3 min

Jul 13, 2024

Editor

The Allocation Block

The Allocation Block

This block is one of the simplest to understand. As you know, a trading robot’s flowchart is read sequentially. This means you cannot move to the next block without validating the current block. When one of the indicator or group blocks is validated, we want to set the allocation we desire for our robot on the chosen asset. This method is very useful because it’s adaptable. For instance, you can open a position with this block by changing the allocation from 0% (indicating "no position") to any value between -500% and 500% (details explained further). Additionally, you can close your trade by setting the allocation back to 0%.

Lucas Inglese

Lucas Inglese

Trading Instructor

Buy - Sell - Leverage

Setting an allocation is good, but understanding it is even better! Why can the allocation vary from -500% to 500%?

Buy: If you choose an allocation of 20%, it means you’re taking a long position with 20% of the capital allocated to this strategy.

Sell: If you select -20%, it means you’re taking a short position (betting on a decline) with 20% of the capital allocated to the strategy.

Leverage: When the allocation exceeds an absolute value of 100% (-100% or 100%), it involves using leverage provided by the broker. In other words, you borrow money for a very short term to invest a larger amount (which increases both your potential gains and losses). For example, an allocation of 300% means you’re using 300% of the capital allocated to this strategy (three times the allocated capital).

How to Configure It?

Unlike most blocks, the allocation block has some optional settings. You can set a base allocation that remains fixed throughout the trade. However, it’s also possible to increase the allocation value by creating a loop that goes through an allocation block multiple times. For example, if you’re already in a long position and the bot wants to open a new long position, you have two options:

Case 1: Maintain the base allocation set in the "Allocation Percentage" parameter.

Case 2: Increase the allocation.

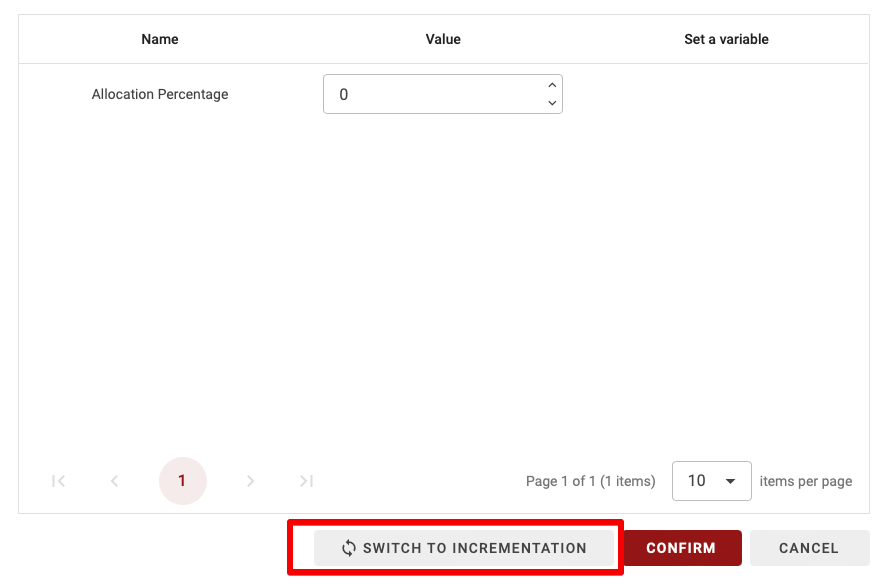

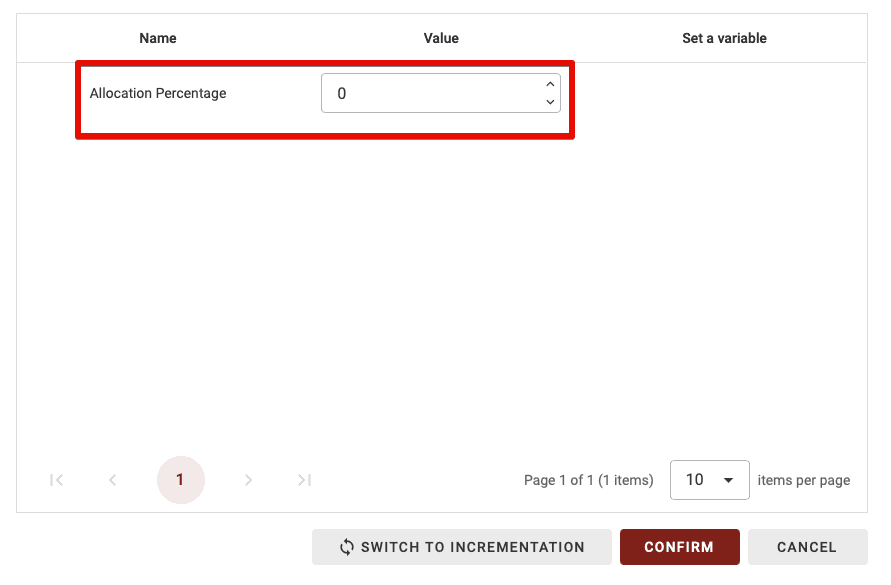

Case 1: Fixed Allocation

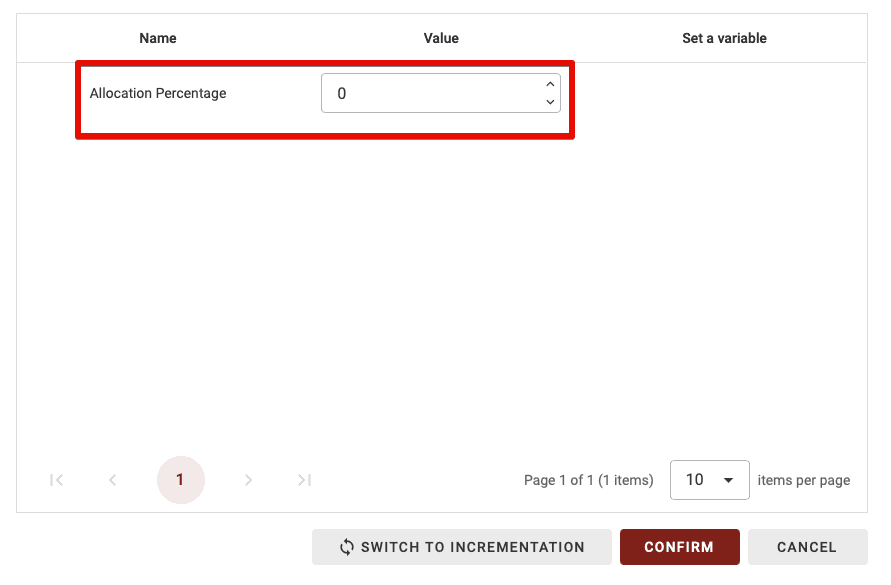

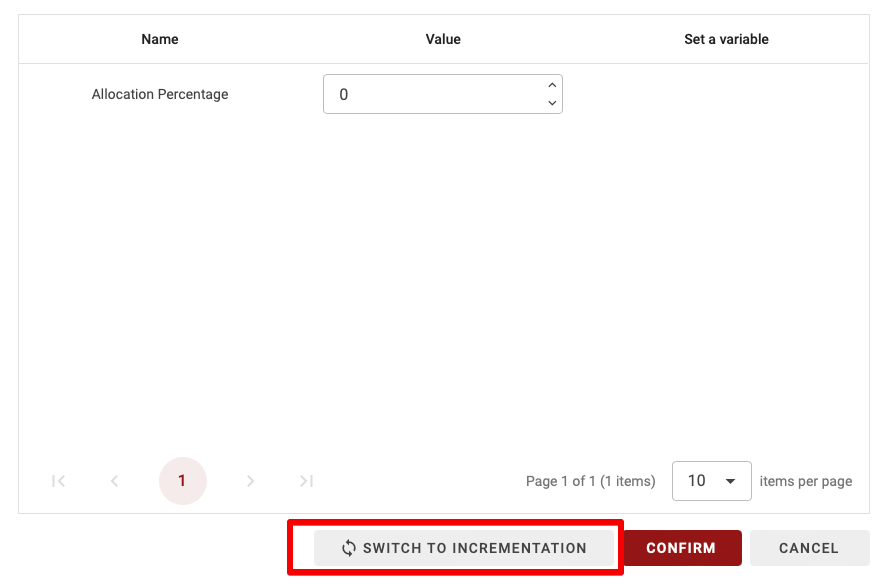

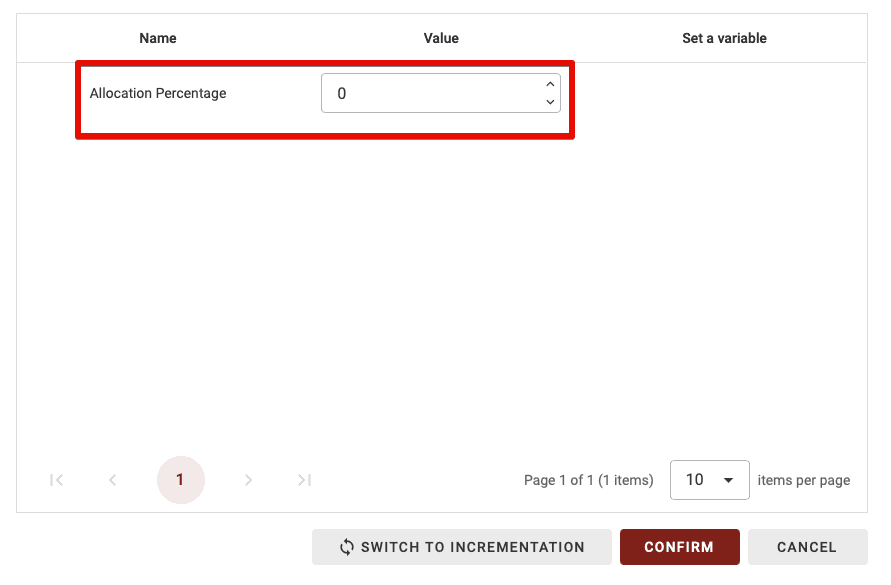

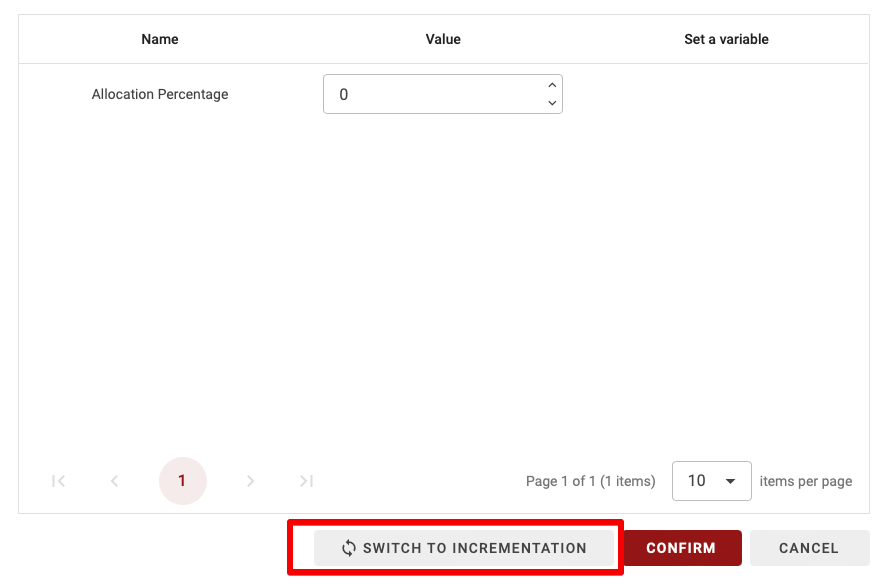

This is the simplest case. When you open the allocation block, you see only the parameter "Allocation Percentage." Here, you set the percentage of your capital you want to use for this position (from -500% to 500%).

Case 2: Incremental Allocation

This block lets you set the initial allocation and vary it by configuring it differently (enabling two types of allocation blocks: initial allocation and incremental allocation).

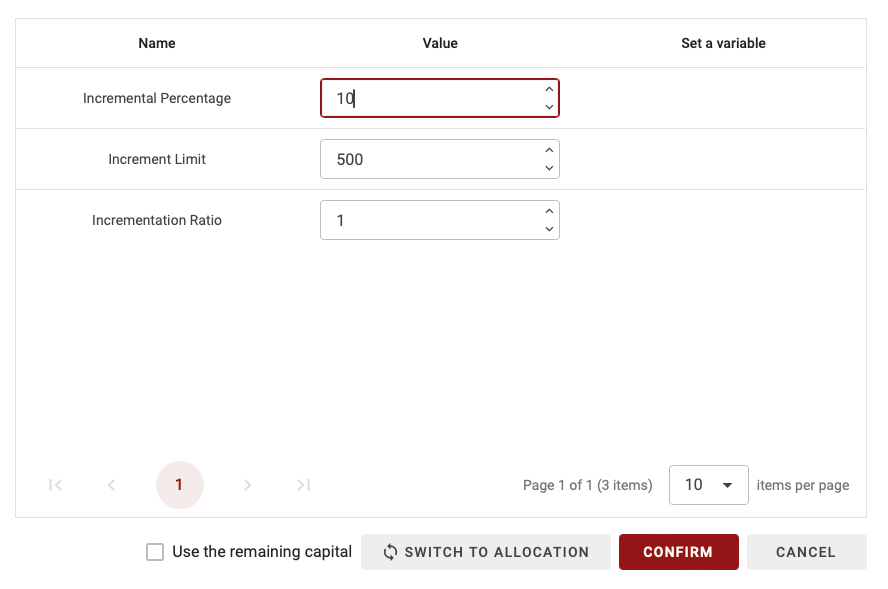

Case 2.1: Incremental Allocation by Absolute Value

To switch to incremental allocation, click the "Switch to Incrementation" button.

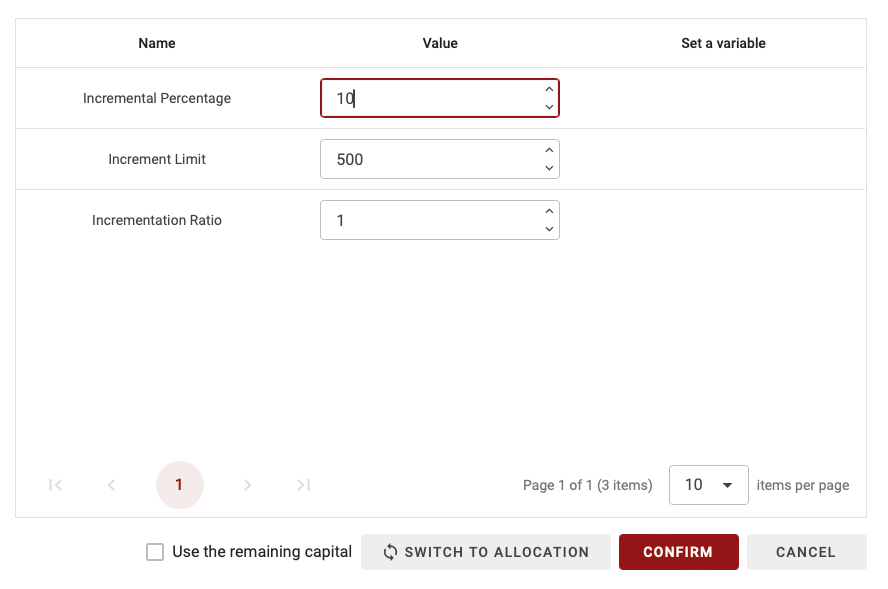

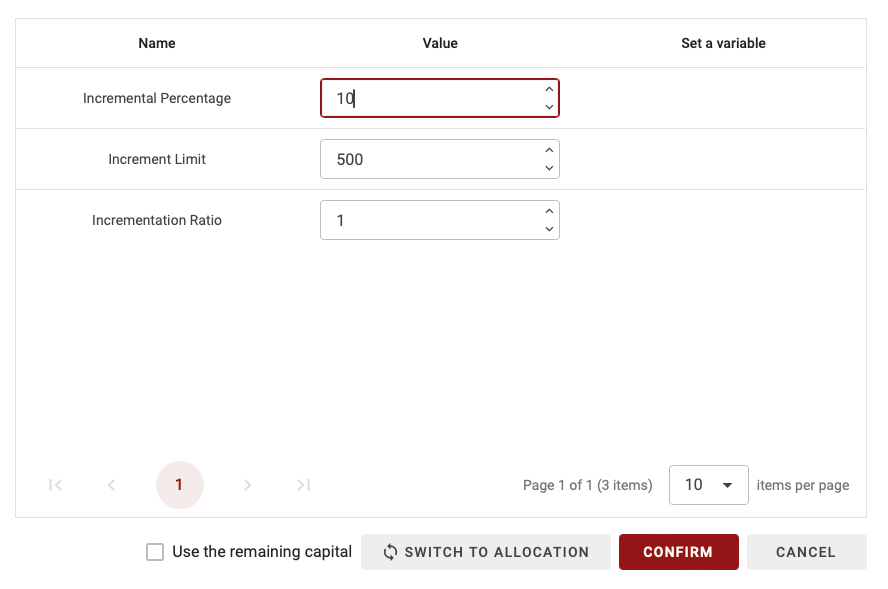

You’ll now see two new parameters:

Incremental Percentage: The percentage by which the allocation will increase or decrease (if negative). For example, here, you might set it to 10%.

Increment Limit: The limit beyond which the allocation will no longer increase or decrease. Here, you may set it to a maximum of 500%.

Incrementation Ratio: For each increment, you can choose to reduce or increase the percentage increment. If set to 1, each increment will add 10% to the allocation. If set to 0.5, the first increment adds 10%, the next 10% * 0.5, then 10% * 0.5 * 0.5, and so on.

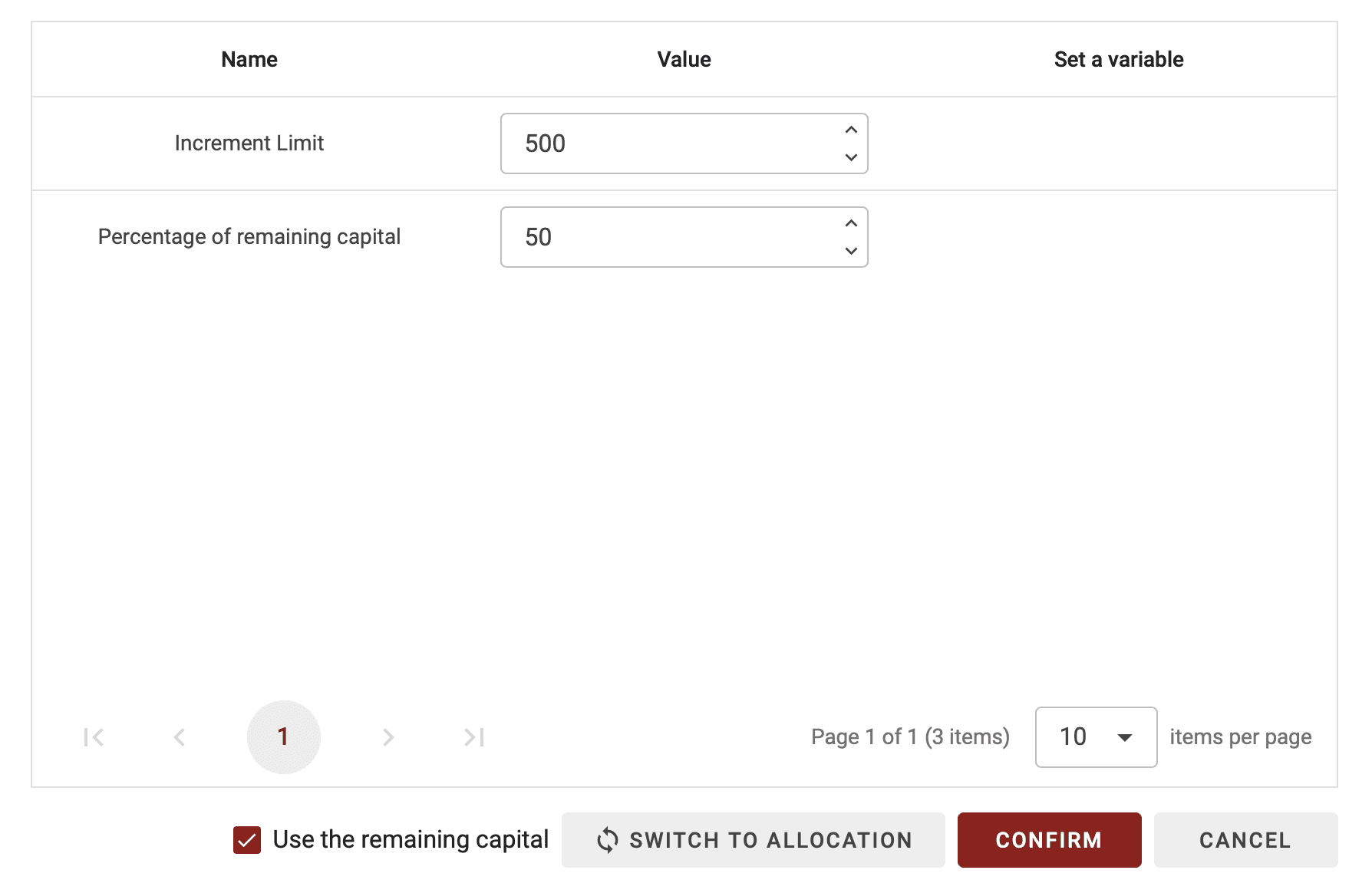

Case 2.2: Incremental Allocation by Relative Value

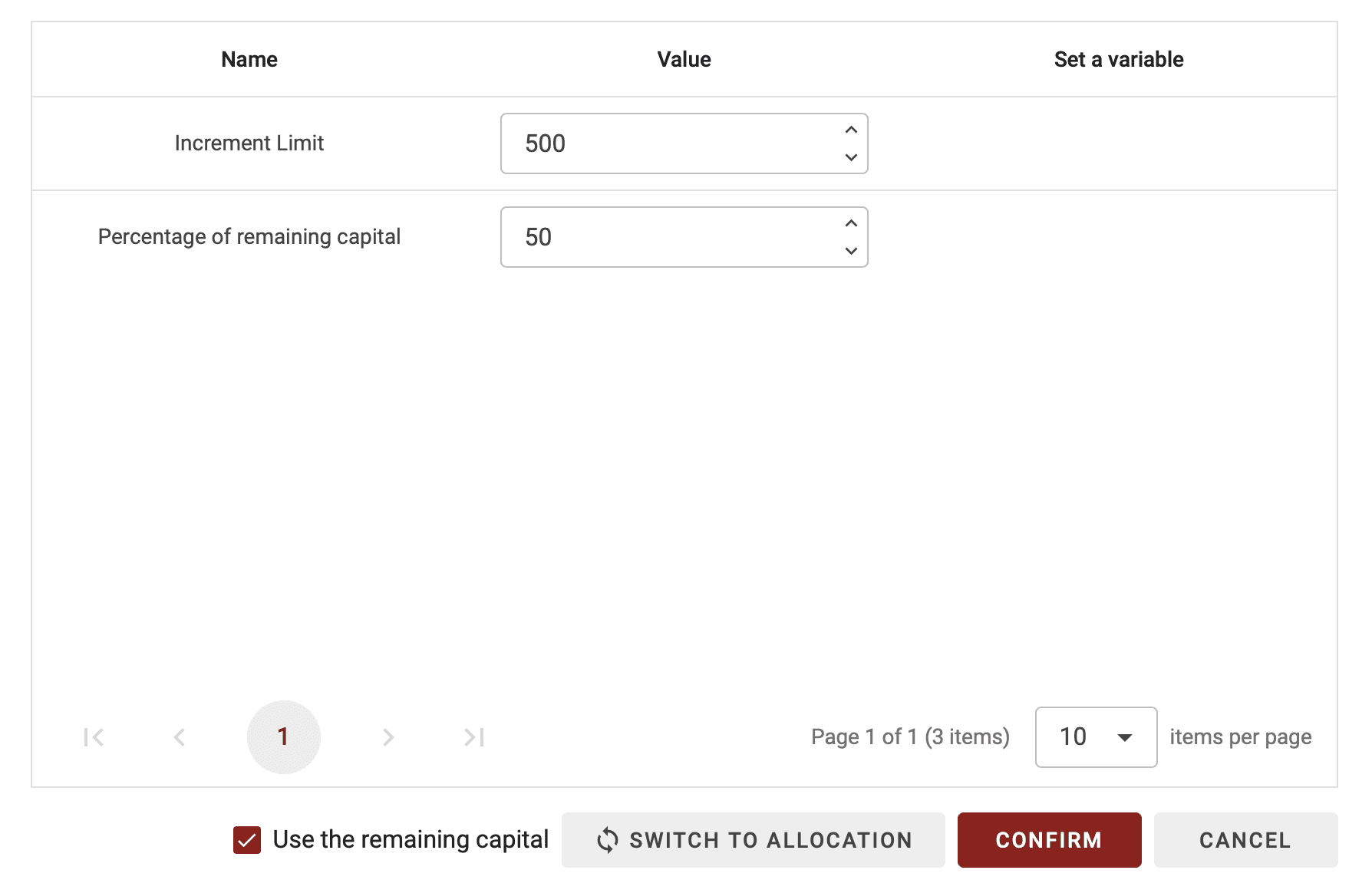

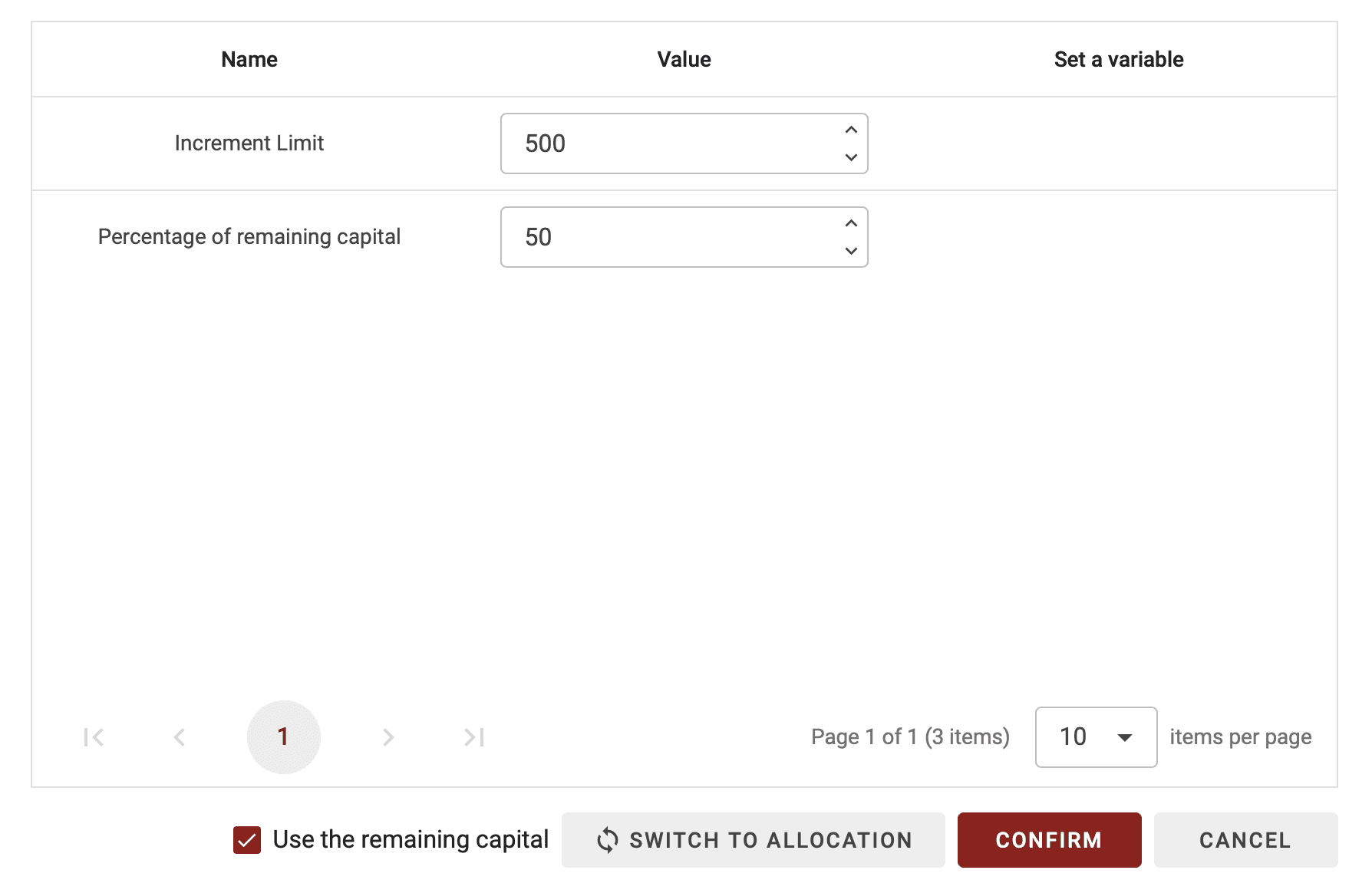

You can also allocate a percentage of your remaining capital by checking the "Use the remaining capital" box.

To do this, first set the "Increment Limit" parameter, which defines the maximum allocation desired (100% max for spot trading, up to 500%, or 100% with leverage 5 for futures).

Then, adjust the final parameter, "Percentage of the remaining capital." For example, if set to 50%, with an initial allocation of 60%, and an Increment Limit of 500%, the next increase would be (500% - 60%) * 50% = 220%.

Buy - Sell - Leverage

Setting an allocation is good, but understanding it is even better! Why can the allocation vary from -500% to 500%?

Buy: If you choose an allocation of 20%, it means you’re taking a long position with 20% of the capital allocated to this strategy.

Sell: If you select -20%, it means you’re taking a short position (betting on a decline) with 20% of the capital allocated to the strategy.

Leverage: When the allocation exceeds an absolute value of 100% (-100% or 100%), it involves using leverage provided by the broker. In other words, you borrow money for a very short term to invest a larger amount (which increases both your potential gains and losses). For example, an allocation of 300% means you’re using 300% of the capital allocated to this strategy (three times the allocated capital).

How to Configure It?

Unlike most blocks, the allocation block has some optional settings. You can set a base allocation that remains fixed throughout the trade. However, it’s also possible to increase the allocation value by creating a loop that goes through an allocation block multiple times. For example, if you’re already in a long position and the bot wants to open a new long position, you have two options:

Case 1: Maintain the base allocation set in the "Allocation Percentage" parameter.

Case 2: Increase the allocation.

Case 1: Fixed Allocation

This is the simplest case. When you open the allocation block, you see only the parameter "Allocation Percentage." Here, you set the percentage of your capital you want to use for this position (from -500% to 500%).

Case 2: Incremental Allocation

This block lets you set the initial allocation and vary it by configuring it differently (enabling two types of allocation blocks: initial allocation and incremental allocation).

Case 2.1: Incremental Allocation by Absolute Value

To switch to incremental allocation, click the "Switch to Incrementation" button.

You’ll now see two new parameters:

Incremental Percentage: The percentage by which the allocation will increase or decrease (if negative). For example, here, you might set it to 10%.

Increment Limit: The limit beyond which the allocation will no longer increase or decrease. Here, you may set it to a maximum of 500%.

Incrementation Ratio: For each increment, you can choose to reduce or increase the percentage increment. If set to 1, each increment will add 10% to the allocation. If set to 0.5, the first increment adds 10%, the next 10% * 0.5, then 10% * 0.5 * 0.5, and so on.

Case 2.2: Incremental Allocation by Relative Value

You can also allocate a percentage of your remaining capital by checking the "Use the remaining capital" box.

To do this, first set the "Increment Limit" parameter, which defines the maximum allocation desired (100% max for spot trading, up to 500%, or 100% with leverage 5 for futures).

Then, adjust the final parameter, "Percentage of the remaining capital." For example, if set to 50%, with an initial allocation of 60%, and an Increment Limit of 500%, the next increase would be (500% - 60%) * 50% = 220%.

Buy - Sell - Leverage

Setting an allocation is good, but understanding it is even better! Why can the allocation vary from -500% to 500%?

Buy: If you choose an allocation of 20%, it means you’re taking a long position with 20% of the capital allocated to this strategy.

Sell: If you select -20%, it means you’re taking a short position (betting on a decline) with 20% of the capital allocated to the strategy.

Leverage: When the allocation exceeds an absolute value of 100% (-100% or 100%), it involves using leverage provided by the broker. In other words, you borrow money for a very short term to invest a larger amount (which increases both your potential gains and losses). For example, an allocation of 300% means you’re using 300% of the capital allocated to this strategy (three times the allocated capital).

How to Configure It?

Unlike most blocks, the allocation block has some optional settings. You can set a base allocation that remains fixed throughout the trade. However, it’s also possible to increase the allocation value by creating a loop that goes through an allocation block multiple times. For example, if you’re already in a long position and the bot wants to open a new long position, you have two options:

Case 1: Maintain the base allocation set in the "Allocation Percentage" parameter.

Case 2: Increase the allocation.

Case 1: Fixed Allocation

This is the simplest case. When you open the allocation block, you see only the parameter "Allocation Percentage." Here, you set the percentage of your capital you want to use for this position (from -500% to 500%).

Case 2: Incremental Allocation

This block lets you set the initial allocation and vary it by configuring it differently (enabling two types of allocation blocks: initial allocation and incremental allocation).

Case 2.1: Incremental Allocation by Absolute Value

To switch to incremental allocation, click the "Switch to Incrementation" button.

You’ll now see two new parameters:

Incremental Percentage: The percentage by which the allocation will increase or decrease (if negative). For example, here, you might set it to 10%.

Increment Limit: The limit beyond which the allocation will no longer increase or decrease. Here, you may set it to a maximum of 500%.

Incrementation Ratio: For each increment, you can choose to reduce or increase the percentage increment. If set to 1, each increment will add 10% to the allocation. If set to 0.5, the first increment adds 10%, the next 10% * 0.5, then 10% * 0.5 * 0.5, and so on.

Case 2.2: Incremental Allocation by Relative Value

You can also allocate a percentage of your remaining capital by checking the "Use the remaining capital" box.

To do this, first set the "Increment Limit" parameter, which defines the maximum allocation desired (100% max for spot trading, up to 500%, or 100% with leverage 5 for futures).

Then, adjust the final parameter, "Percentage of the remaining capital." For example, if set to 50%, with an initial allocation of 60%, and an Increment Limit of 500%, the next increase would be (500% - 60%) * 50% = 220%.

Similar articles

You may also like

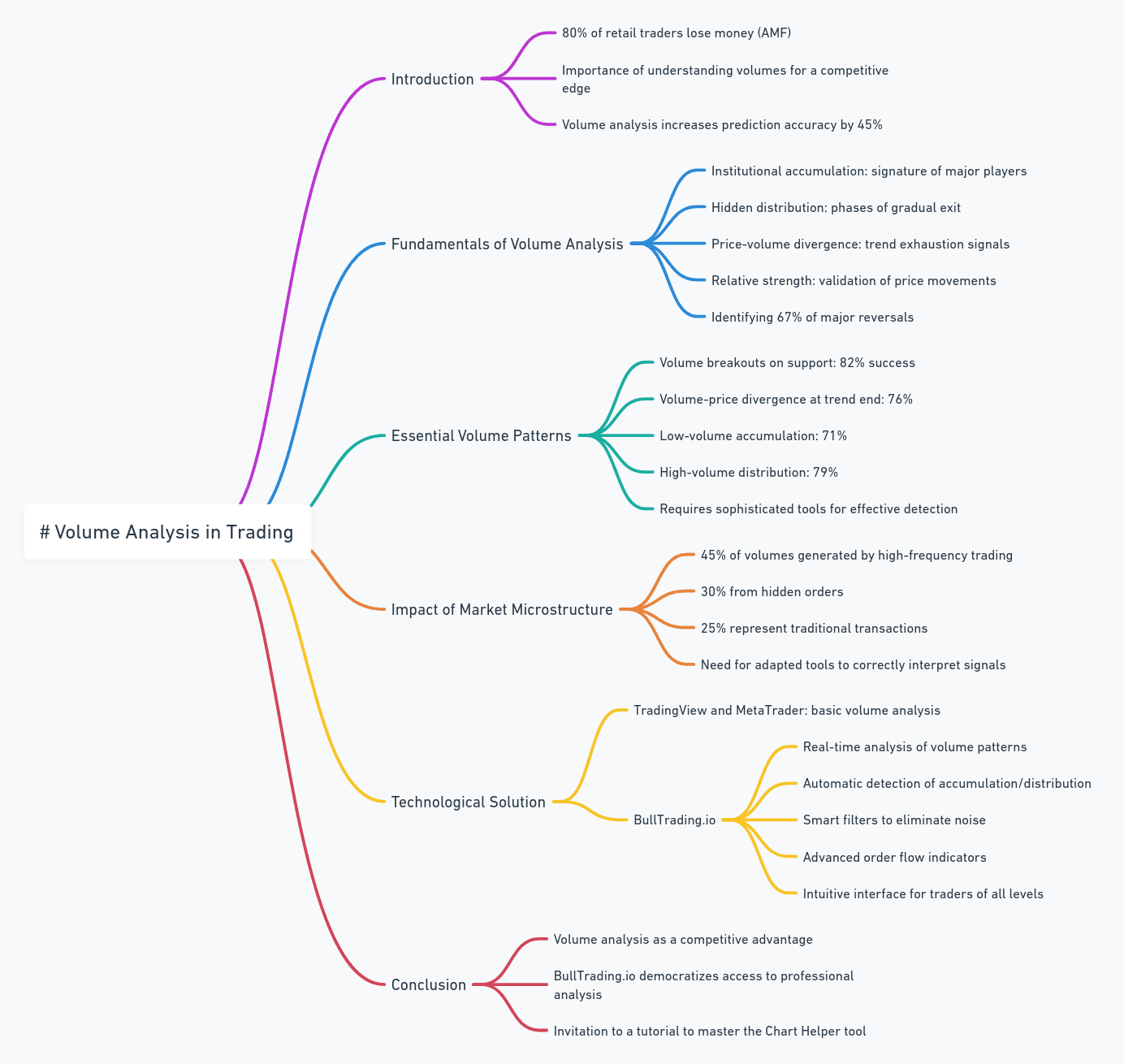

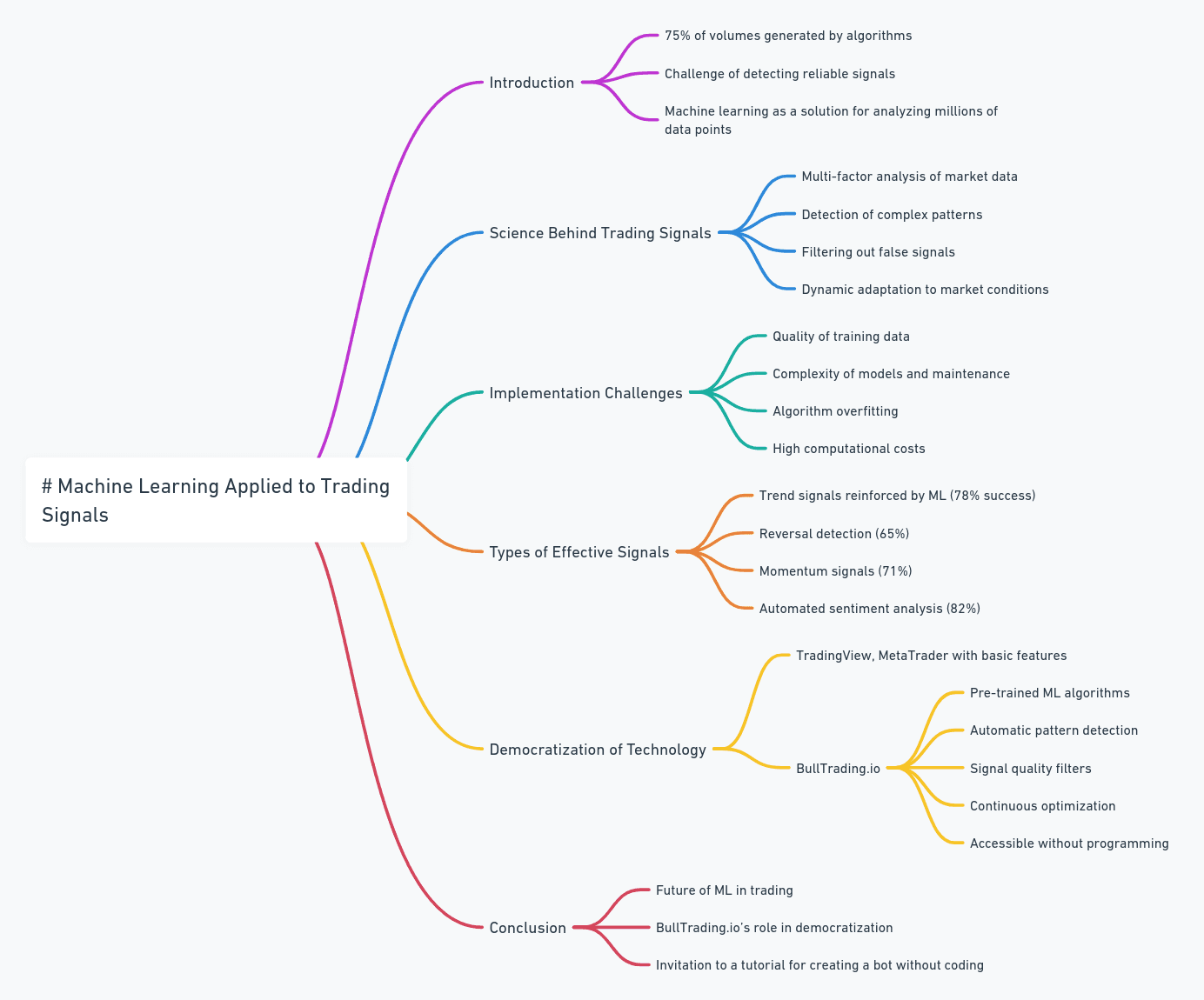

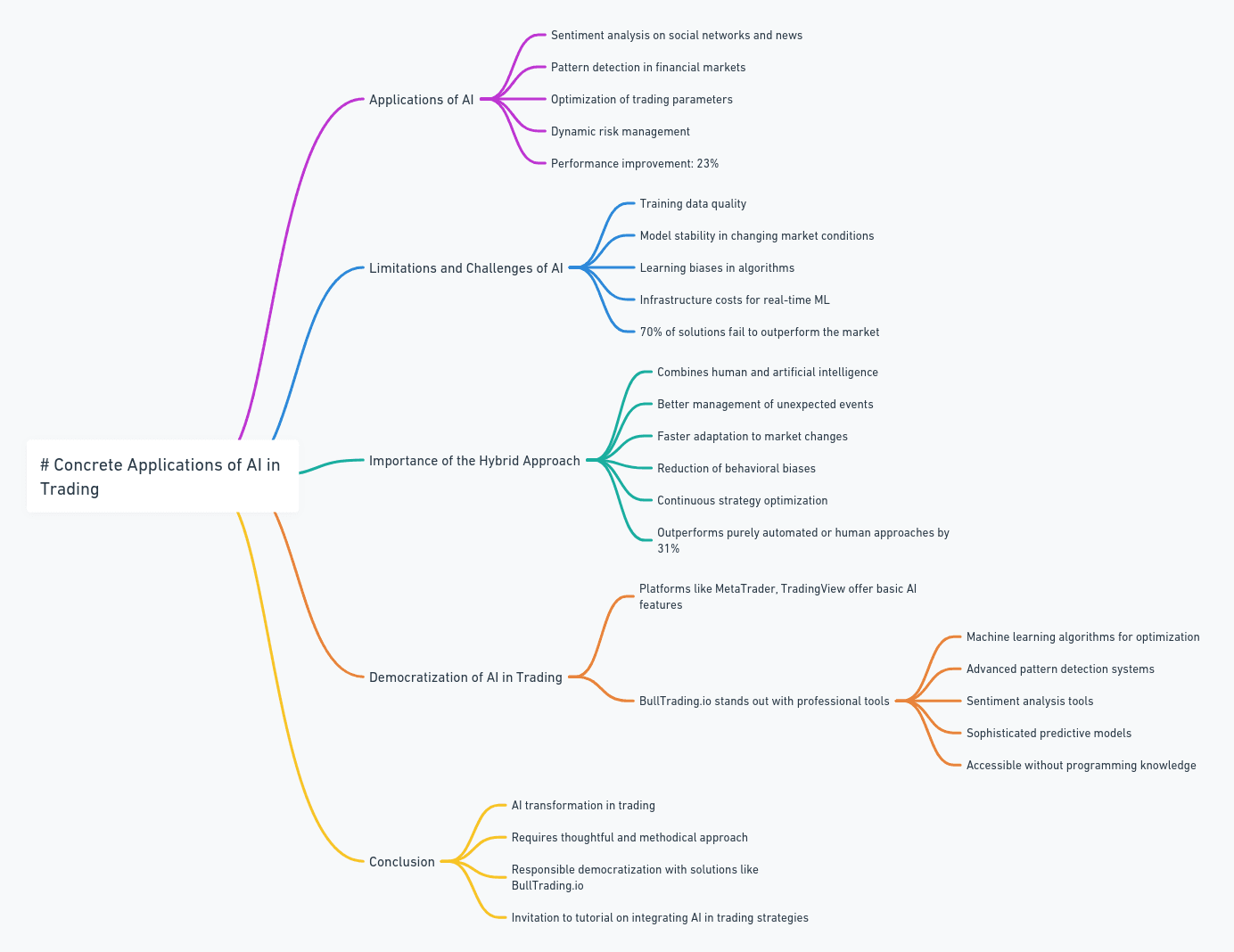

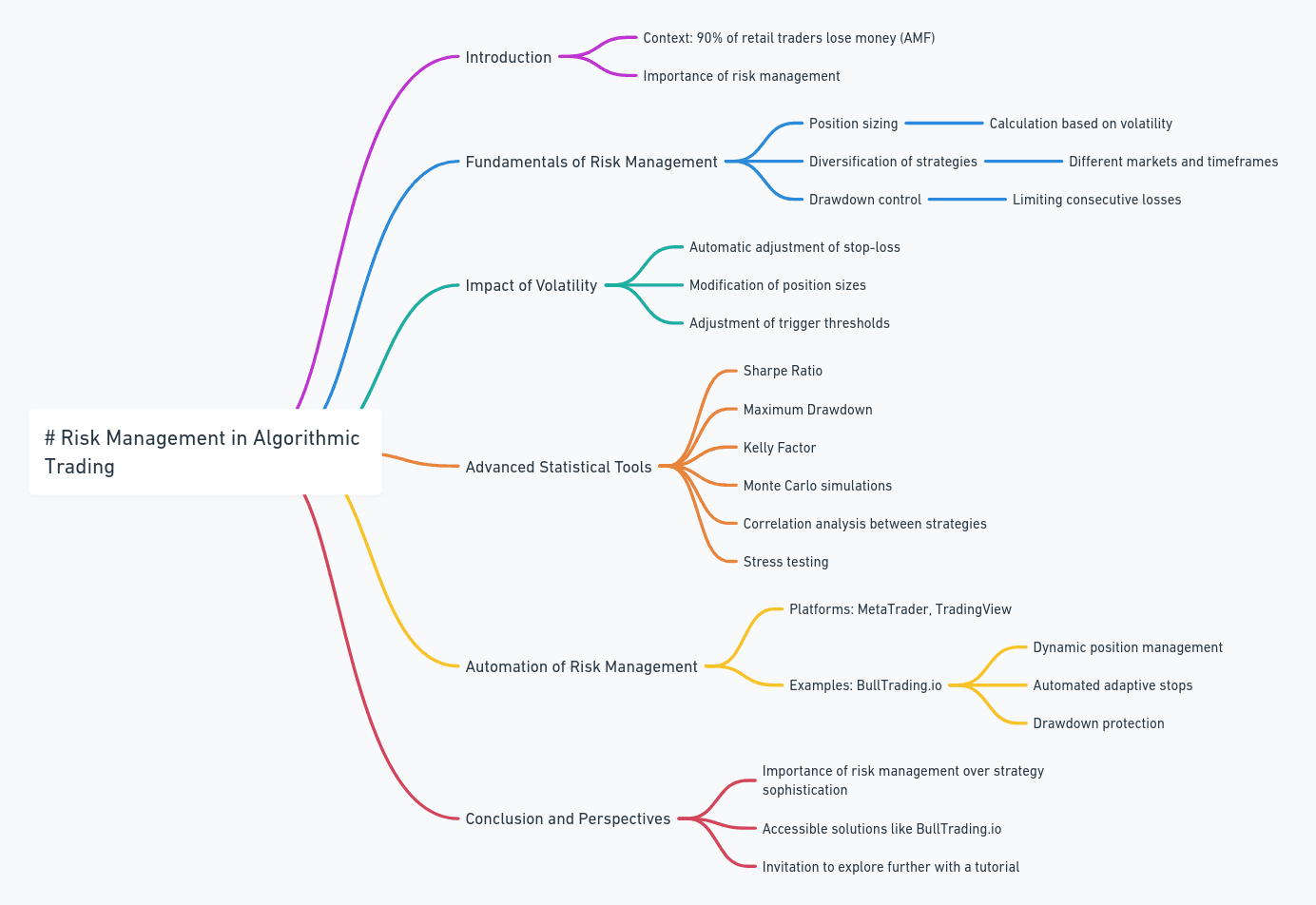

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required