5 min

Nov 10, 2024

Editor

Backtesting in Trading: How to Validate Your Strategy Without Risking Capital

Backtesting in Trading: How to Validate Your Strategy Without Risking Capital

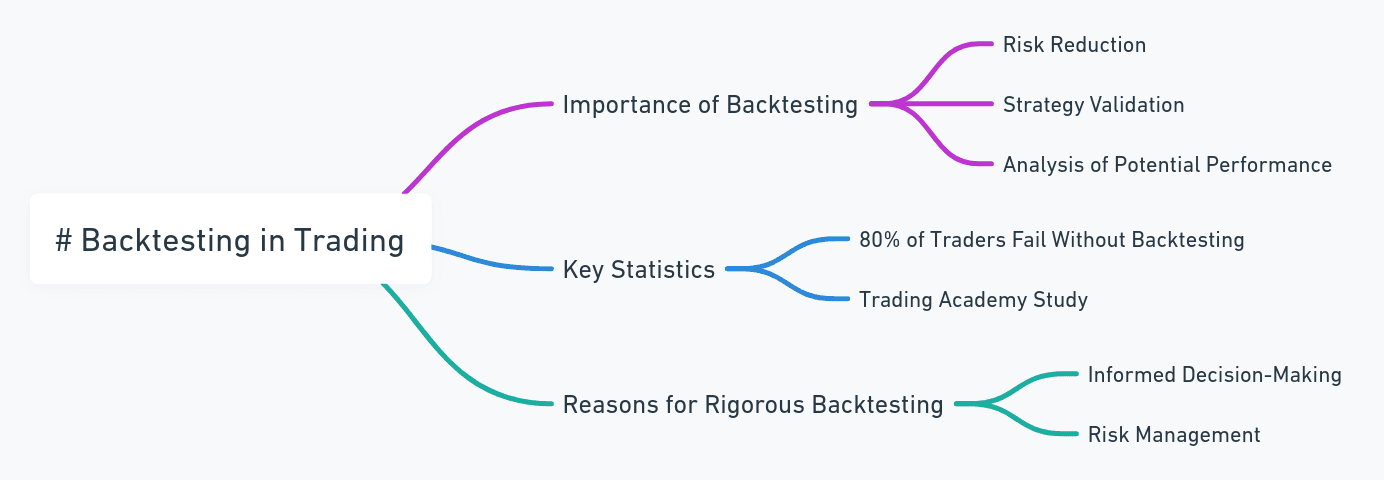

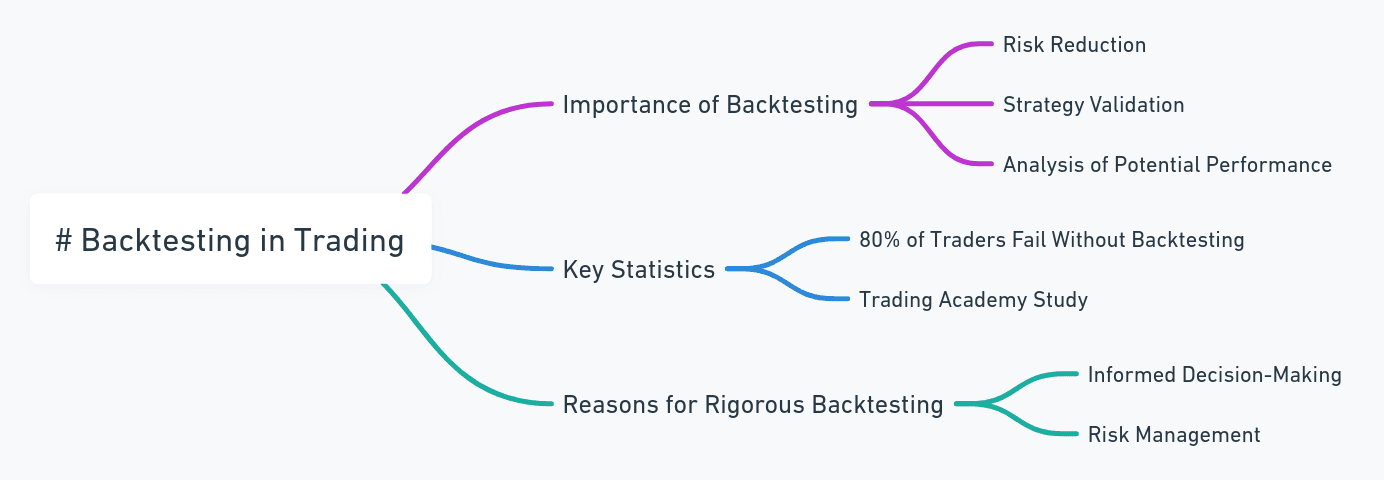

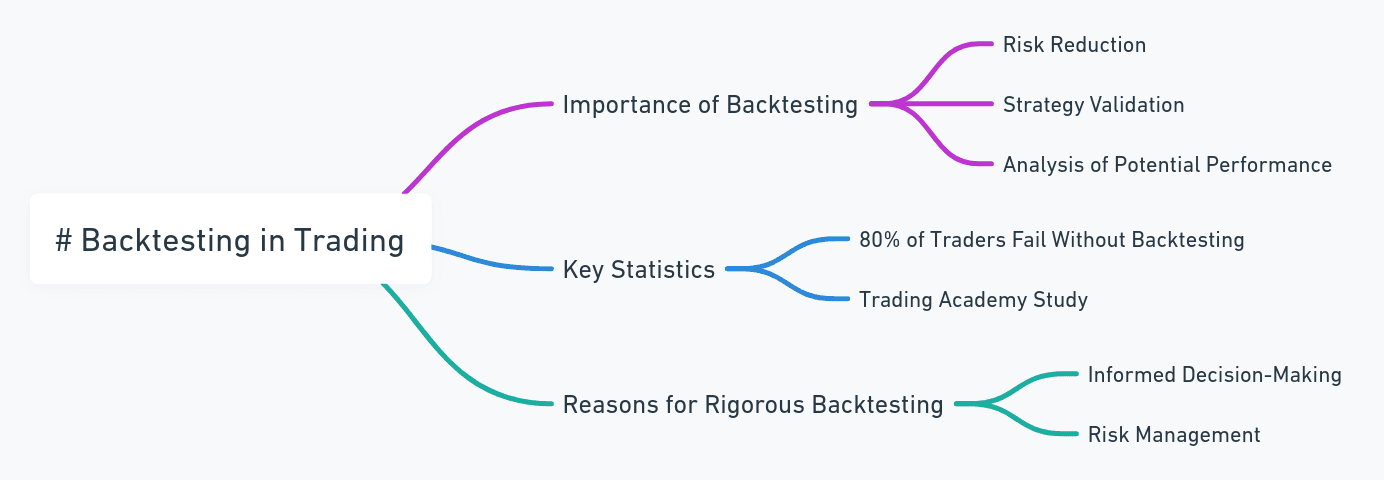

In the world of trading, validating a strategy before applying it in real markets is essential for any informed investor. Backtesting, the practice of testing a strategy on historical data, has become a crucial element of risk management. According to a study by the Trading Academy in 2023, 80% of traders who don’t backtest lose their capital within the first six months. This statistic highlights the importance of a rigorous approach in strategy development.

Lucas Inglese

Lucas Inglese

Trading Instructor

Fundamentals of Backtesting

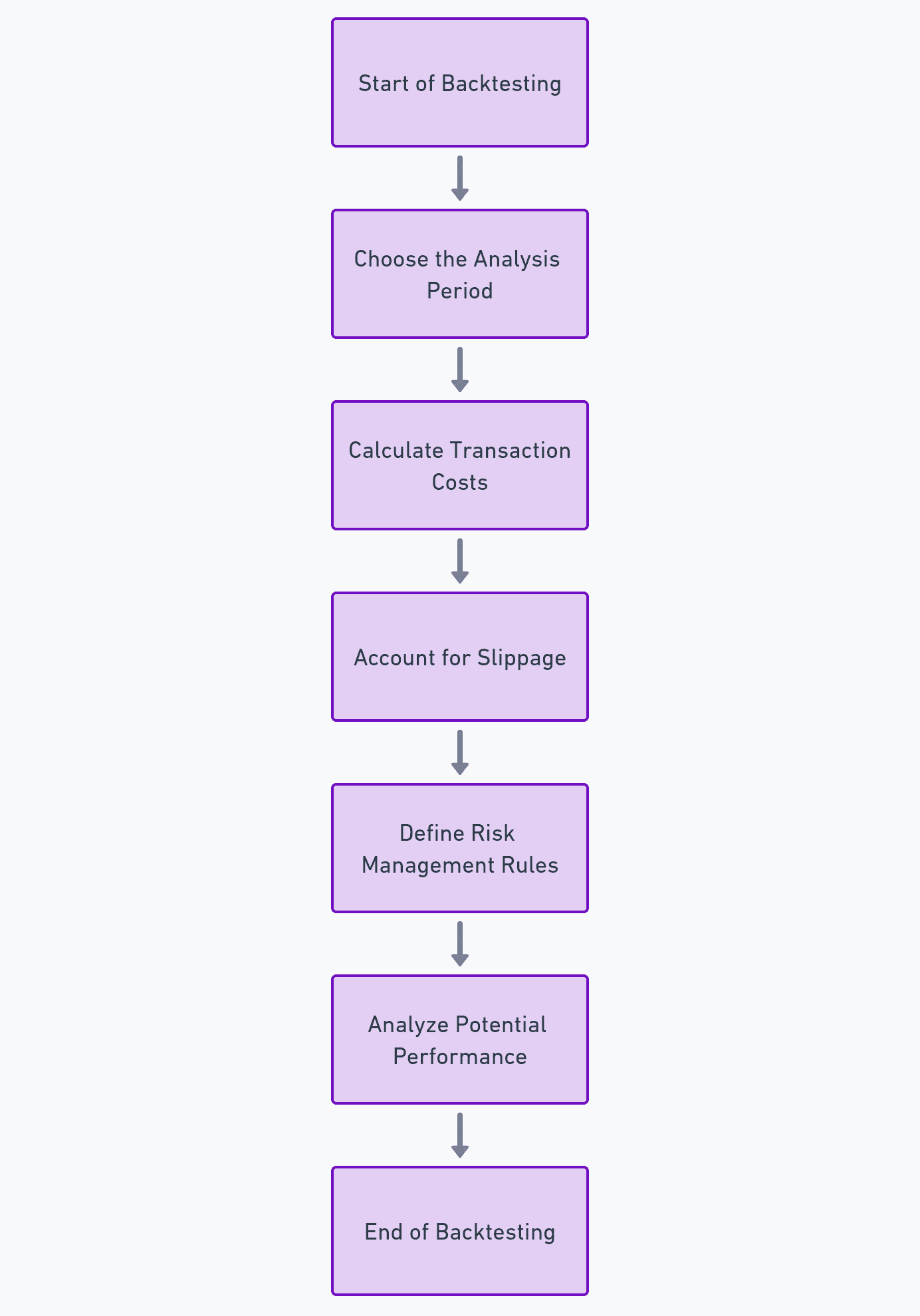

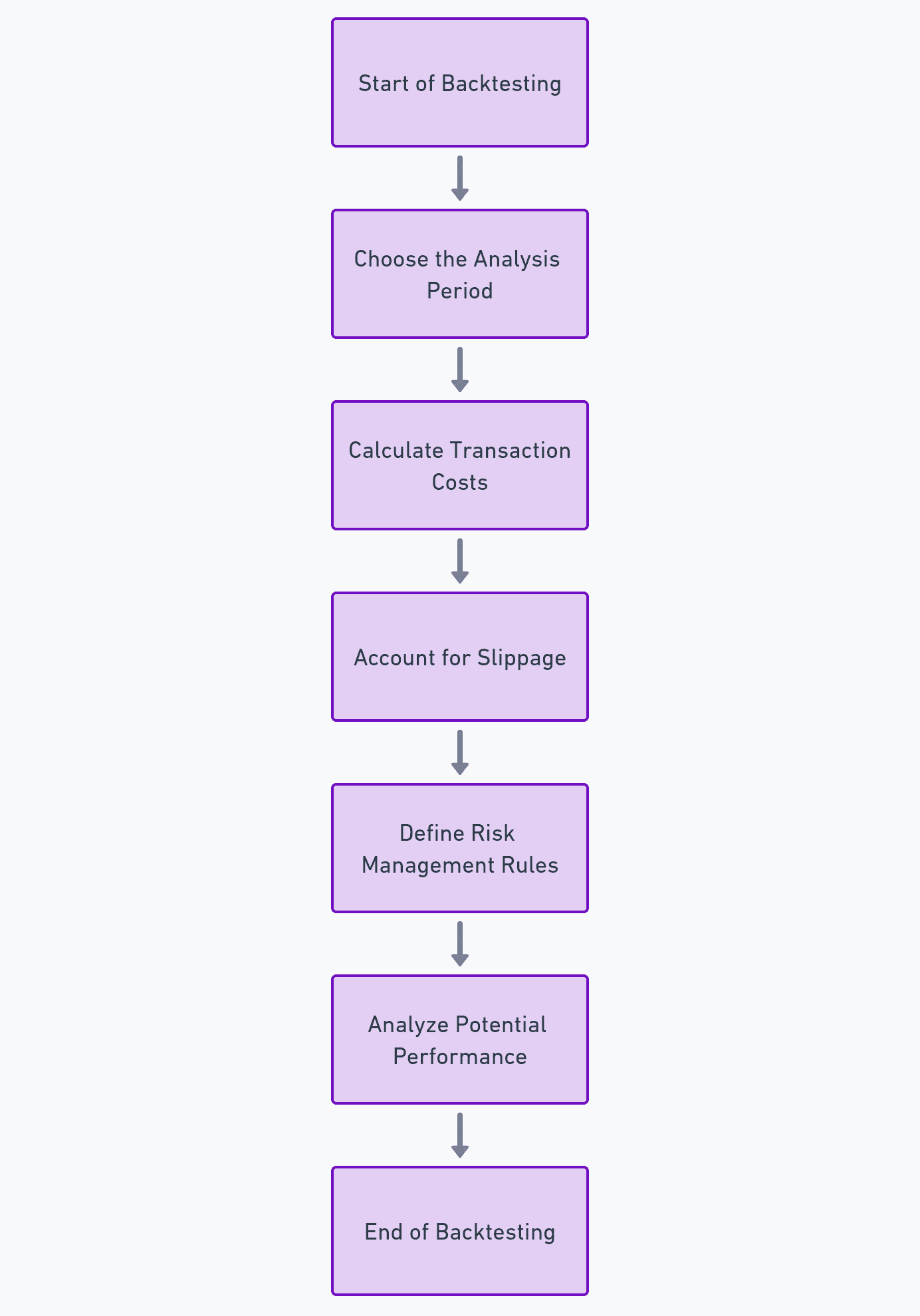

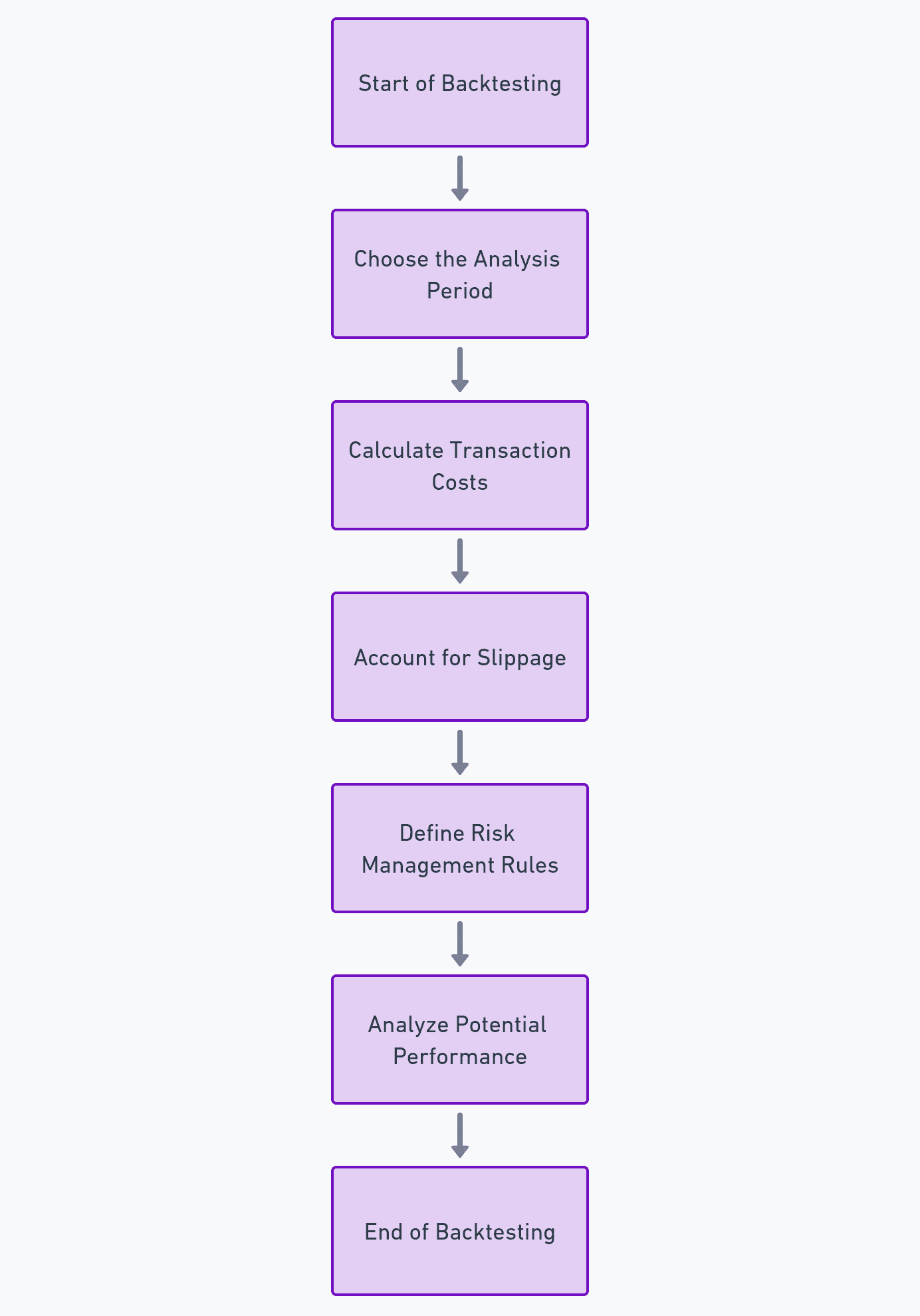

Backtesting is based on analyzing a trading strategy’s performance on historical data. Key components of effective backtesting include:

The analysis period (timeframe)

Transaction costs

Slippage (difference between theoretical and actual price)

Risk management (stop-loss, take-profit)

These elements help reveal the strengths and weaknesses of a strategy before launching it in real markets.

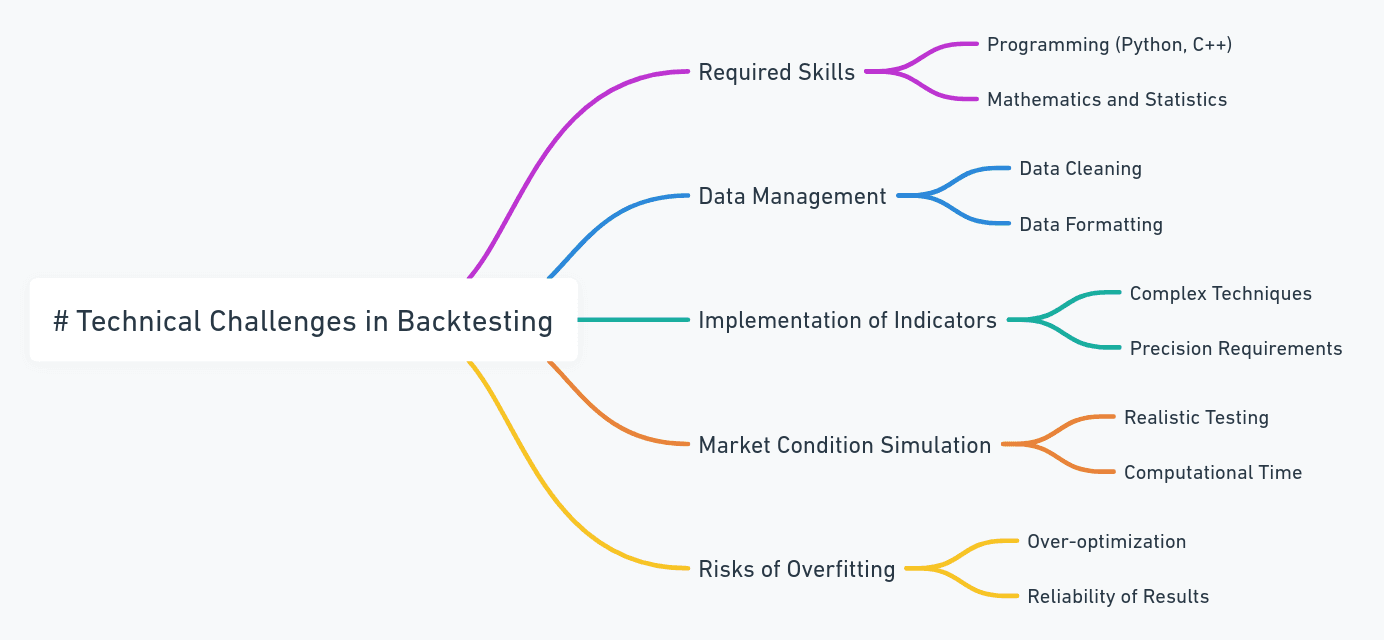

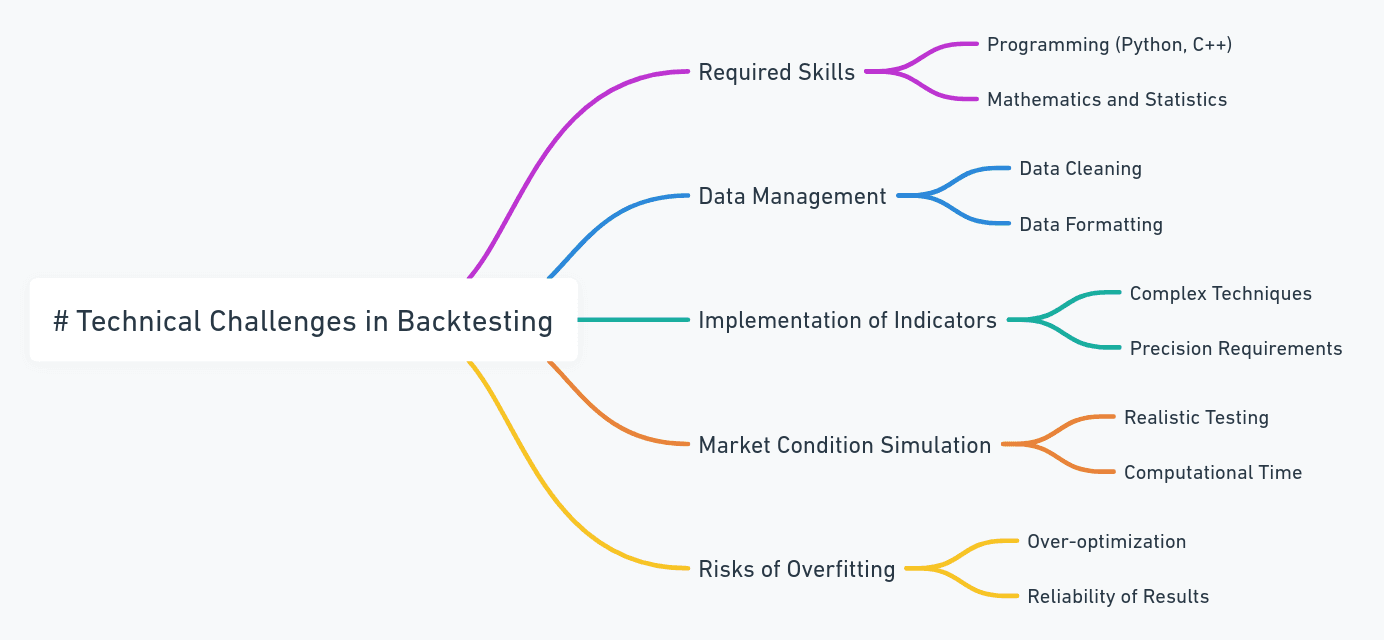

Technical Challenges in Backtesting

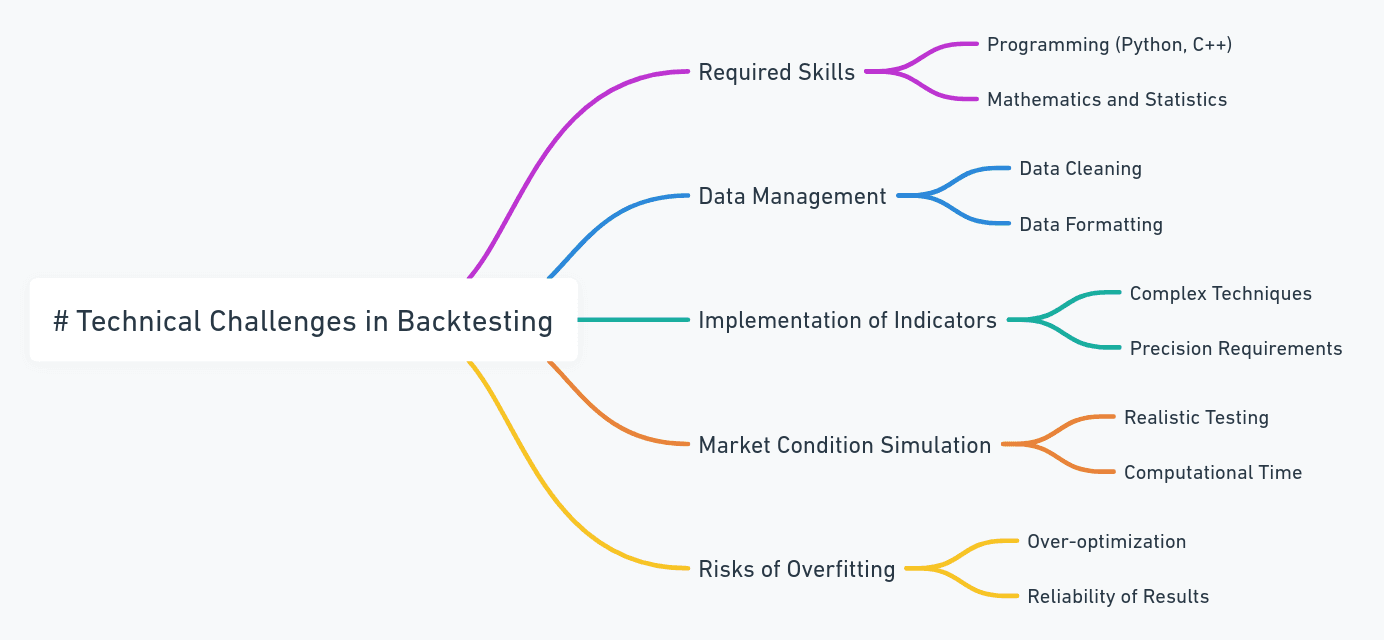

Implementing effective backtesting presents several technical challenges, including:

Programming skills (Python, C++) and knowledge of statistics

Historical data management (cleaning and formatting)

Technical indicator implementation

Market condition simulation

Overfitting risk is also crucial. A 2022 study in the Journal of Financial Markets shows that 73% of over-optimized strategies fail in real conditions despite promising backtest results.

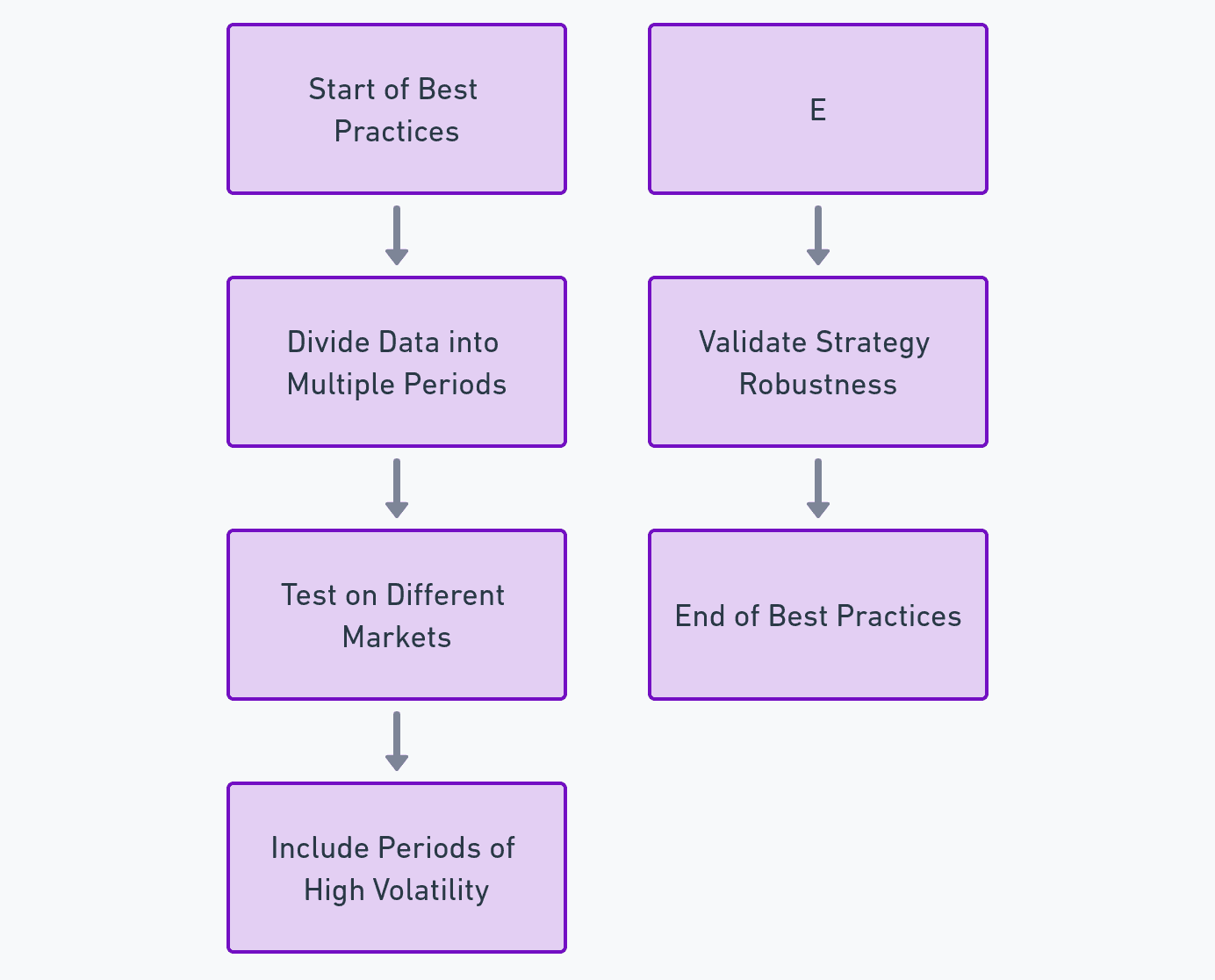

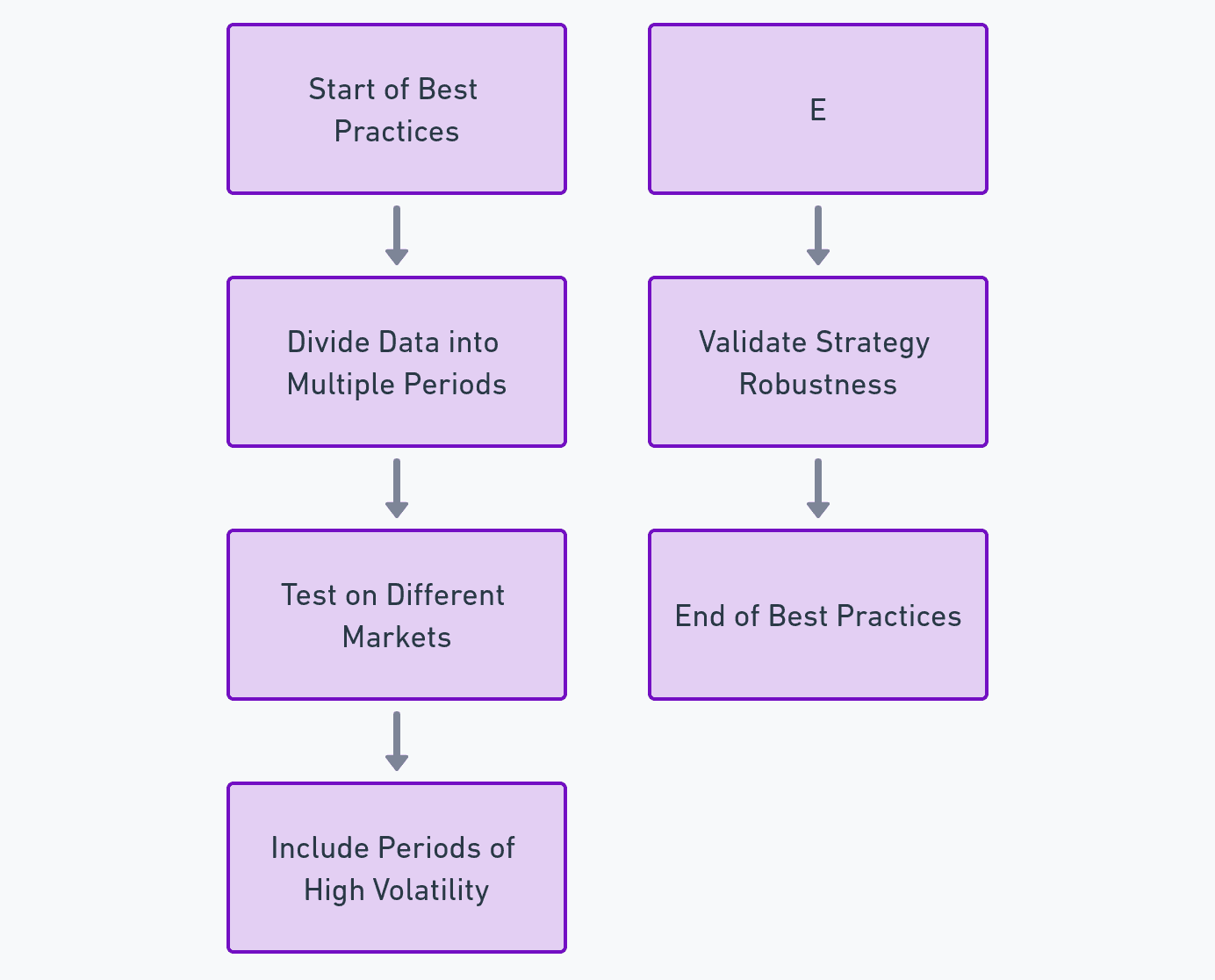

Best Practices for Reliable Backtesting

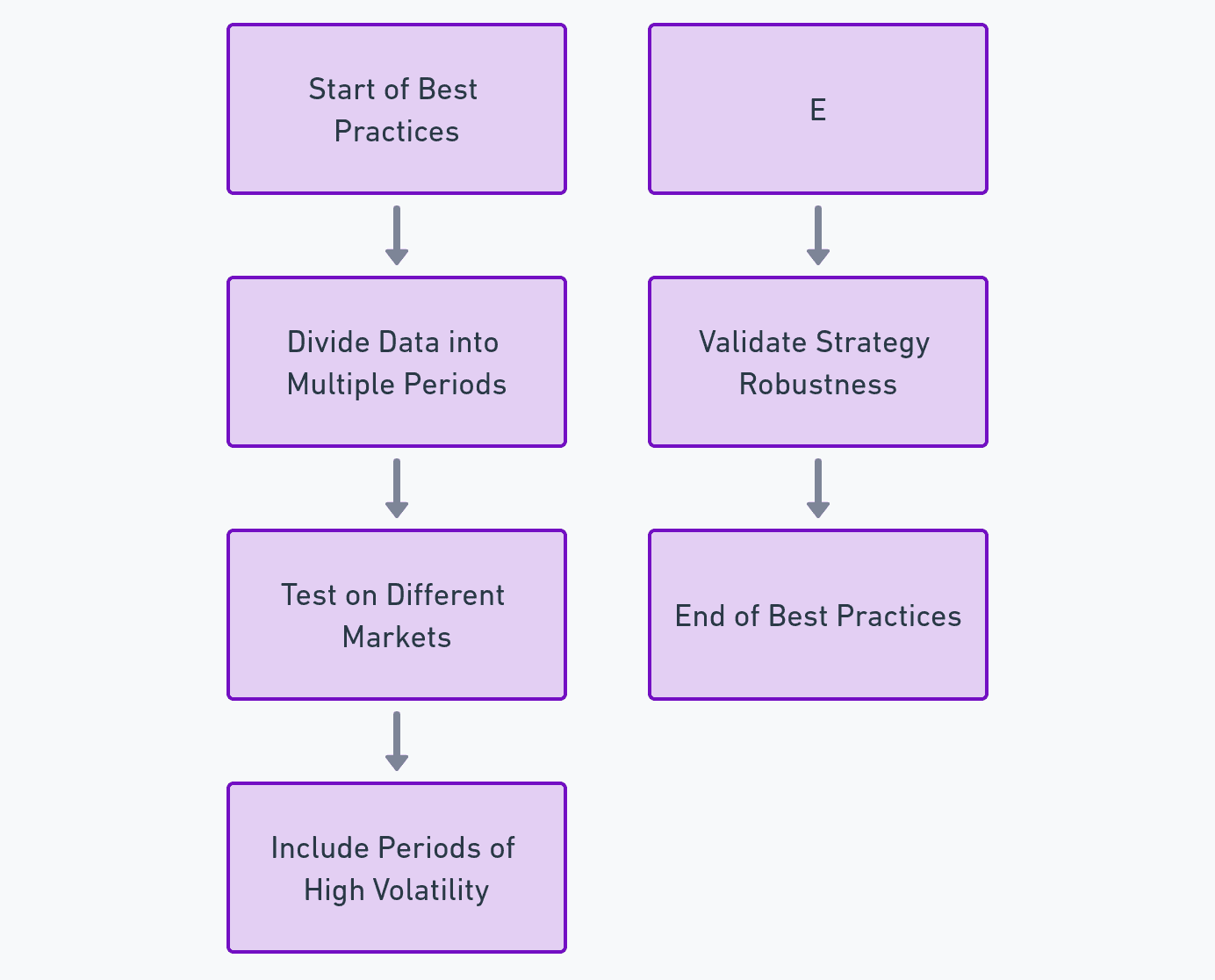

To maximize the relevance of backtest results, the following practices are essential:

Divide data into multiple periods

Test across different markets

Include periods of high volatility

Analyze performance metrics (Sharpe ratio, drawdown)

These best practices ensure that a strategy remains robust under varying market conditions.

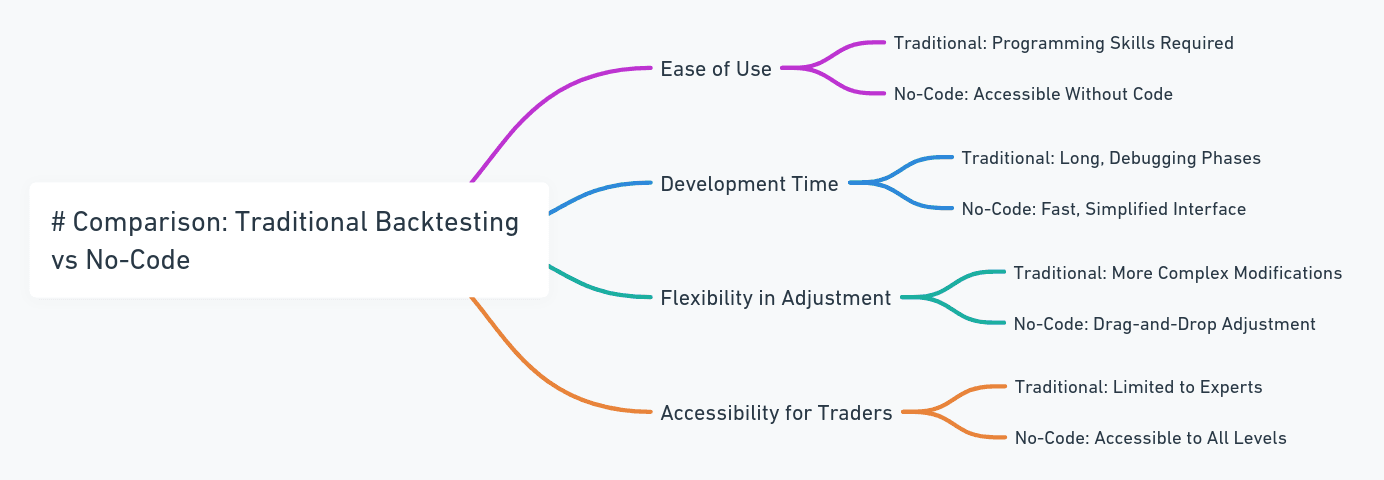

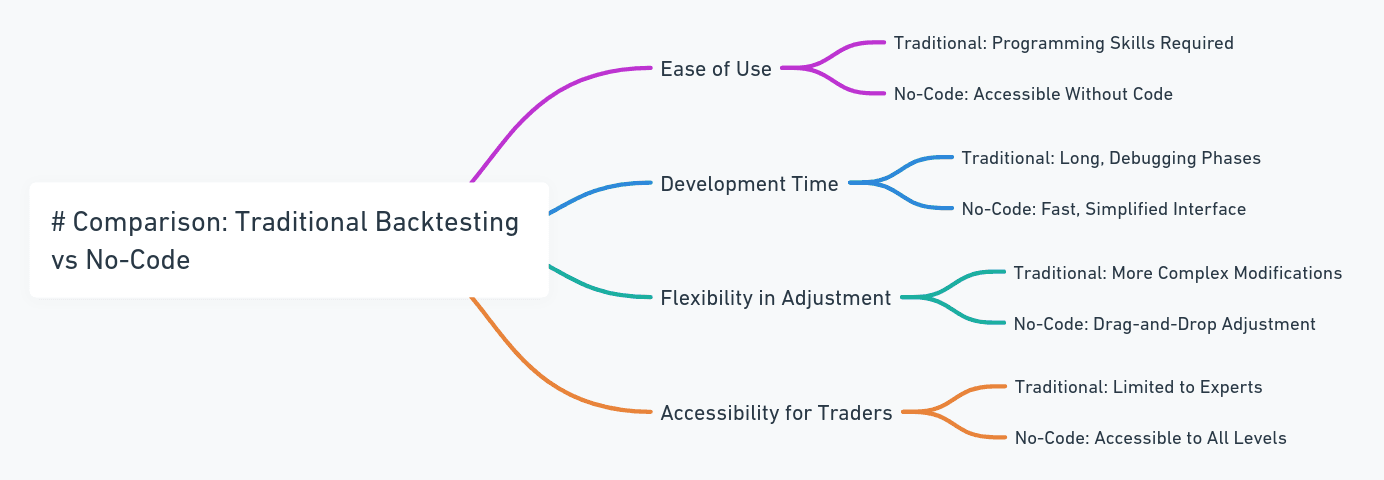

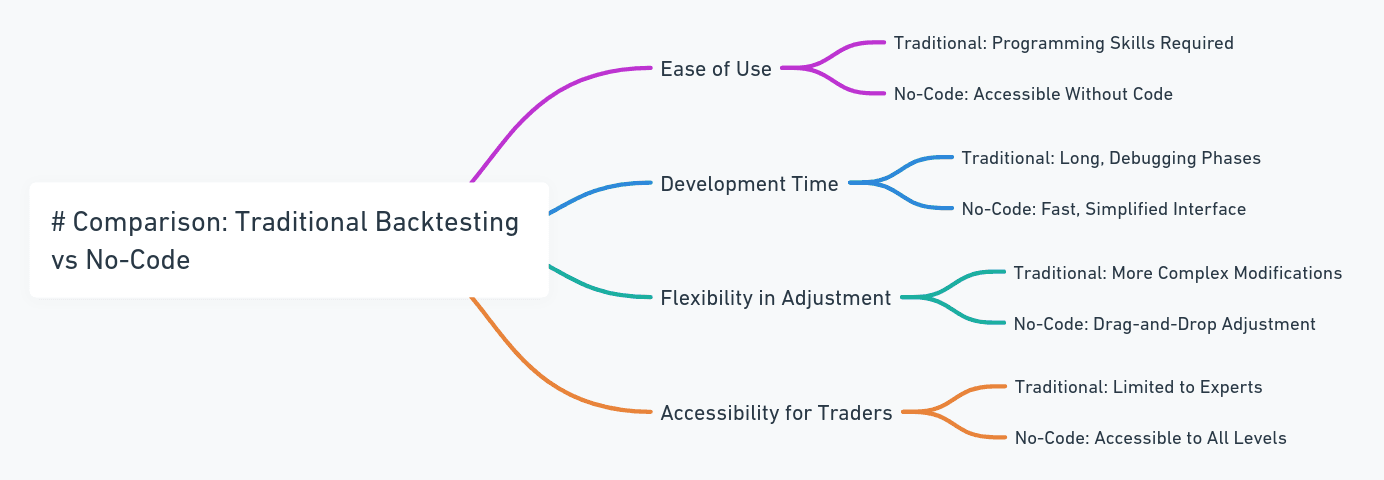

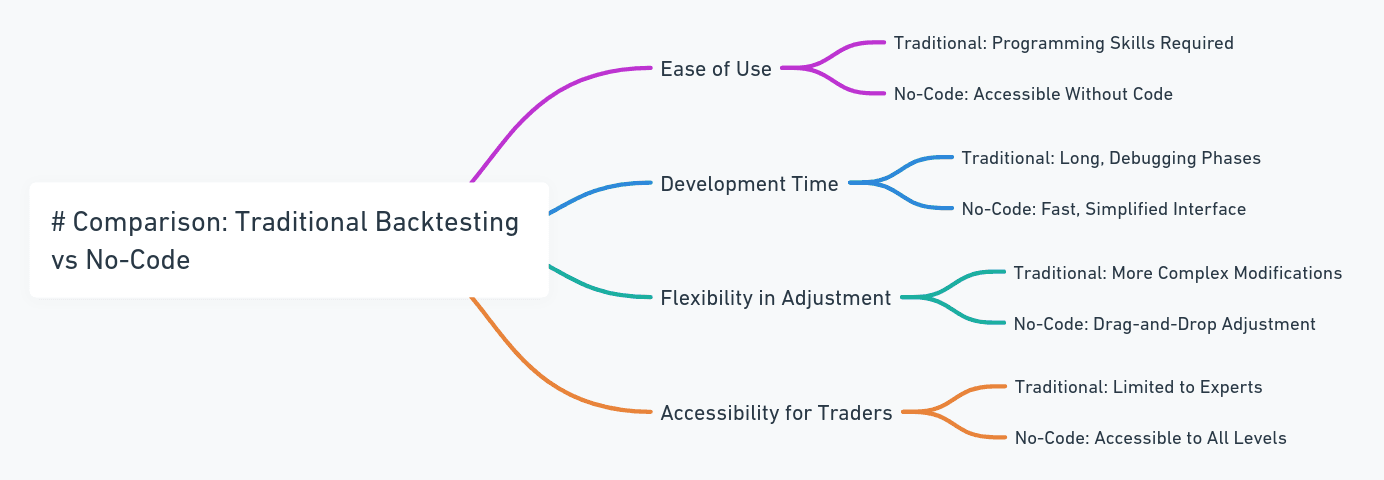

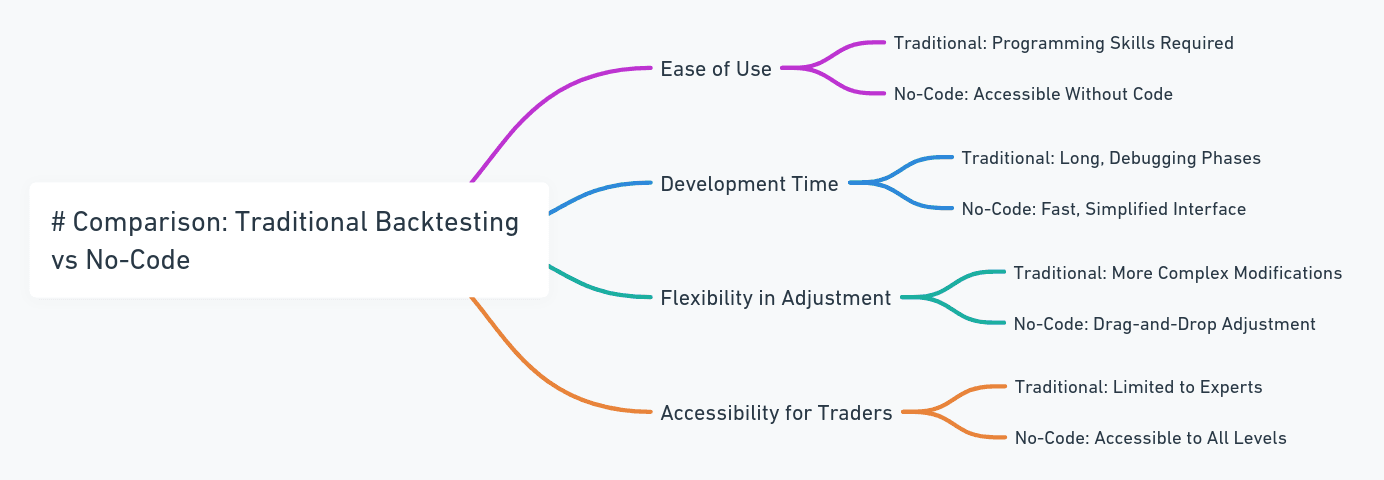

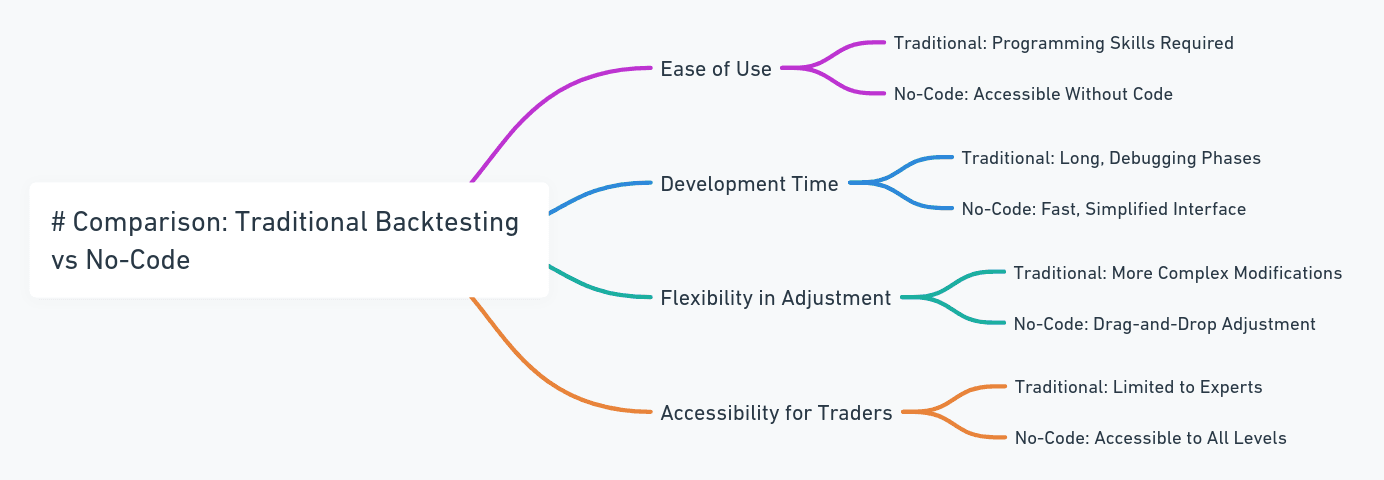

The Revolution of No-Code Backtesting

Faced with the technical challenges of traditional backtesting, no-code tools make these essential tools more accessible to traders without programming skills. Platforms like Bulltrading.io allow traders to develop and test strategies through an intuitive interface with several advantages:

Reduced development time

Fewer programming errors

Increased flexibility for strategy adjustments

These tools make backtesting accessible to all levels of traders.

Conclusion

Backtesting is a crucial step in developing effective trading strategies. No-code solutions, like those offered by Bulltrading.io, democratize access to advanced backtesting tools without requiring complex programming. To optimize your backtesting process, explore Bulltrading.io.

Fundamentals of Backtesting

Backtesting is based on analyzing a trading strategy’s performance on historical data. Key components of effective backtesting include:

The analysis period (timeframe)

Transaction costs

Slippage (difference between theoretical and actual price)

Risk management (stop-loss, take-profit)

These elements help reveal the strengths and weaknesses of a strategy before launching it in real markets.

Technical Challenges in Backtesting

Implementing effective backtesting presents several technical challenges, including:

Programming skills (Python, C++) and knowledge of statistics

Historical data management (cleaning and formatting)

Technical indicator implementation

Market condition simulation

Overfitting risk is also crucial. A 2022 study in the Journal of Financial Markets shows that 73% of over-optimized strategies fail in real conditions despite promising backtest results.

Best Practices for Reliable Backtesting

To maximize the relevance of backtest results, the following practices are essential:

Divide data into multiple periods

Test across different markets

Include periods of high volatility

Analyze performance metrics (Sharpe ratio, drawdown)

These best practices ensure that a strategy remains robust under varying market conditions.

The Revolution of No-Code Backtesting

Faced with the technical challenges of traditional backtesting, no-code tools make these essential tools more accessible to traders without programming skills. Platforms like Bulltrading.io allow traders to develop and test strategies through an intuitive interface with several advantages:

Reduced development time

Fewer programming errors

Increased flexibility for strategy adjustments

These tools make backtesting accessible to all levels of traders.

Conclusion

Backtesting is a crucial step in developing effective trading strategies. No-code solutions, like those offered by Bulltrading.io, democratize access to advanced backtesting tools without requiring complex programming. To optimize your backtesting process, explore Bulltrading.io.

Fundamentals of Backtesting

Backtesting is based on analyzing a trading strategy’s performance on historical data. Key components of effective backtesting include:

The analysis period (timeframe)

Transaction costs

Slippage (difference between theoretical and actual price)

Risk management (stop-loss, take-profit)

These elements help reveal the strengths and weaknesses of a strategy before launching it in real markets.

Technical Challenges in Backtesting

Implementing effective backtesting presents several technical challenges, including:

Programming skills (Python, C++) and knowledge of statistics

Historical data management (cleaning and formatting)

Technical indicator implementation

Market condition simulation

Overfitting risk is also crucial. A 2022 study in the Journal of Financial Markets shows that 73% of over-optimized strategies fail in real conditions despite promising backtest results.

Best Practices for Reliable Backtesting

To maximize the relevance of backtest results, the following practices are essential:

Divide data into multiple periods

Test across different markets

Include periods of high volatility

Analyze performance metrics (Sharpe ratio, drawdown)

These best practices ensure that a strategy remains robust under varying market conditions.

The Revolution of No-Code Backtesting

Faced with the technical challenges of traditional backtesting, no-code tools make these essential tools more accessible to traders without programming skills. Platforms like Bulltrading.io allow traders to develop and test strategies through an intuitive interface with several advantages:

Reduced development time

Fewer programming errors

Increased flexibility for strategy adjustments

These tools make backtesting accessible to all levels of traders.

Conclusion

Backtesting is a crucial step in developing effective trading strategies. No-code solutions, like those offered by Bulltrading.io, democratize access to advanced backtesting tools without requiring complex programming. To optimize your backtesting process, explore Bulltrading.io.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required