5 min

Nov 15, 2024

Editor

Correlation Trading: The Key to Smart Diversification

Correlation Trading: The Key to Smart Diversification

In modern trading, portfolio diversification is no longer limited to simple asset allocation. According to a Morgan Stanley study (2023), over 65% of major trading losses are due to unanticipated correlations between supposedly independent assets. Correlation trading emerges as a sophisticated approach to exploit complex relationships between different markets while minimizing systemic risks.

Lucas Inglese

Lucas Inglese

Trading Instructor

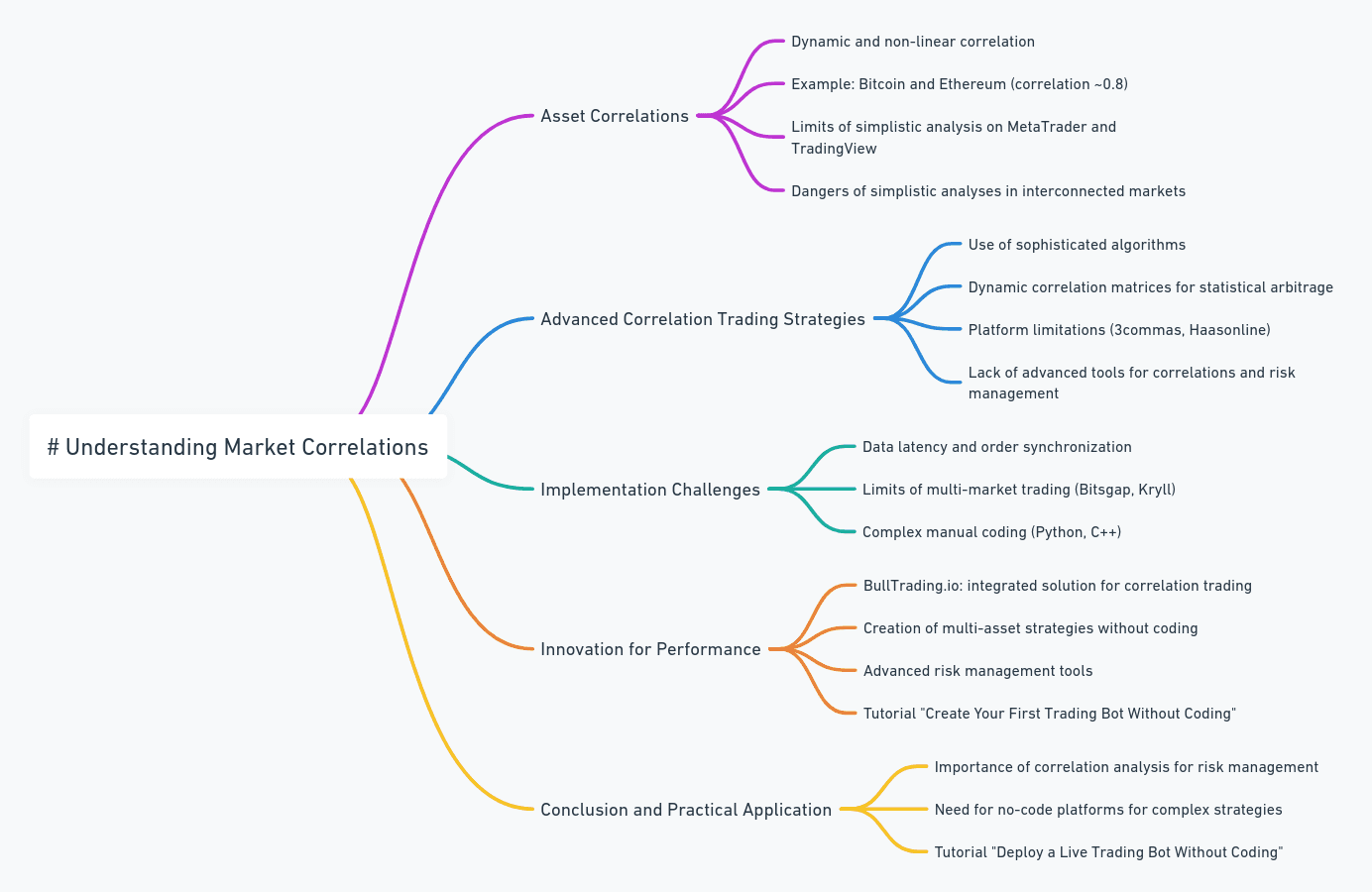

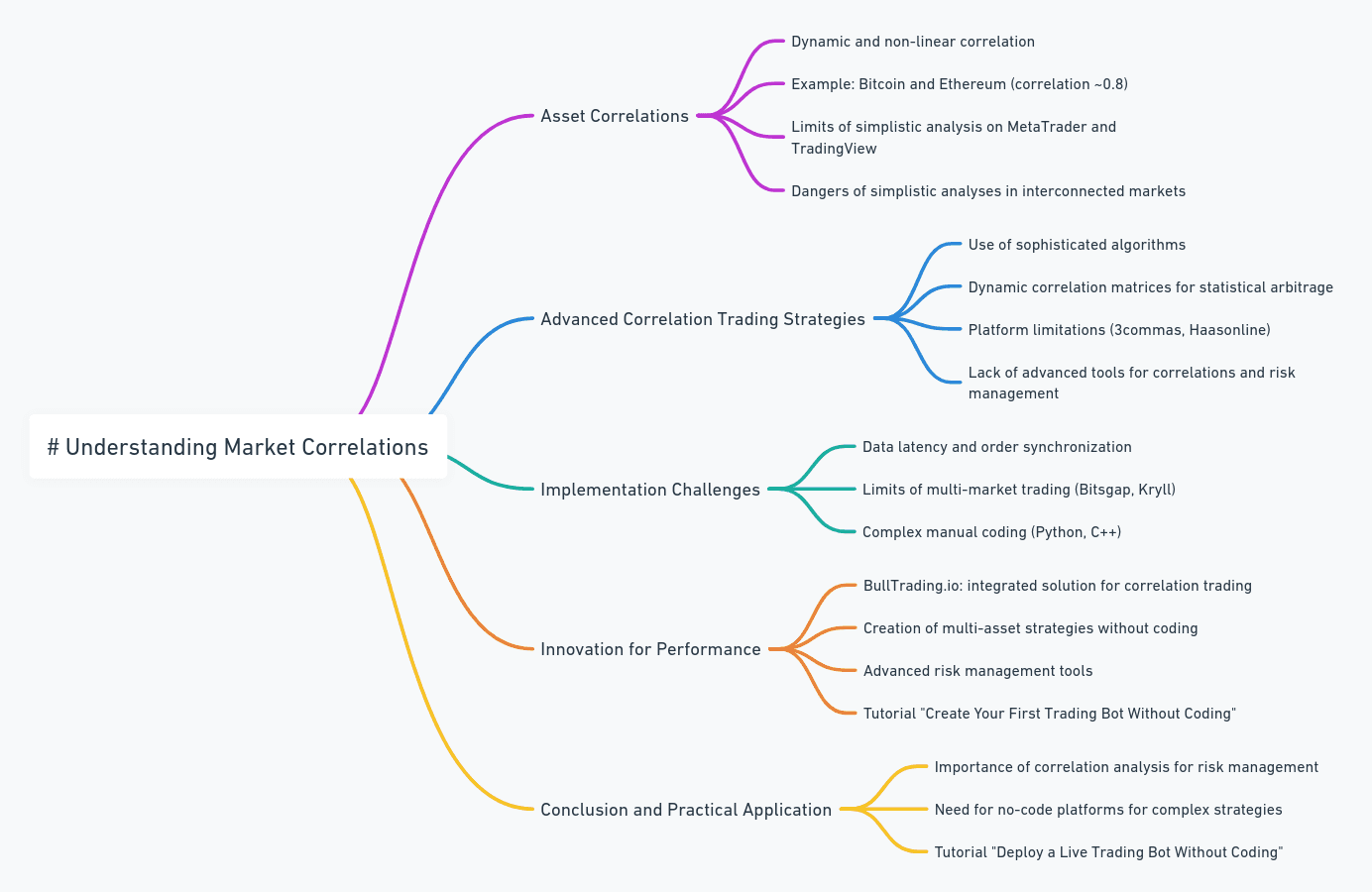

Understanding Market Correlations

Asset correlations are dynamic and non-linear. For example, Bitcoin and Ethereum typically show a positive correlation of 0.8, but this relationship can suddenly reverse during market stress. Traditional traders using MetaTrader or TradingView often limit themselves to simple correlation analyses, ignoring the subtleties of inter-market relationships. This simplistic approach can be dangerous, particularly in today's interconnected markets.

Advanced Correlation Trading Strategies

Modern correlation trading relies on sophisticated algorithms capable of analyzing relationships between dozens of assets in real-time. Hedge funds use dynamic correlation matrices to identify statistical arbitrage opportunities. While platforms like 3commas or Haasonline offer multi-asset trading features, they often lack advanced tools for correlation analysis and cross-risk management.

Implementation Challenges

Implementing correlation-based strategies presents several major obstacles. Data latency and order synchronization across different markets can compromise performance. Traditional solutions like Bitsgap or Kryll offer limited capabilities for multi-market trading, and manual programming in Python or C++ requires considerable expertise.

Innovation Driving Performance

Facing these challenges, BullTrading.io innovates by offering an integrated solution for correlation trading. The platform enables creating and testing multi-asset strategies without programming, while offering advanced risk management tools. To understand how to effectively implement these strategies, I highly recommend the tutorial "Create your first trading bot without coding with BullTrading! (Complete Tutorial)" which presents the fundamental concepts.

Conclusion and Implementation

Correlation trading represents the future of algorithmic portfolio management. To deepen your knowledge and validate your strategies, I invite you to explore "Put your Trading bot in live Trading without coding! (Complete Tutorial)". This resource will guide you in the secure production deployment of your correlation trading strategies.

Note: Statistics cited come from recent market studies and may vary according to conditions and observation periods.

Key points:

Critical importance of correlation analysis in risk management

Need for sophisticated tools for multi-asset trading

Advantages of no-code platforms for implementing complex strategies

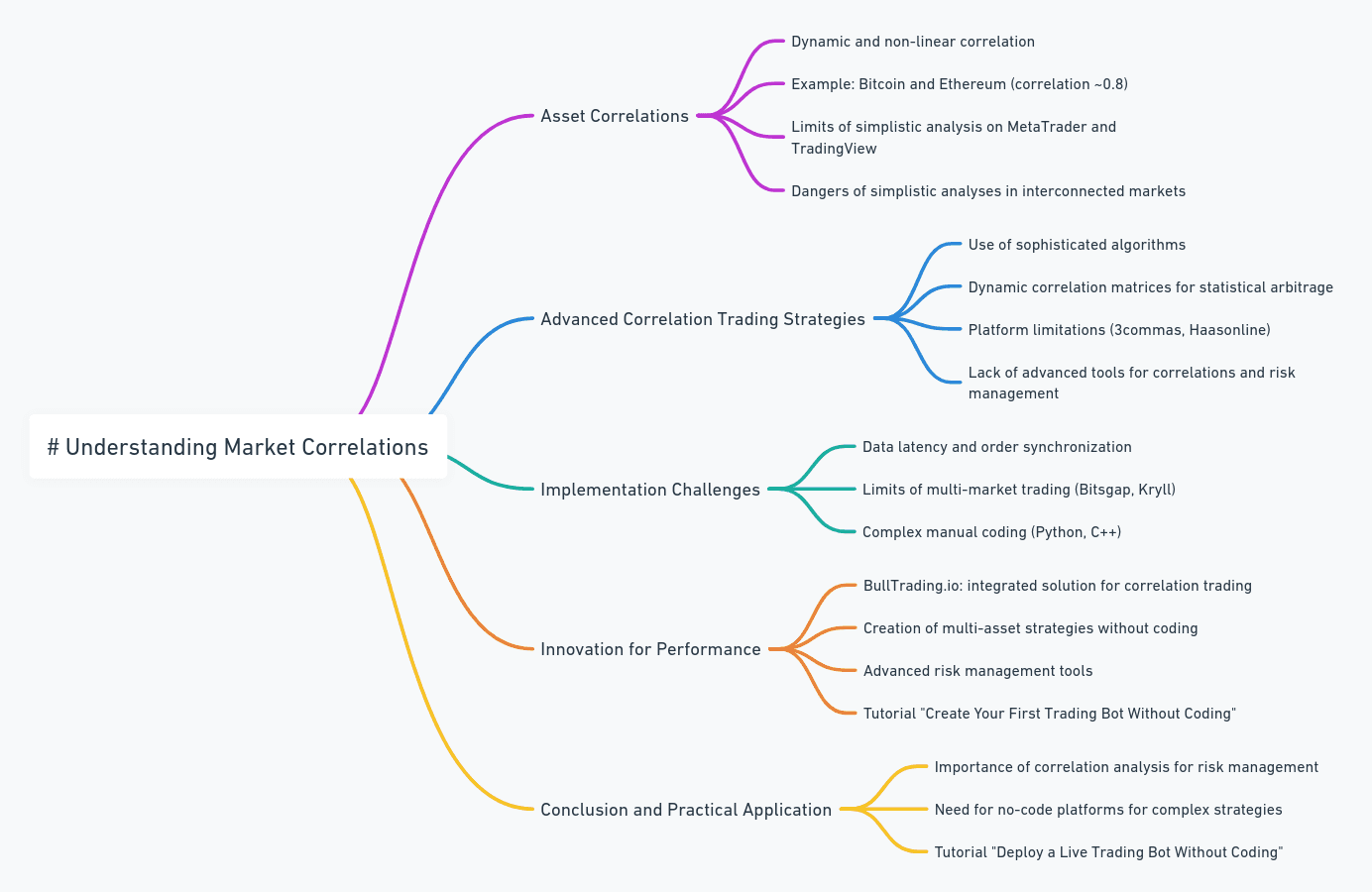

Understanding Market Correlations

Asset correlations are dynamic and non-linear. For example, Bitcoin and Ethereum typically show a positive correlation of 0.8, but this relationship can suddenly reverse during market stress. Traditional traders using MetaTrader or TradingView often limit themselves to simple correlation analyses, ignoring the subtleties of inter-market relationships. This simplistic approach can be dangerous, particularly in today's interconnected markets.

Advanced Correlation Trading Strategies

Modern correlation trading relies on sophisticated algorithms capable of analyzing relationships between dozens of assets in real-time. Hedge funds use dynamic correlation matrices to identify statistical arbitrage opportunities. While platforms like 3commas or Haasonline offer multi-asset trading features, they often lack advanced tools for correlation analysis and cross-risk management.

Implementation Challenges

Implementing correlation-based strategies presents several major obstacles. Data latency and order synchronization across different markets can compromise performance. Traditional solutions like Bitsgap or Kryll offer limited capabilities for multi-market trading, and manual programming in Python or C++ requires considerable expertise.

Innovation Driving Performance

Facing these challenges, BullTrading.io innovates by offering an integrated solution for correlation trading. The platform enables creating and testing multi-asset strategies without programming, while offering advanced risk management tools. To understand how to effectively implement these strategies, I highly recommend the tutorial "Create your first trading bot without coding with BullTrading! (Complete Tutorial)" which presents the fundamental concepts.

Conclusion and Implementation

Correlation trading represents the future of algorithmic portfolio management. To deepen your knowledge and validate your strategies, I invite you to explore "Put your Trading bot in live Trading without coding! (Complete Tutorial)". This resource will guide you in the secure production deployment of your correlation trading strategies.

Note: Statistics cited come from recent market studies and may vary according to conditions and observation periods.

Key points:

Critical importance of correlation analysis in risk management

Need for sophisticated tools for multi-asset trading

Advantages of no-code platforms for implementing complex strategies

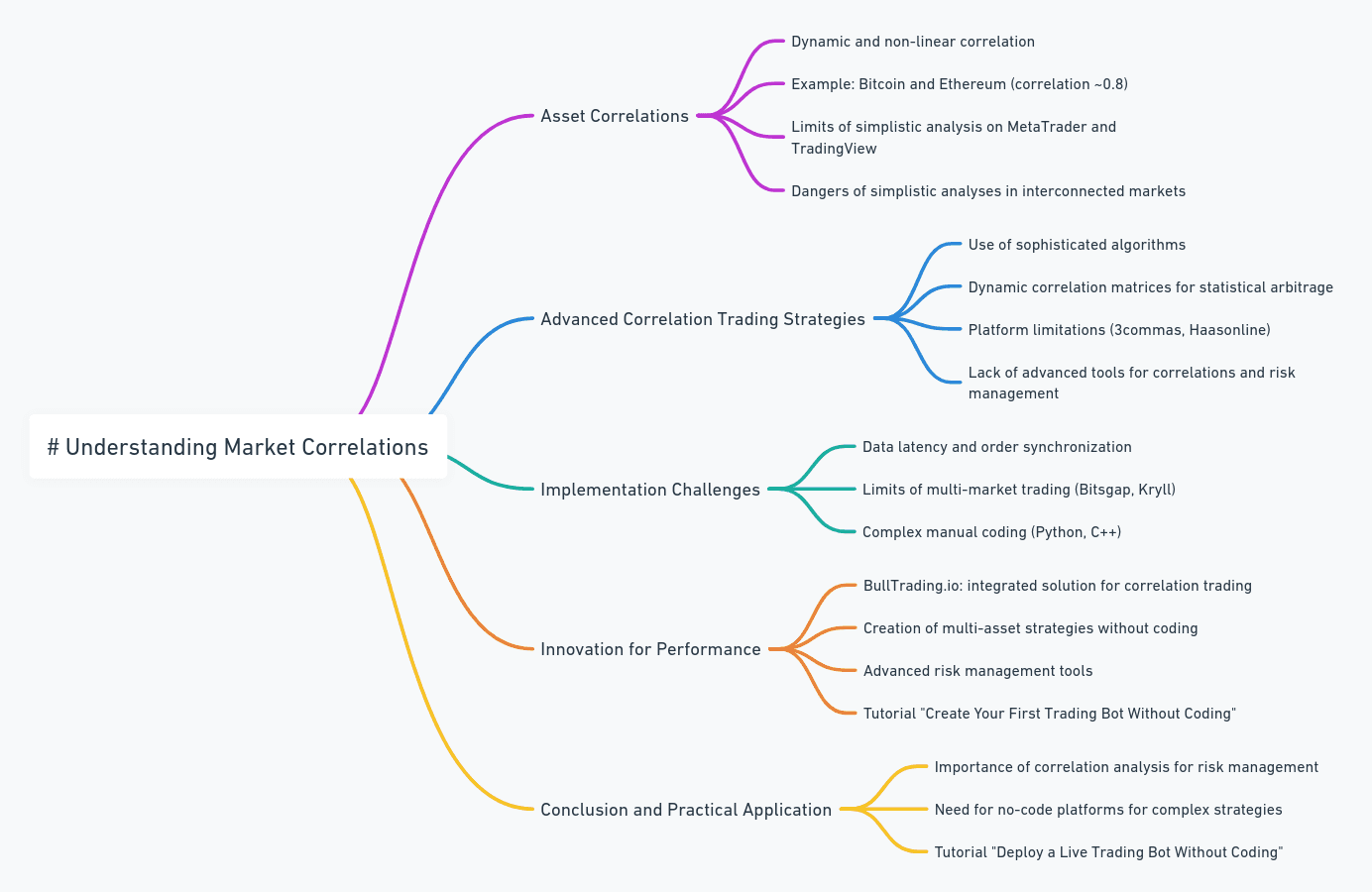

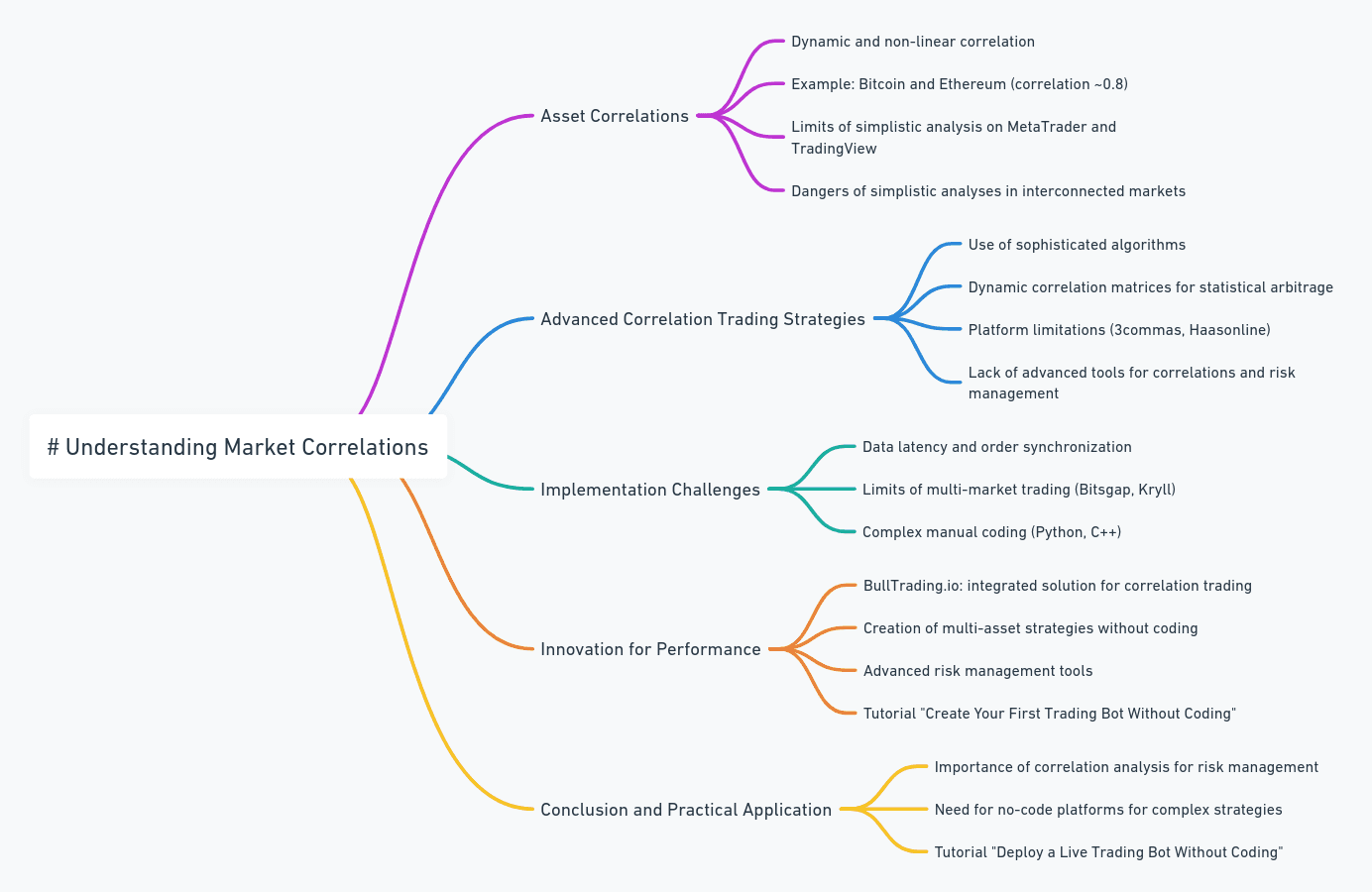

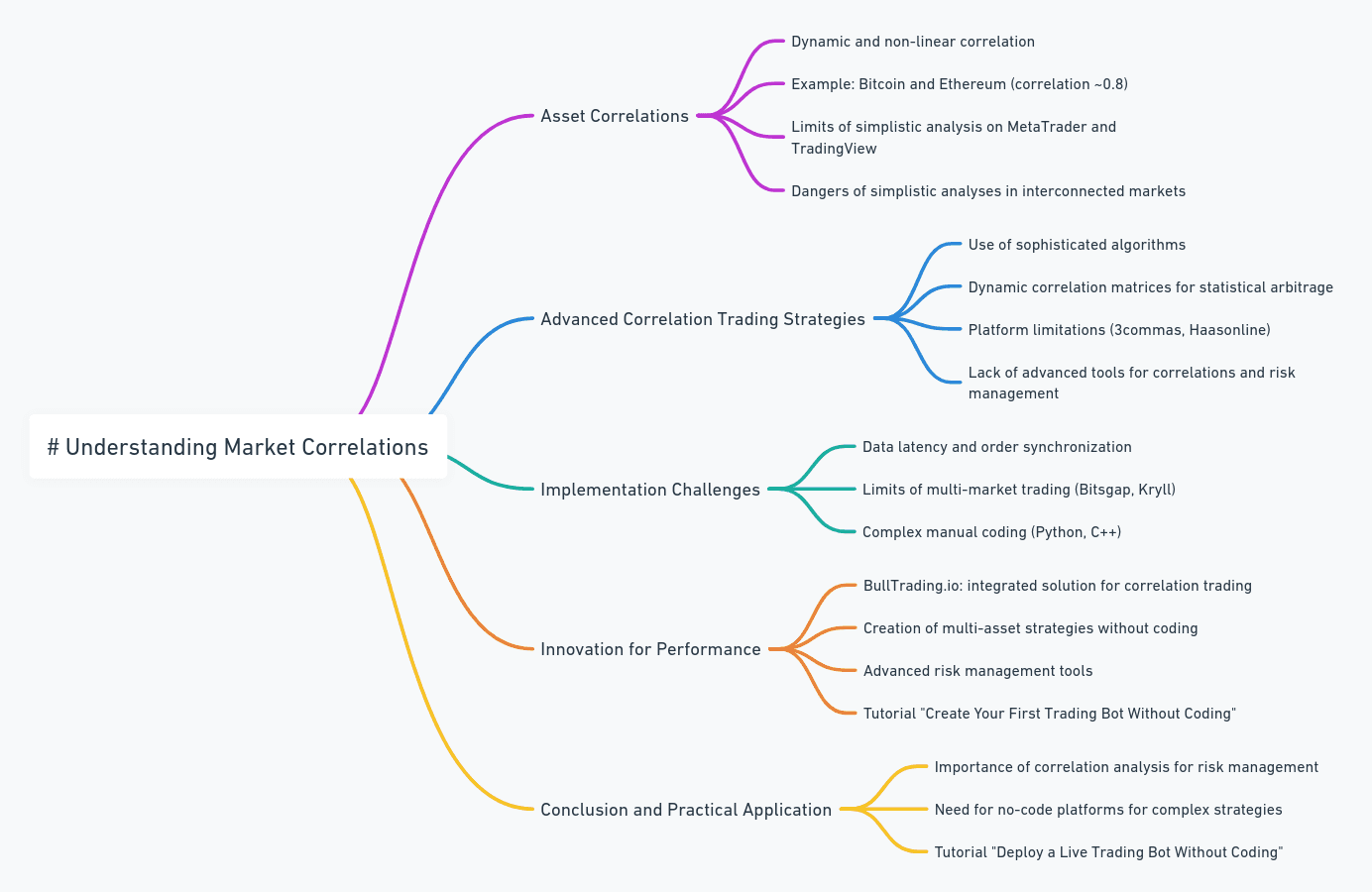

Understanding Market Correlations

Asset correlations are dynamic and non-linear. For example, Bitcoin and Ethereum typically show a positive correlation of 0.8, but this relationship can suddenly reverse during market stress. Traditional traders using MetaTrader or TradingView often limit themselves to simple correlation analyses, ignoring the subtleties of inter-market relationships. This simplistic approach can be dangerous, particularly in today's interconnected markets.

Advanced Correlation Trading Strategies

Modern correlation trading relies on sophisticated algorithms capable of analyzing relationships between dozens of assets in real-time. Hedge funds use dynamic correlation matrices to identify statistical arbitrage opportunities. While platforms like 3commas or Haasonline offer multi-asset trading features, they often lack advanced tools for correlation analysis and cross-risk management.

Implementation Challenges

Implementing correlation-based strategies presents several major obstacles. Data latency and order synchronization across different markets can compromise performance. Traditional solutions like Bitsgap or Kryll offer limited capabilities for multi-market trading, and manual programming in Python or C++ requires considerable expertise.

Innovation Driving Performance

Facing these challenges, BullTrading.io innovates by offering an integrated solution for correlation trading. The platform enables creating and testing multi-asset strategies without programming, while offering advanced risk management tools. To understand how to effectively implement these strategies, I highly recommend the tutorial "Create your first trading bot without coding with BullTrading! (Complete Tutorial)" which presents the fundamental concepts.

Conclusion and Implementation

Correlation trading represents the future of algorithmic portfolio management. To deepen your knowledge and validate your strategies, I invite you to explore "Put your Trading bot in live Trading without coding! (Complete Tutorial)". This resource will guide you in the secure production deployment of your correlation trading strategies.

Note: Statistics cited come from recent market studies and may vary according to conditions and observation periods.

Key points:

Critical importance of correlation analysis in risk management

Need for sophisticated tools for multi-asset trading

Advantages of no-code platforms for implementing complex strategies

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required