4 min

Nov 20, 2024

Editor

Volume Analysis in Trading: The Key to Better Market Understanding

Volume Analysis in Trading: The Key to Better Market Understanding

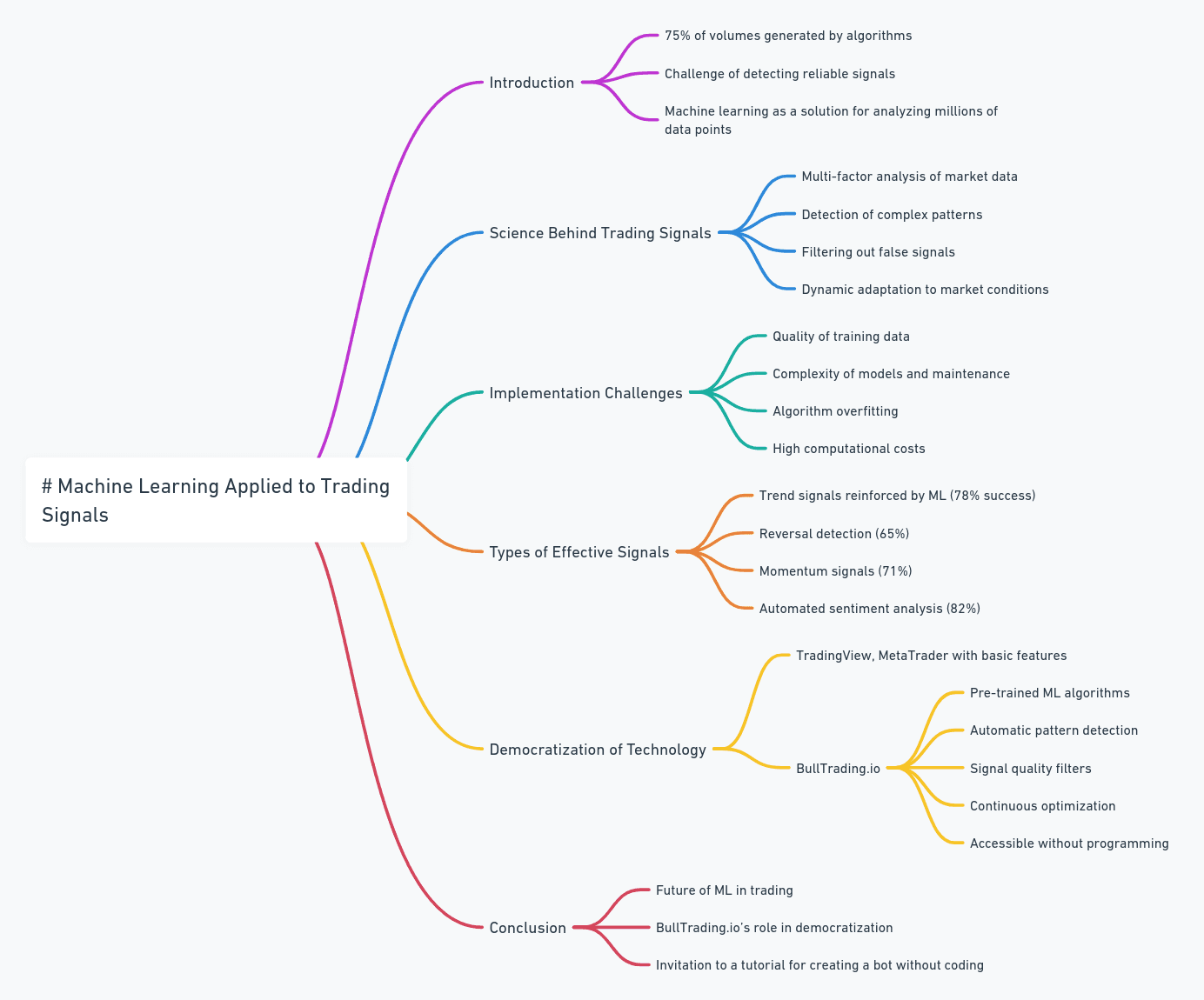

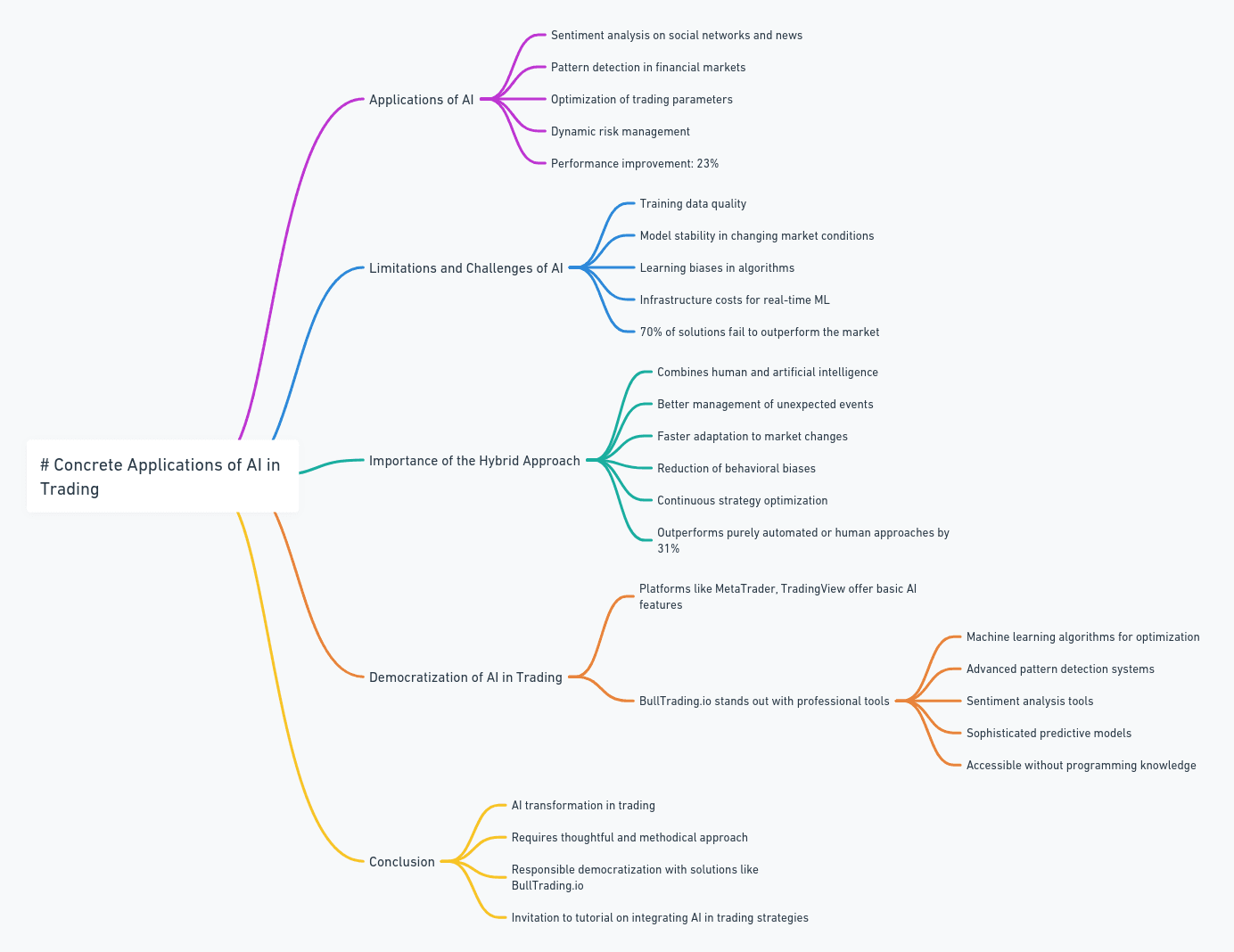

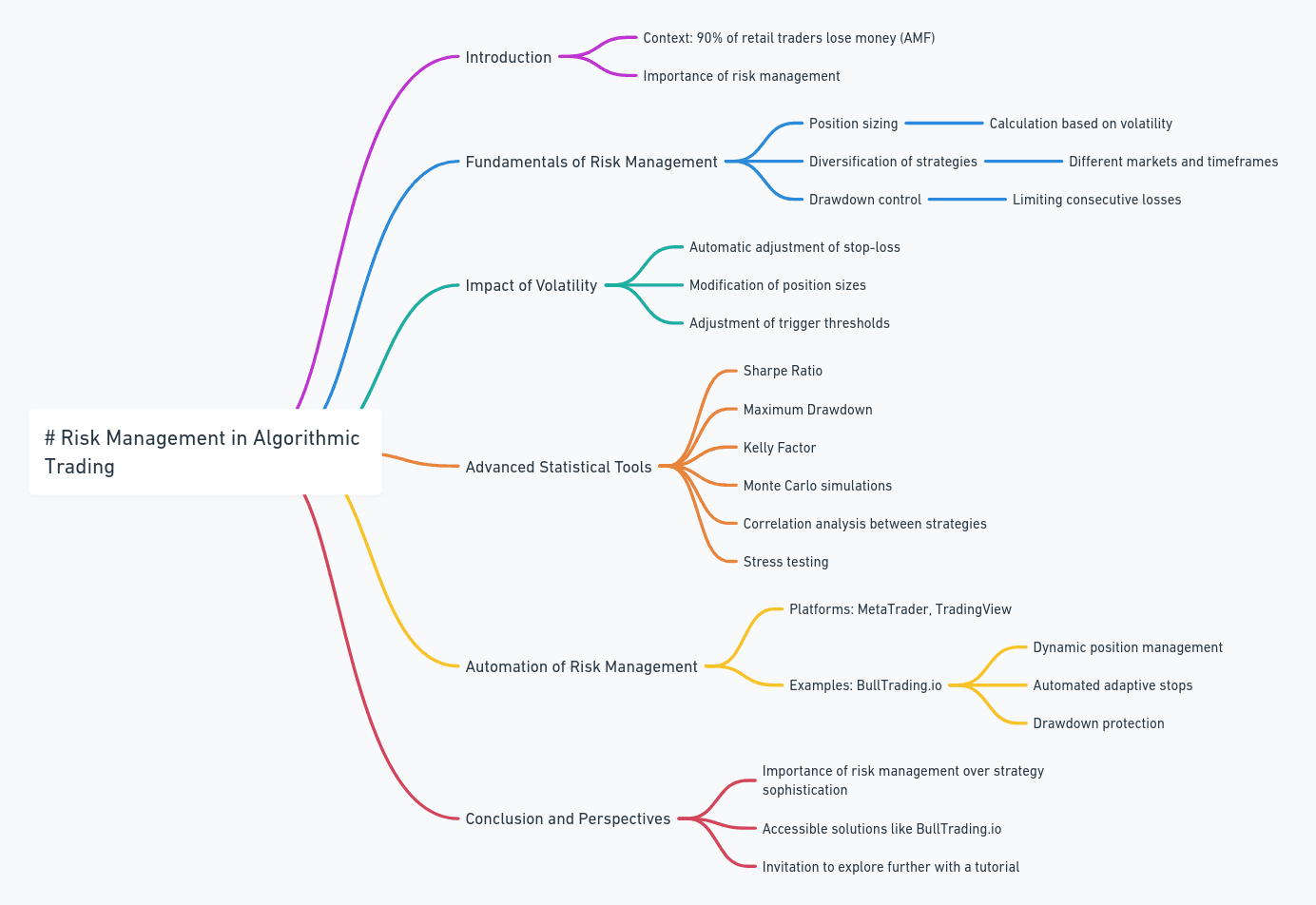

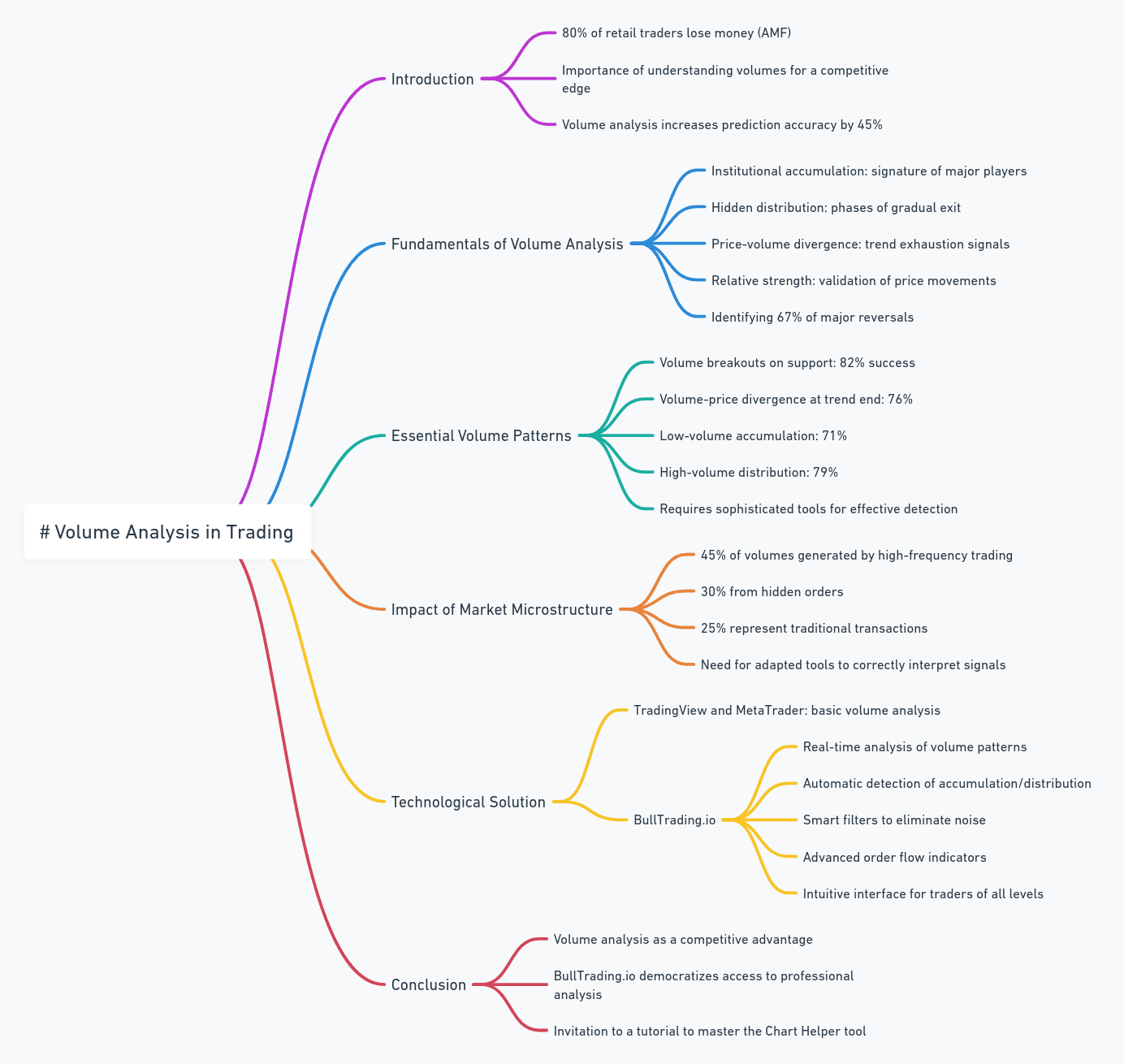

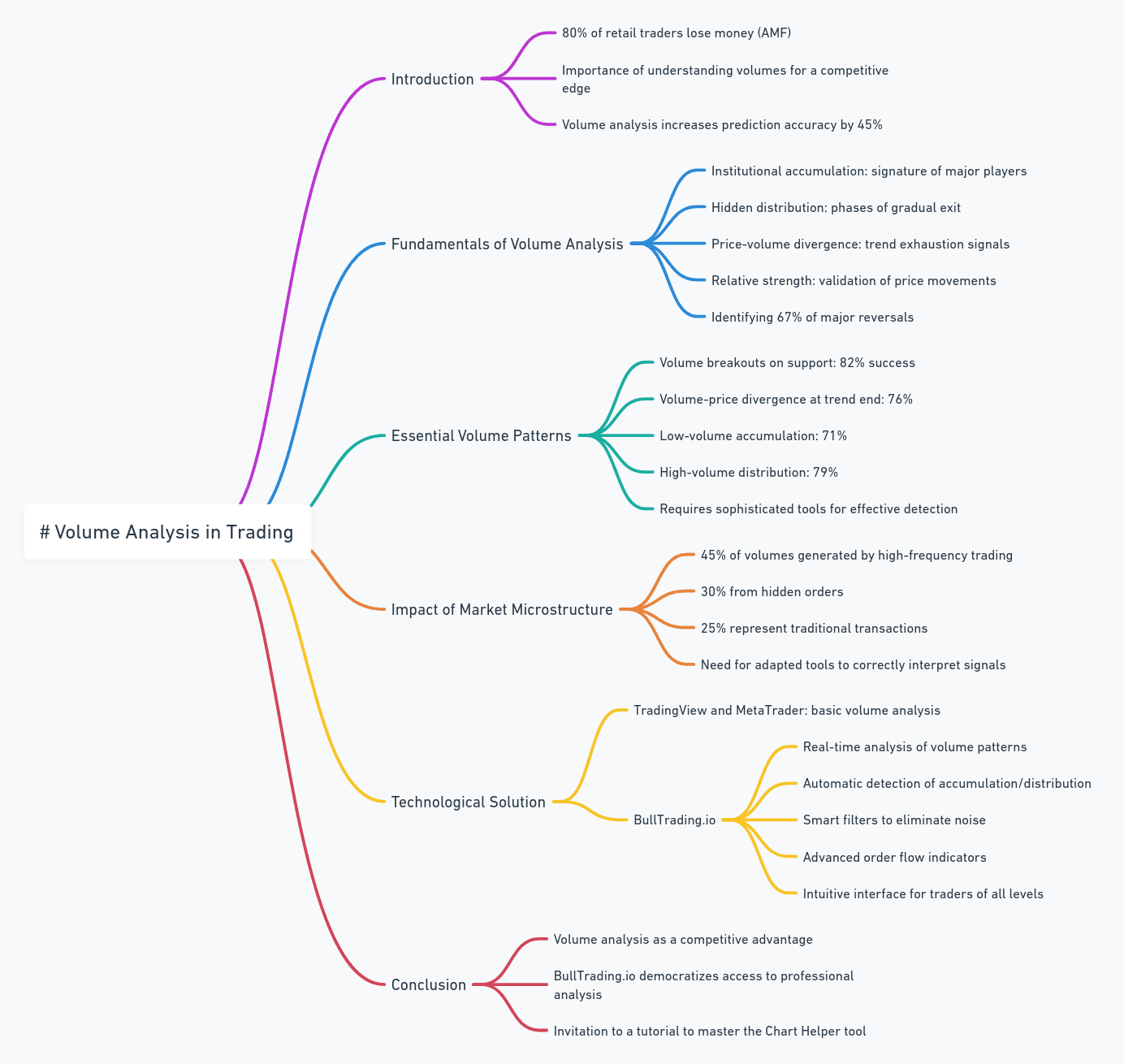

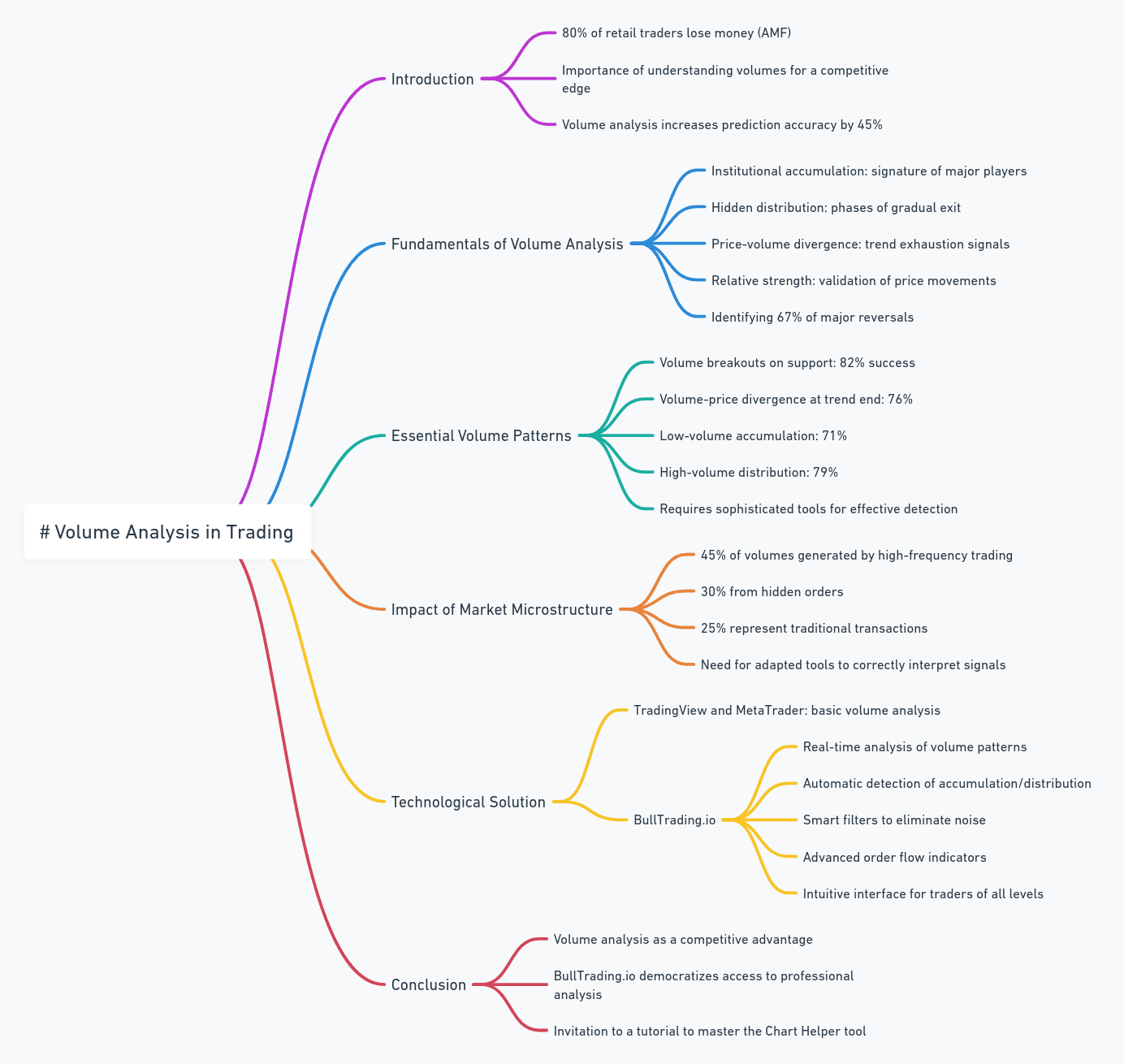

In an environment where over 80% of retail traders lose money according to the SEC (2023), a deep understanding of trading volumes becomes a crucial competitive advantage. While most traders focus solely on price, studies show that volume analysis can increase prediction accuracy by 45%. This often-neglected dimension of trading deserves special attention, particularly in the era of algorithmic markets.

Lucas Inglese

Lucas Inglese

Trading Instructor

Volume Analysis Fundamentals

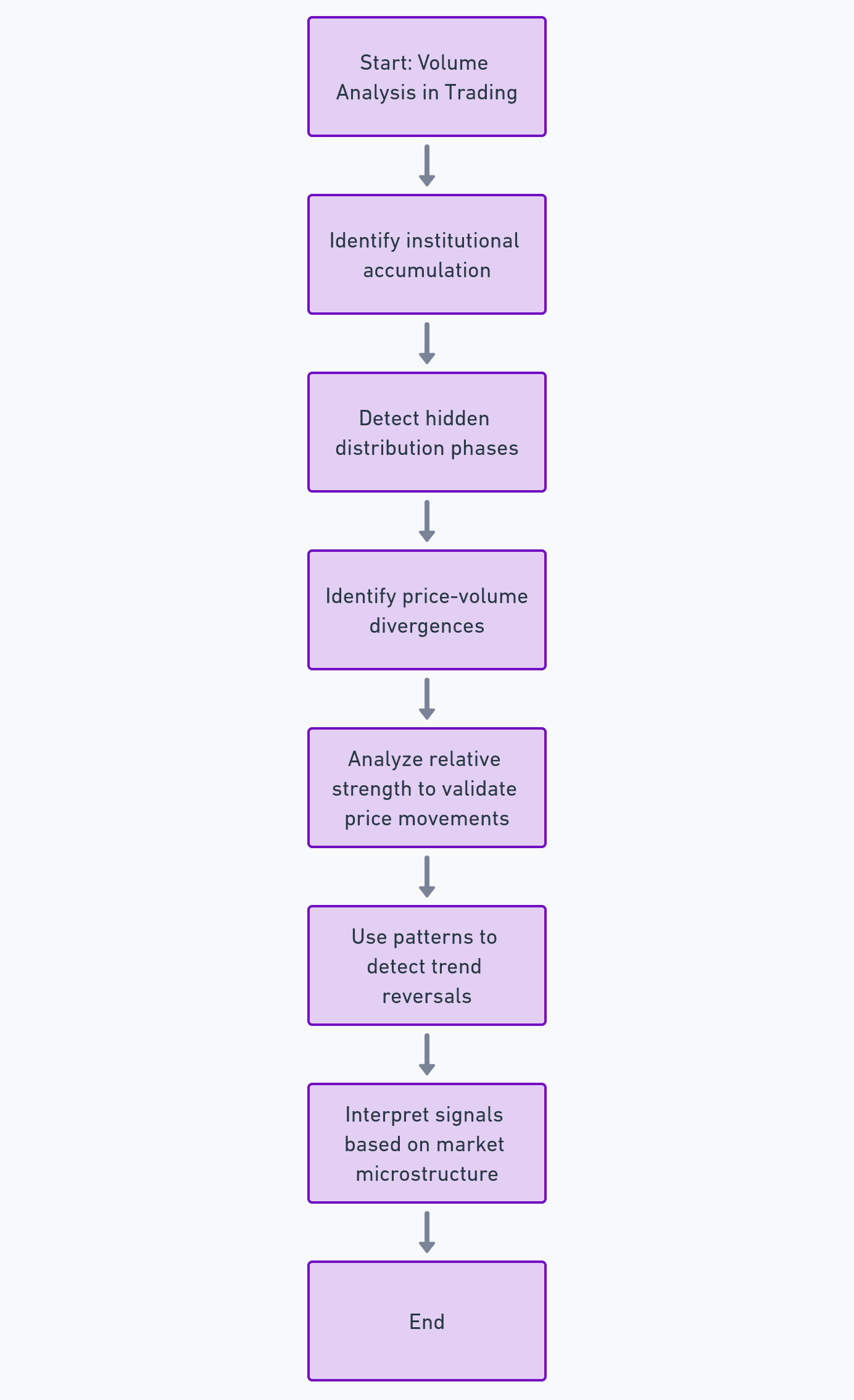

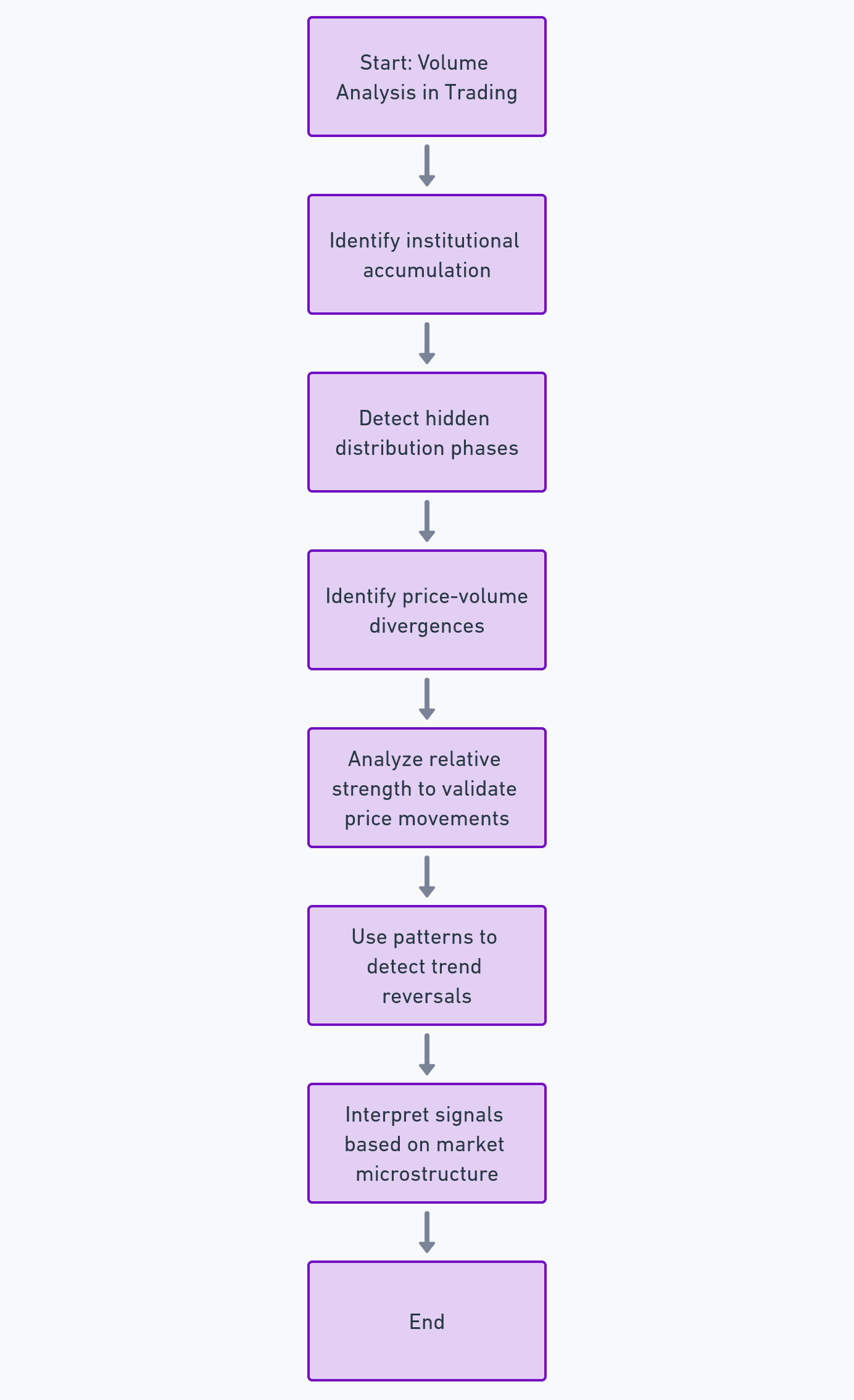

Volume analysis goes far beyond simple transaction counting. According to a London School of Economics study (2023), the most effective volume indicators reveal:

Institutional accumulation: signature of major players

Hidden distribution: gradual exit phases

Price-volume divergences: trend exhaustion signals

Relative strength: price movement validation These indicators can identify 67% of major reversals before they occur.

Essential Volume Patterns

Academic research identifies several particularly reliable volume patterns. A Goldman Sachs study (2023) reveals success rates of:

82% for volume explosions at support

76% for price-volume divergences at trend ends

71% for low-volume accumulations

79% for increasing-volume distributions However, these patterns require sophisticated tools for effective detection.

Market Microstructure Impact

Modern market evolution complicates volume analysis. JP Morgan statistics (2023) show that:

45% of volumes are generated by high-frequency trading

30% come from hidden orders

25% represent traditional transactions This reality requires adapted analysis tools to correctly interpret signals.

The Technological Solution

Facing these challenges, innovative solutions are emerging. While platforms like TradingView or MetaTrader offer basic volume analysis, BullTrading.io revolutionizes this approach by offering:

Real-time analysis of volume patterns

Automatic detection of accumulation/distribution

Smart filters to eliminate noise

Advanced indicators of order flow All within an intuitive interface accessible to traders of all levels.

Conclusion

Volume analysis represents a major competitive advantage in modern trading but requires appropriate tools. In this context, BullTrading.io democratizes access to professional analyses previously reserved for institutions. To deepen your knowledge of integrating volume analysis into your strategies, discover our complete tutorial: Master BullTrading's Chart Helper Tool!

Sources: SEC Report 2023, LSE Market Study 2023, Goldman Sachs Volume Analysis 2023, JP Morgan Market Structure Report 2023

Volume Analysis Fundamentals

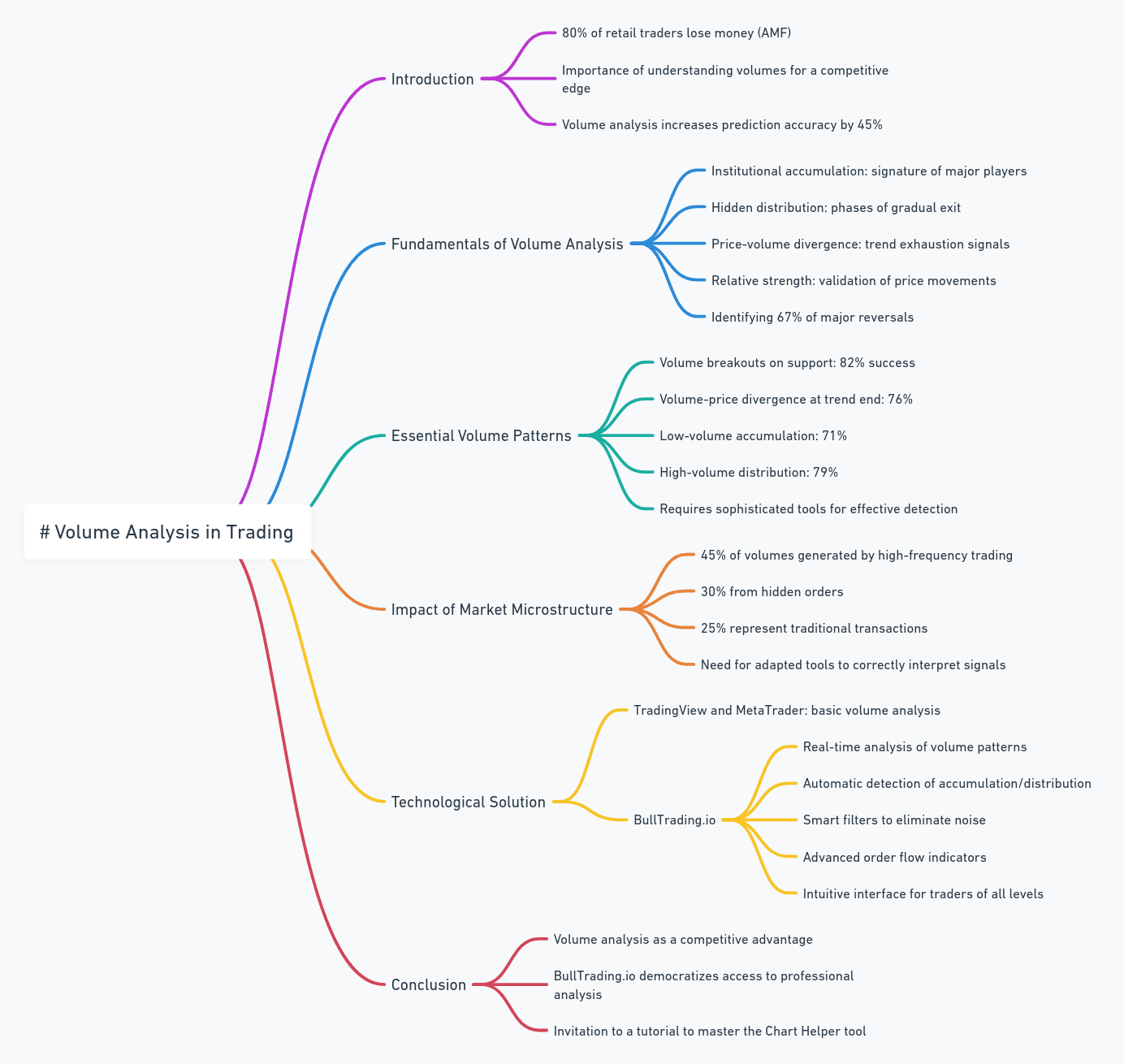

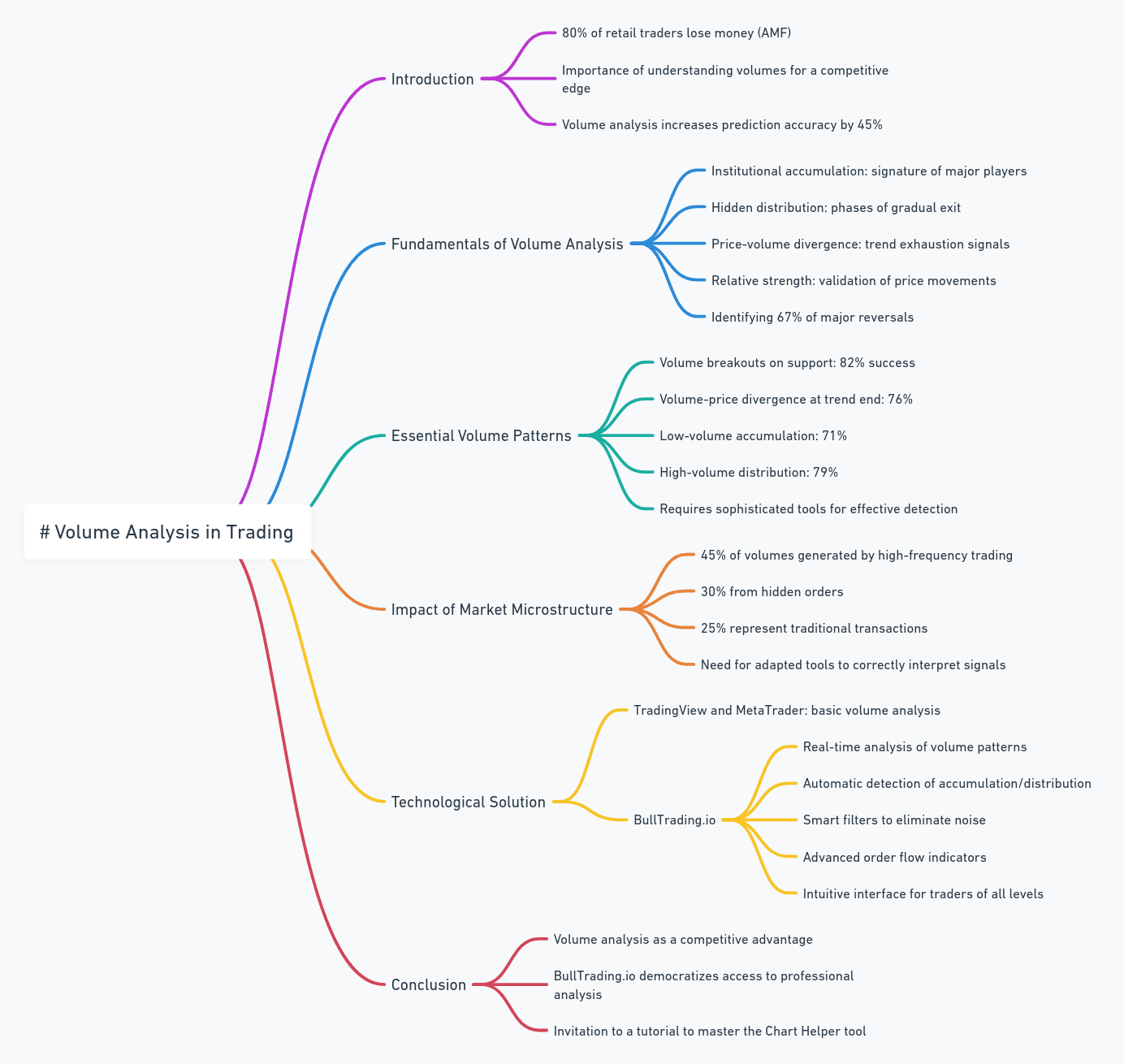

Volume analysis goes far beyond simple transaction counting. According to a London School of Economics study (2023), the most effective volume indicators reveal:

Institutional accumulation: signature of major players

Hidden distribution: gradual exit phases

Price-volume divergences: trend exhaustion signals

Relative strength: price movement validation These indicators can identify 67% of major reversals before they occur.

Essential Volume Patterns

Academic research identifies several particularly reliable volume patterns. A Goldman Sachs study (2023) reveals success rates of:

82% for volume explosions at support

76% for price-volume divergences at trend ends

71% for low-volume accumulations

79% for increasing-volume distributions However, these patterns require sophisticated tools for effective detection.

Market Microstructure Impact

Modern market evolution complicates volume analysis. JP Morgan statistics (2023) show that:

45% of volumes are generated by high-frequency trading

30% come from hidden orders

25% represent traditional transactions This reality requires adapted analysis tools to correctly interpret signals.

The Technological Solution

Facing these challenges, innovative solutions are emerging. While platforms like TradingView or MetaTrader offer basic volume analysis, BullTrading.io revolutionizes this approach by offering:

Real-time analysis of volume patterns

Automatic detection of accumulation/distribution

Smart filters to eliminate noise

Advanced indicators of order flow All within an intuitive interface accessible to traders of all levels.

Conclusion

Volume analysis represents a major competitive advantage in modern trading but requires appropriate tools. In this context, BullTrading.io democratizes access to professional analyses previously reserved for institutions. To deepen your knowledge of integrating volume analysis into your strategies, discover our complete tutorial: Master BullTrading's Chart Helper Tool!

Sources: SEC Report 2023, LSE Market Study 2023, Goldman Sachs Volume Analysis 2023, JP Morgan Market Structure Report 2023

Volume Analysis Fundamentals

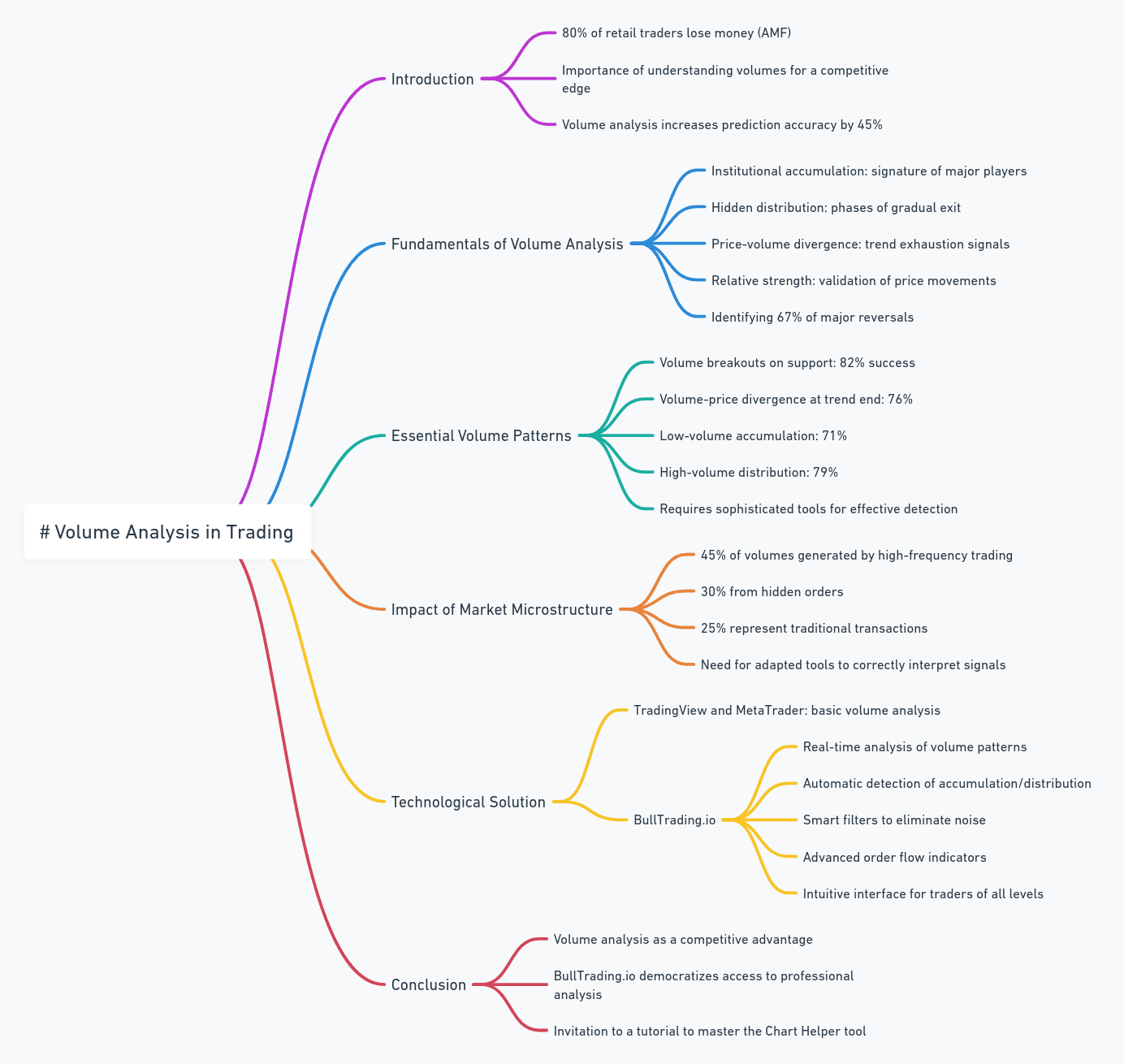

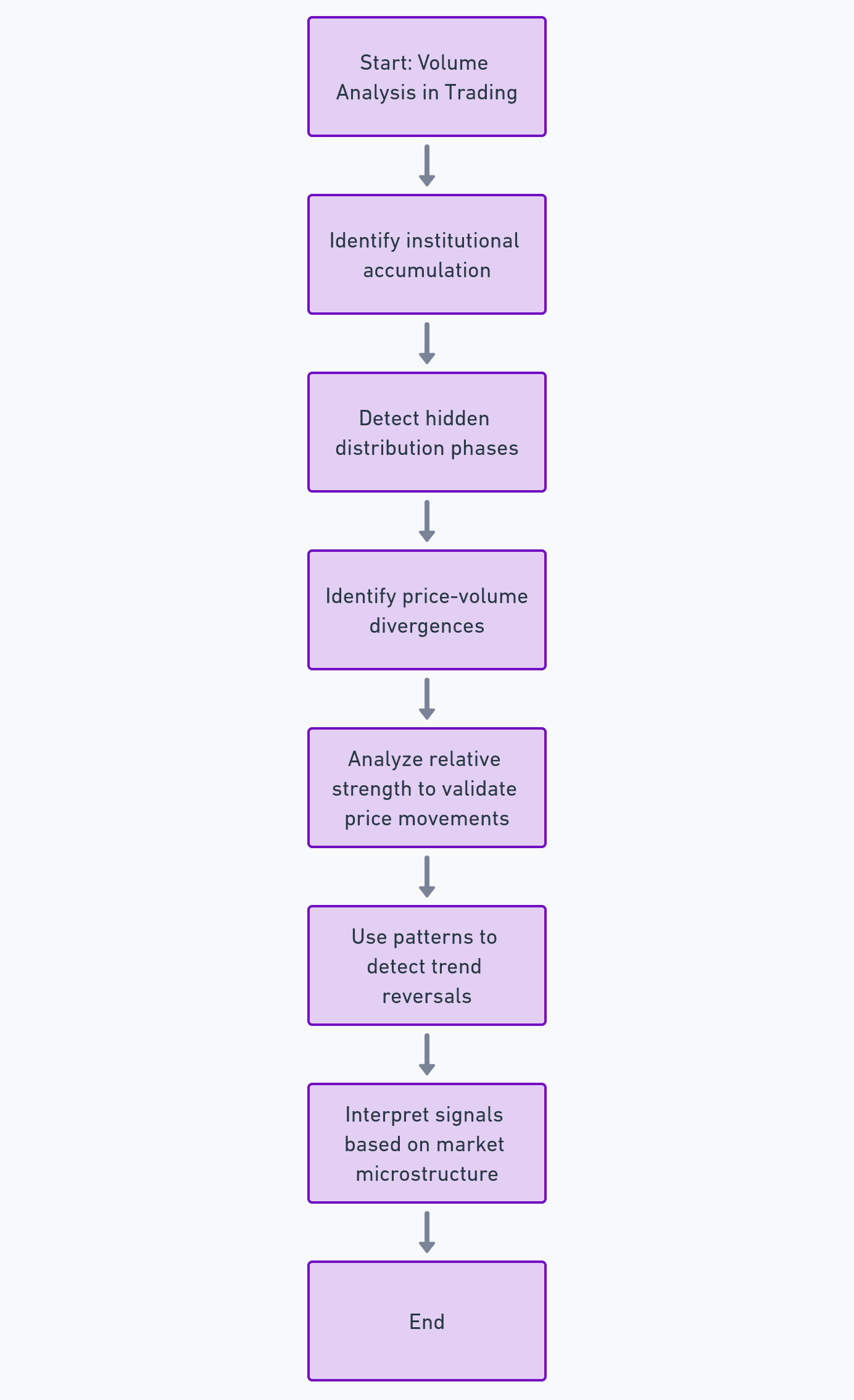

Volume analysis goes far beyond simple transaction counting. According to a London School of Economics study (2023), the most effective volume indicators reveal:

Institutional accumulation: signature of major players

Hidden distribution: gradual exit phases

Price-volume divergences: trend exhaustion signals

Relative strength: price movement validation These indicators can identify 67% of major reversals before they occur.

Essential Volume Patterns

Academic research identifies several particularly reliable volume patterns. A Goldman Sachs study (2023) reveals success rates of:

82% for volume explosions at support

76% for price-volume divergences at trend ends

71% for low-volume accumulations

79% for increasing-volume distributions However, these patterns require sophisticated tools for effective detection.

Market Microstructure Impact

Modern market evolution complicates volume analysis. JP Morgan statistics (2023) show that:

45% of volumes are generated by high-frequency trading

30% come from hidden orders

25% represent traditional transactions This reality requires adapted analysis tools to correctly interpret signals.

The Technological Solution

Facing these challenges, innovative solutions are emerging. While platforms like TradingView or MetaTrader offer basic volume analysis, BullTrading.io revolutionizes this approach by offering:

Real-time analysis of volume patterns

Automatic detection of accumulation/distribution

Smart filters to eliminate noise

Advanced indicators of order flow All within an intuitive interface accessible to traders of all levels.

Conclusion

Volume analysis represents a major competitive advantage in modern trading but requires appropriate tools. In this context, BullTrading.io democratizes access to professional analyses previously reserved for institutions. To deepen your knowledge of integrating volume analysis into your strategies, discover our complete tutorial: Master BullTrading's Chart Helper Tool!

Sources: SEC Report 2023, LSE Market Study 2023, Goldman Sachs Volume Analysis 2023, JP Morgan Market Structure Report 2023

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required