6 min

17 nov. 2024

Éditeur

The Importance of Robustness Testing in Automated Trading: From Theory to Practice

The Importance of Robustness Testing in Automated Trading: From Theory to Practice

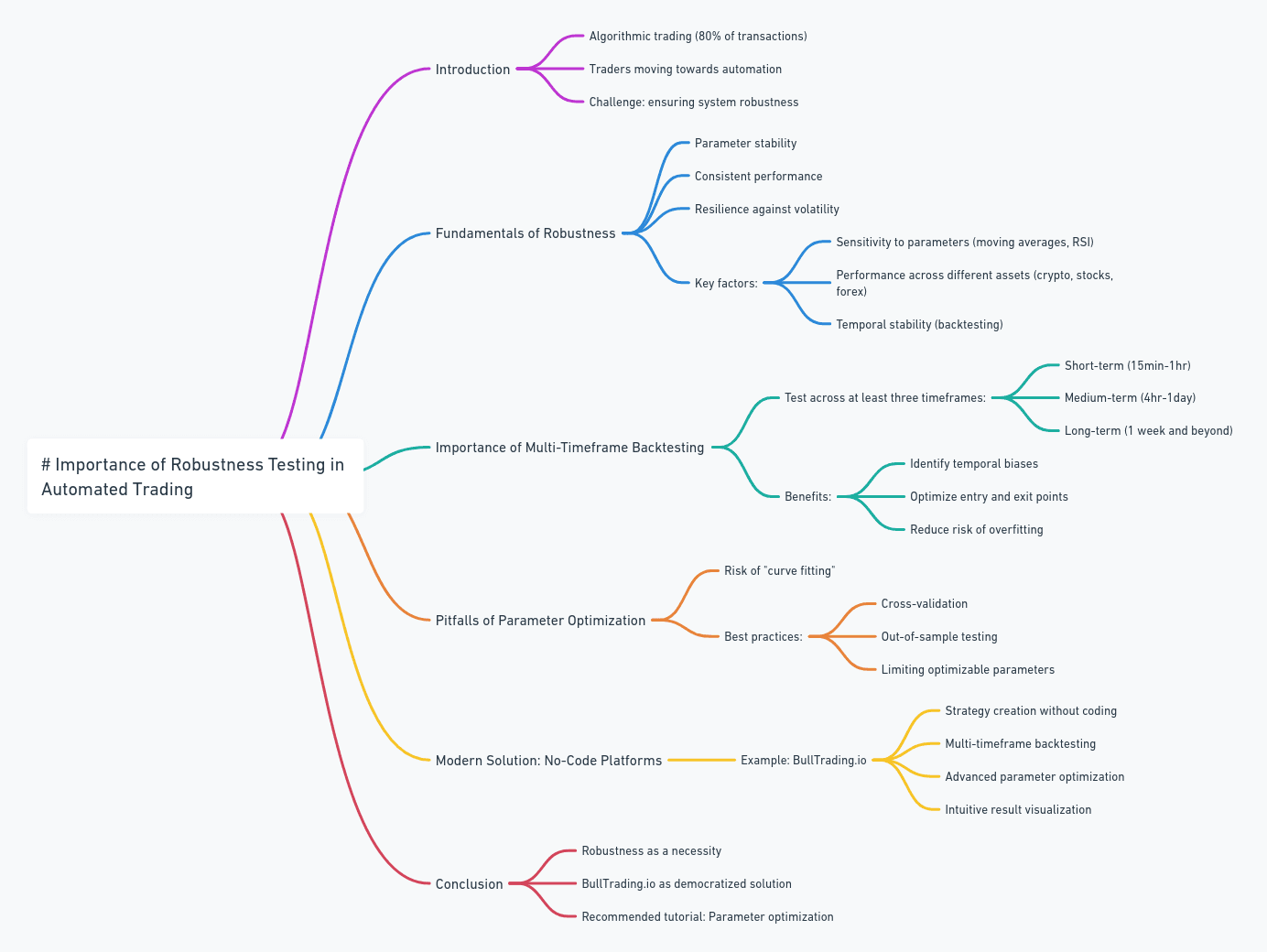

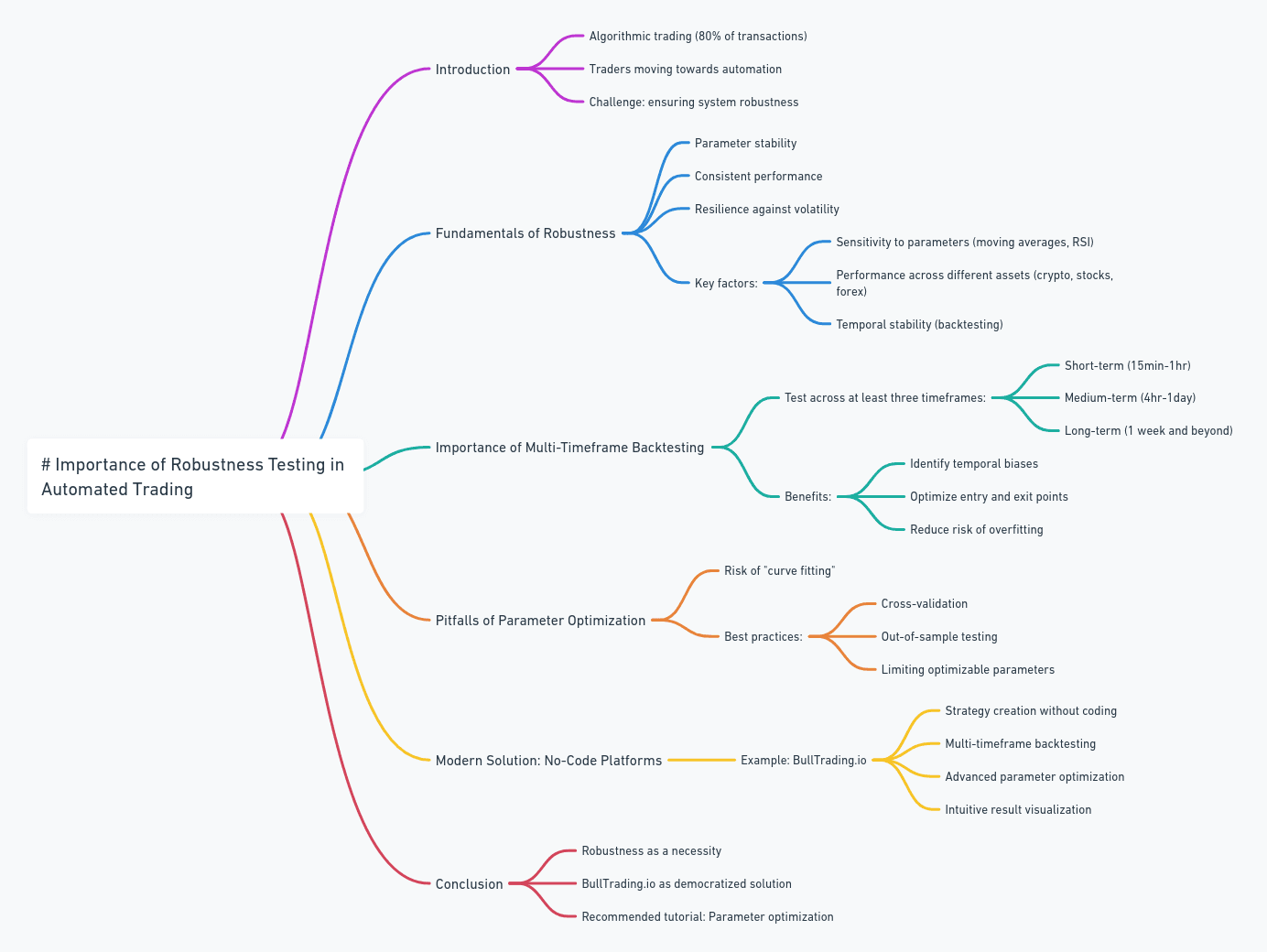

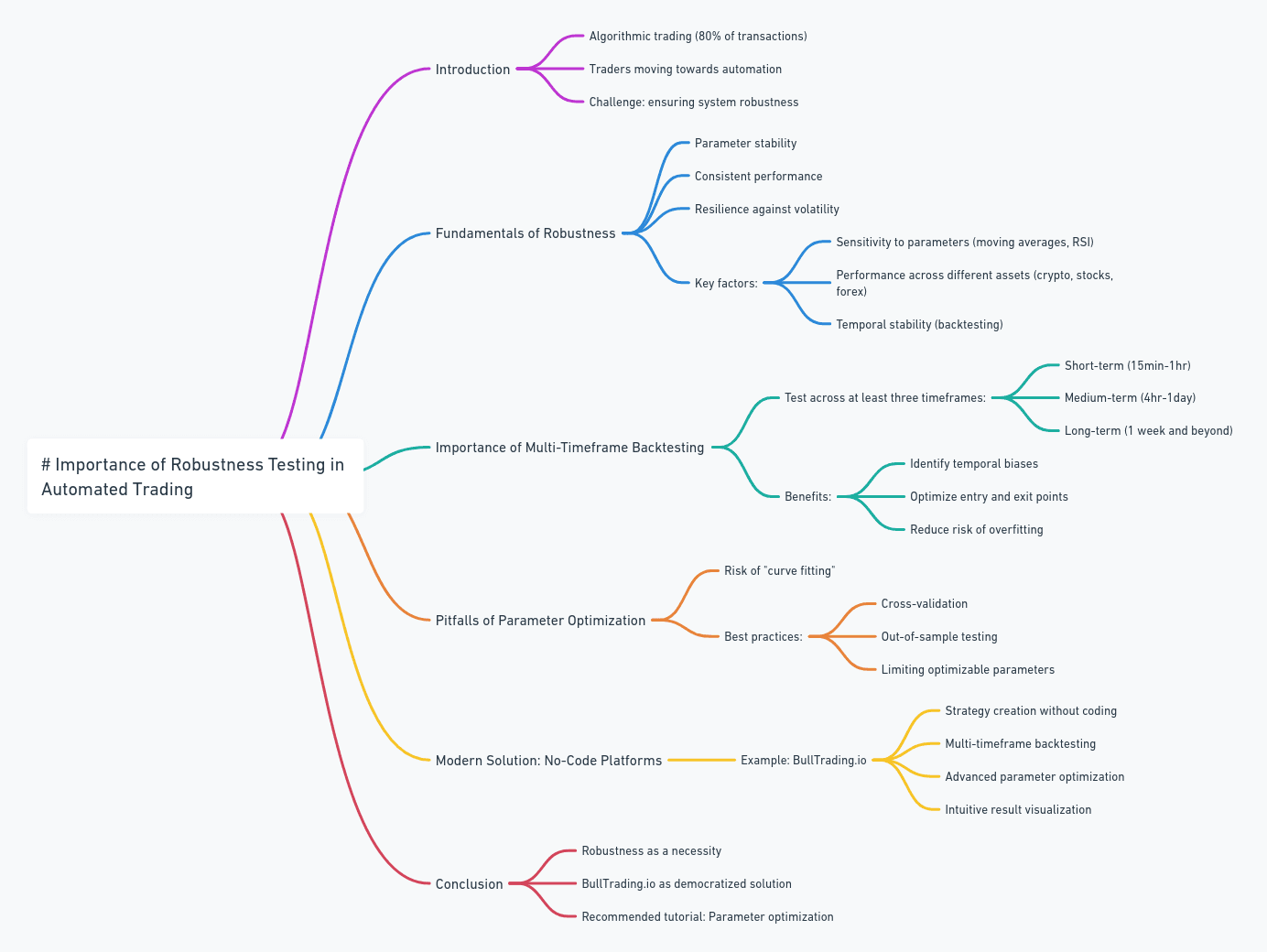

Algorithmic trading currently represents more than 80% of transactions in traditional financial markets. Faced with this reality, many retail traders are turning to strategy automation but quickly encounter a major obstacle: trading system robustness. How can one ensure that a strategy that performs well on paper will continue to generate profits in real market conditions? This fundamental question requires a methodical approach and appropriate tools.

Lucas Inglese

Lucas Inglese

Trading instructor

Trading Robustness Fundamentals

A trading strategy's robustness is measured by its ability to maintain stable performance under different market conditions. Robustness testing involves several crucial dimensions: parameter stability, performance consistency across different timeframes, and resilience to market volatility. A JPMorgan study (2023) reveals that 73% of trading strategies that fail in real conditions haven't undergone sufficient robustness testing. Key factors to test include:

Parameter sensitivity: variation of moving averages, RSI thresholds, etc.

Performance across different assets: cryptocurrencies, stocks, forex

Time stability: backtesting across different historical periods

The Importance of Multi-Timeframe Backtests

The multi-timeframe approach constitutes an essential pillar of robustness testing. A truly robust strategy must demonstrate its effectiveness across different time scales. Experts recommend testing on at least three different timeframes: short-term (15 minutes to 1 hour), medium-term (4 hours to 1 day), and long-term (1 week and more). This approach allows:

Identifying temporal biases of the strategy

Optimizing entry and exit points

Reducing the risk of overoptimization

The Pitfalls of Parameter Optimization

Parameter optimization often represents a false sense of security. Many traders fall into the "curve fitting" trap, excessively adjusting their parameters to achieve perfect results on historical data. A CFA Institute study shows that more than 60% of overoptimized strategies fail within the first six months of real trading. Best practices include:

Cross-validation across different periods

Using out-of-sample test periods

Limiting the number of optimizable parameters

The Modern Solution: No-Code Platforms

Facing these technical challenges, no-code trading platforms emerge as an accessible solution. While traditional tools like MetaTrader, TradingView, or 3Commas offer basic functionality, BullTrading.io stands out with its comprehensive approach to robustness testing. The platform allows:

Creating complex strategies without programming knowledge

Performing sophisticated backtests across multiple timeframes

Optimizing parameters with advanced statistical tools

Visualizing results through intuitive interfaces

Conclusion and Perspectives

The robustness of an automated trading strategy isn't a luxury but an absolute necessity. Given the increasing complexity of financial markets, no-code tools like BullTrading.io democratize access to professional testing methodologies. To deepen your understanding and start creating robust strategies, we recommend watching our complete tutorial on parameter optimization: Optimize Trading Strategy Parameters Simply with BullTrading!

Sources statistiques : JPMorgan Global Algorithmic Trading Report 2023, CFA Institute Trading Strategy Analysis 2023

Trading Robustness Fundamentals

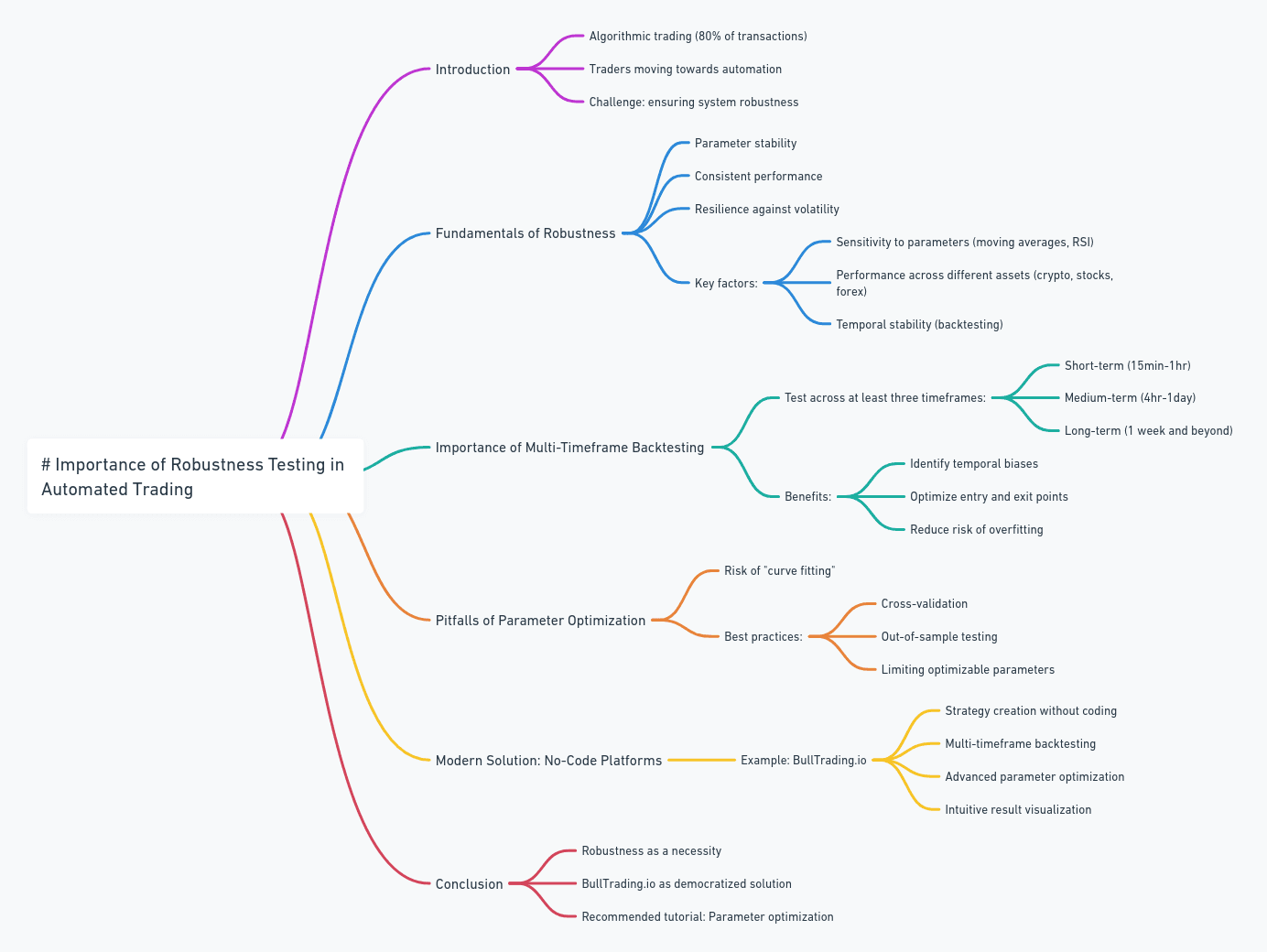

A trading strategy's robustness is measured by its ability to maintain stable performance under different market conditions. Robustness testing involves several crucial dimensions: parameter stability, performance consistency across different timeframes, and resilience to market volatility. A JPMorgan study (2023) reveals that 73% of trading strategies that fail in real conditions haven't undergone sufficient robustness testing. Key factors to test include:

Parameter sensitivity: variation of moving averages, RSI thresholds, etc.

Performance across different assets: cryptocurrencies, stocks, forex

Time stability: backtesting across different historical periods

The Importance of Multi-Timeframe Backtests

The multi-timeframe approach constitutes an essential pillar of robustness testing. A truly robust strategy must demonstrate its effectiveness across different time scales. Experts recommend testing on at least three different timeframes: short-term (15 minutes to 1 hour), medium-term (4 hours to 1 day), and long-term (1 week and more). This approach allows:

Identifying temporal biases of the strategy

Optimizing entry and exit points

Reducing the risk of overoptimization

The Pitfalls of Parameter Optimization

Parameter optimization often represents a false sense of security. Many traders fall into the "curve fitting" trap, excessively adjusting their parameters to achieve perfect results on historical data. A CFA Institute study shows that more than 60% of overoptimized strategies fail within the first six months of real trading. Best practices include:

Cross-validation across different periods

Using out-of-sample test periods

Limiting the number of optimizable parameters

The Modern Solution: No-Code Platforms

Facing these technical challenges, no-code trading platforms emerge as an accessible solution. While traditional tools like MetaTrader, TradingView, or 3Commas offer basic functionality, BullTrading.io stands out with its comprehensive approach to robustness testing. The platform allows:

Creating complex strategies without programming knowledge

Performing sophisticated backtests across multiple timeframes

Optimizing parameters with advanced statistical tools

Visualizing results through intuitive interfaces

Conclusion and Perspectives

The robustness of an automated trading strategy isn't a luxury but an absolute necessity. Given the increasing complexity of financial markets, no-code tools like BullTrading.io democratize access to professional testing methodologies. To deepen your understanding and start creating robust strategies, we recommend watching our complete tutorial on parameter optimization: Optimize Trading Strategy Parameters Simply with BullTrading!

Sources statistiques : JPMorgan Global Algorithmic Trading Report 2023, CFA Institute Trading Strategy Analysis 2023

Trading Robustness Fundamentals

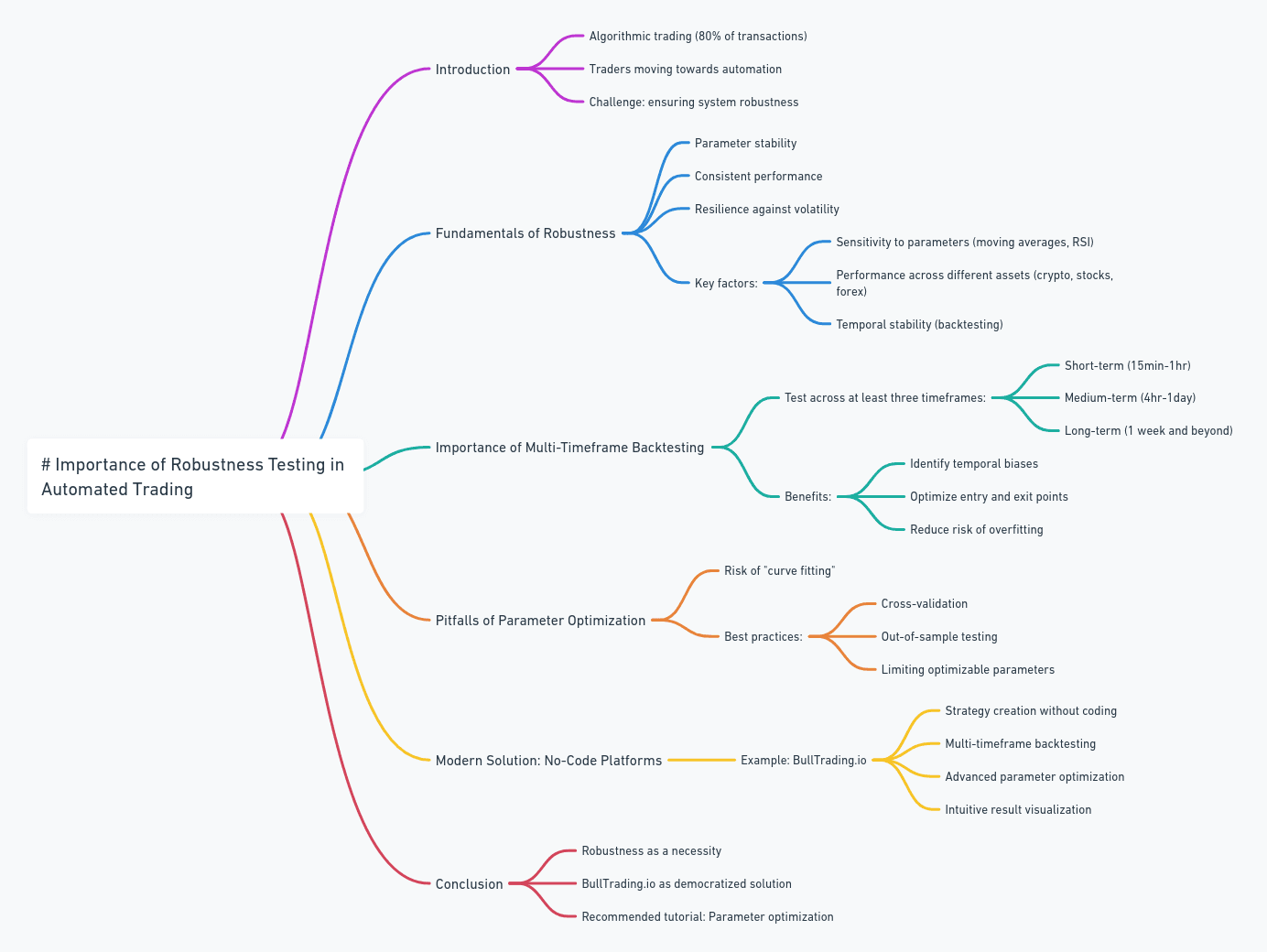

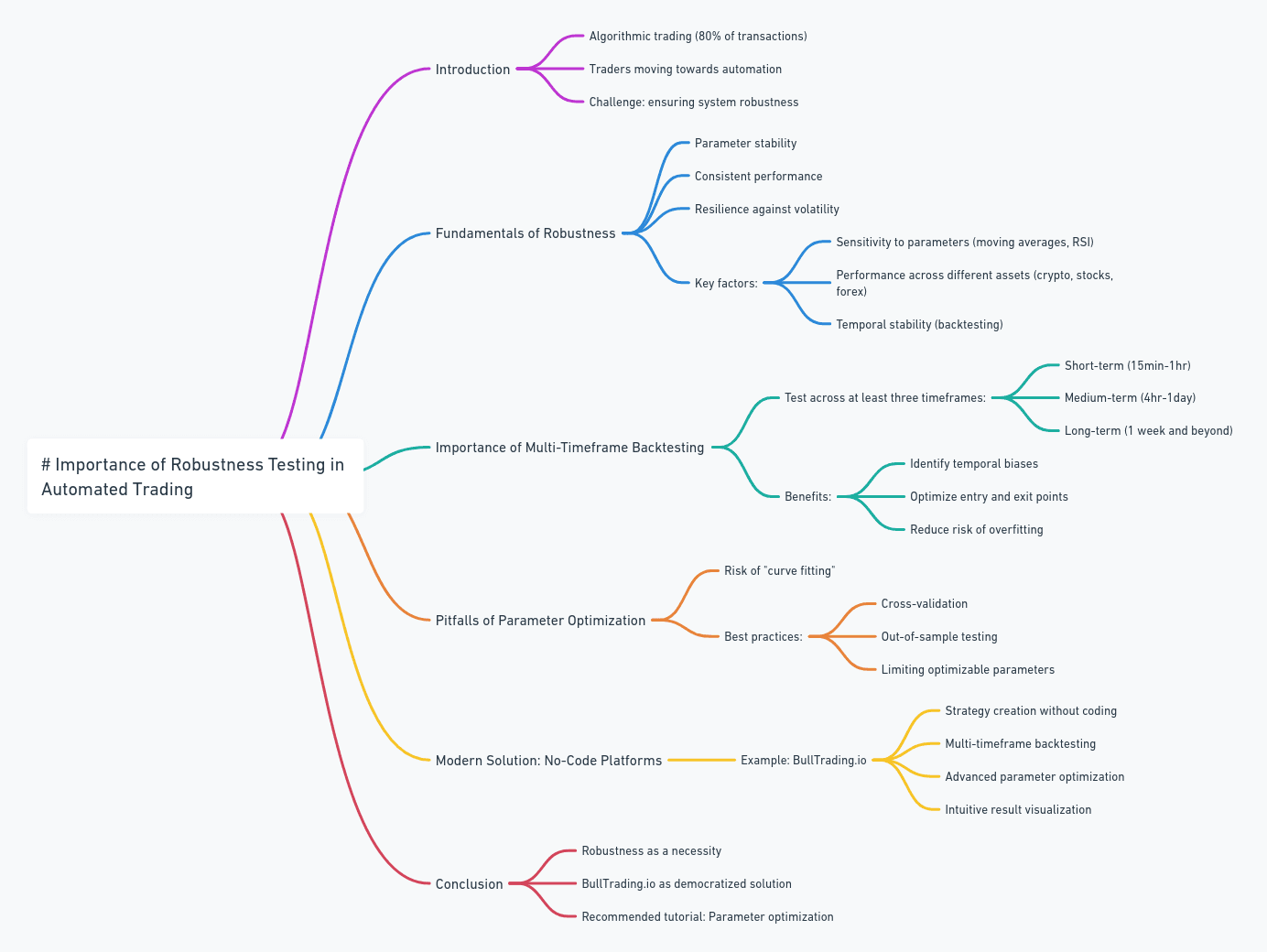

A trading strategy's robustness is measured by its ability to maintain stable performance under different market conditions. Robustness testing involves several crucial dimensions: parameter stability, performance consistency across different timeframes, and resilience to market volatility. A JPMorgan study (2023) reveals that 73% of trading strategies that fail in real conditions haven't undergone sufficient robustness testing. Key factors to test include:

Parameter sensitivity: variation of moving averages, RSI thresholds, etc.

Performance across different assets: cryptocurrencies, stocks, forex

Time stability: backtesting across different historical periods

The Importance of Multi-Timeframe Backtests

The multi-timeframe approach constitutes an essential pillar of robustness testing. A truly robust strategy must demonstrate its effectiveness across different time scales. Experts recommend testing on at least three different timeframes: short-term (15 minutes to 1 hour), medium-term (4 hours to 1 day), and long-term (1 week and more). This approach allows:

Identifying temporal biases of the strategy

Optimizing entry and exit points

Reducing the risk of overoptimization

The Pitfalls of Parameter Optimization

Parameter optimization often represents a false sense of security. Many traders fall into the "curve fitting" trap, excessively adjusting their parameters to achieve perfect results on historical data. A CFA Institute study shows that more than 60% of overoptimized strategies fail within the first six months of real trading. Best practices include:

Cross-validation across different periods

Using out-of-sample test periods

Limiting the number of optimizable parameters

The Modern Solution: No-Code Platforms

Facing these technical challenges, no-code trading platforms emerge as an accessible solution. While traditional tools like MetaTrader, TradingView, or 3Commas offer basic functionality, BullTrading.io stands out with its comprehensive approach to robustness testing. The platform allows:

Creating complex strategies without programming knowledge

Performing sophisticated backtests across multiple timeframes

Optimizing parameters with advanced statistical tools

Visualizing results through intuitive interfaces

Conclusion and Perspectives

The robustness of an automated trading strategy isn't a luxury but an absolute necessity. Given the increasing complexity of financial markets, no-code tools like BullTrading.io democratize access to professional testing methodologies. To deepen your understanding and start creating robust strategies, we recommend watching our complete tutorial on parameter optimization: Optimize Trading Strategy Parameters Simply with BullTrading!

Sources statistiques : JPMorgan Global Algorithmic Trading Report 2023, CFA Institute Trading Strategy Analysis 2023

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Related Articles

You Might Also Like

Discover all our articles and tutorials to deepen your knowledge.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom Strategies

No Skills Required