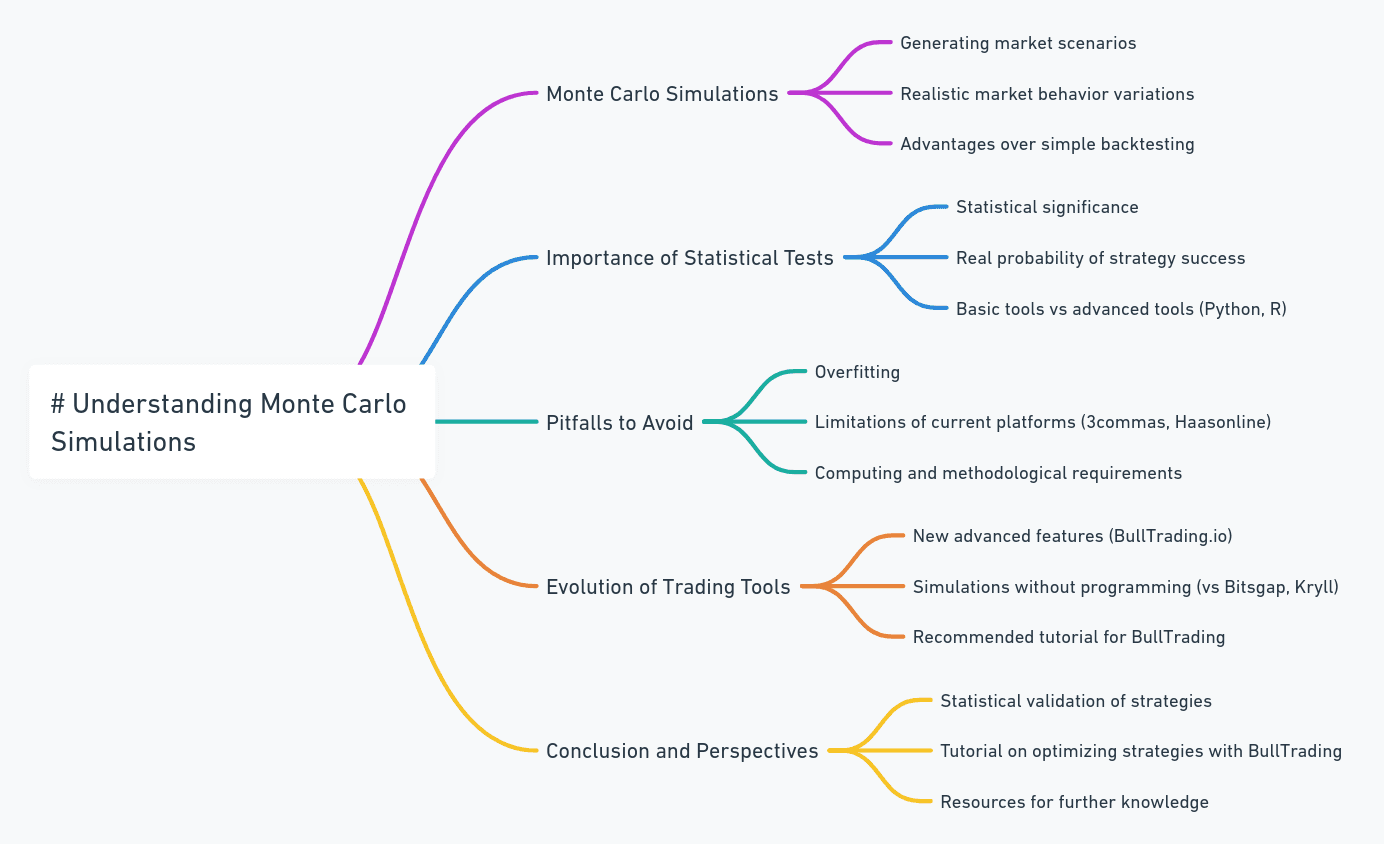

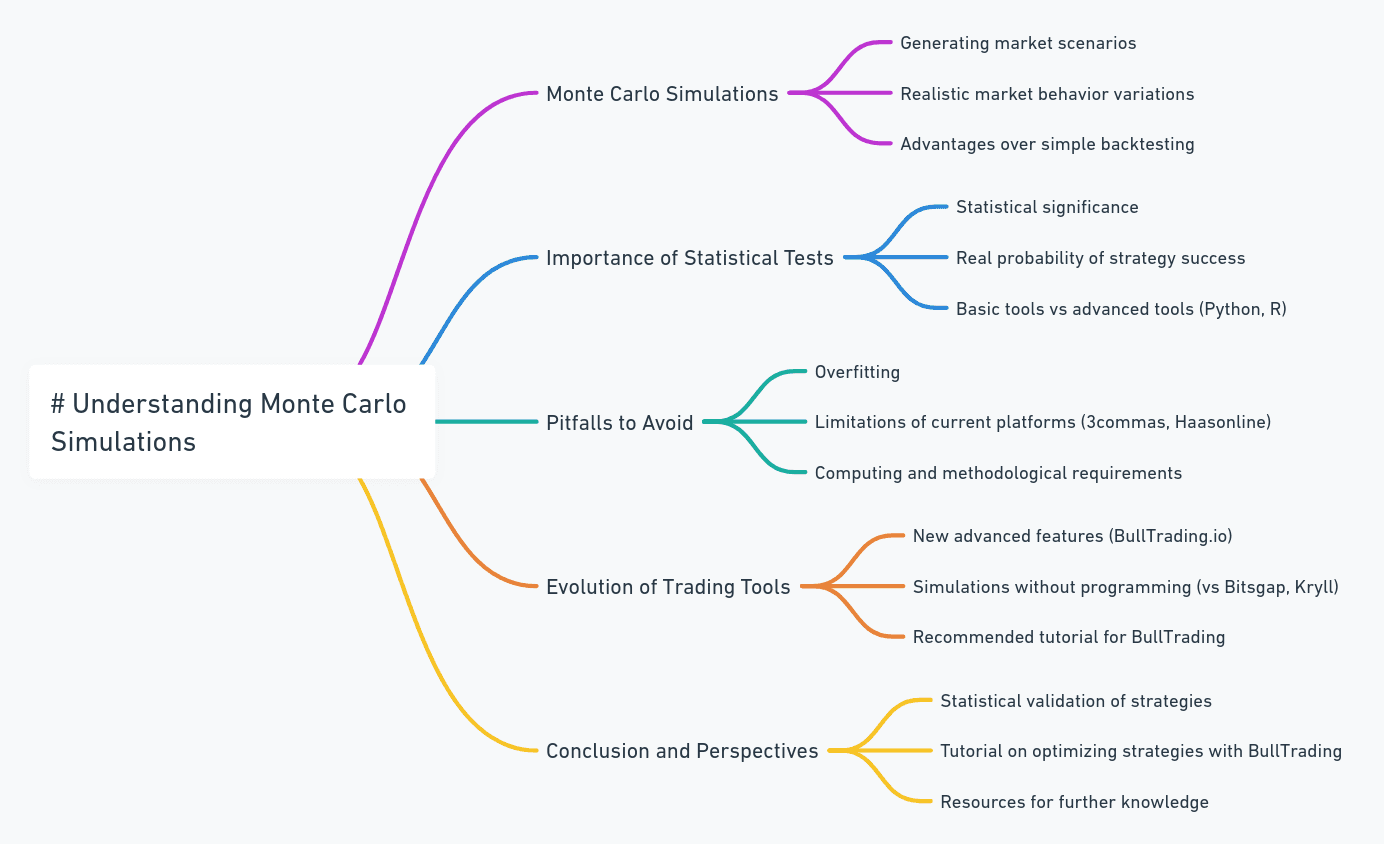

Understanding Monte Carlo Simulations

Monte Carlo simulations are powerful mathematical tools that allow for generating thousands of possible market scenarios. In trading, this method involves randomly modifying historical data to create realistic variations in market behavior. For example, a strategy tested on 1000 different simulations will give a much more accurate picture of its potential performance than a simple backtest on historical data. This approach often reveals hidden weaknesses that wouldn't be apparent otherwise.

The Importance of Statistical Testing

In quantitative trading, statistical significance is crucial. Traditional backtesting can show promising results by pure chance. Monte Carlo simulations allow calculating the real probability of success for a strategy. Platforms like TradingView or MetaTrader offer basic backtesting features but often lack advanced statistical tools. More technical traders turn to Python or R, requiring considerable programming skills.

Pitfalls to Avoid

Implementing Monte Carlo simulations presents several major challenges. Overfitting is the most dangerous: a strategy might seem perfect on historical data but fail on new data. Available solutions like 3commas or Haasonline offer backtesting tools, but their Monte Carlo simulation capabilities are often limited or non-existent. Additionally, managing multiple scenarios requires significant computational power and a rigorous methodology.

The Evolution of Trading Tools

Facing these challenges, modern algorithmic trading platforms are evolving rapidly. BullTrading.io stands out by natively integrating advanced backtesting and optimization features. For a detailed understanding of how to effectively test your strategies, I highly recommend watching "Backtest your Trading strategy with BullTrading! (Complete Tutorial)" which explains the methodology step by step.

Conclusion and Future Perspectives

Statistical validation of trading strategies is no longer optional in an increasingly complex market. To deepen your knowledge and start creating robust strategies, I invite you to discover "Optimize Trading strategy parameters easily with BullTrading!". This resource will guide you in optimizing and validating your trading strategies.

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required