5 min

Nov 8, 2024

Editor

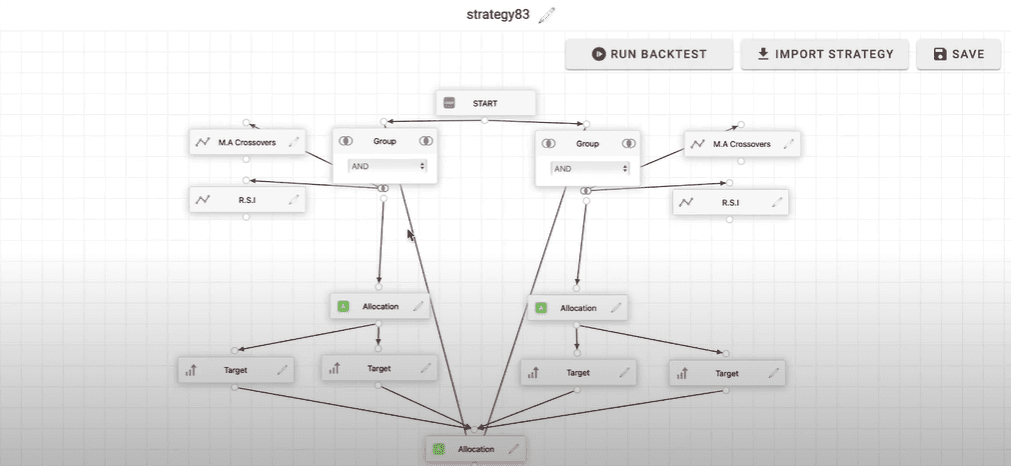

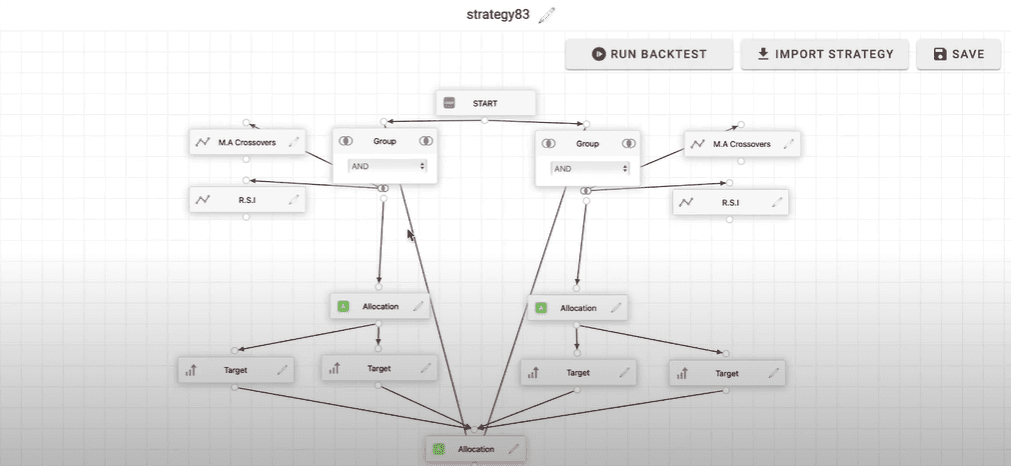

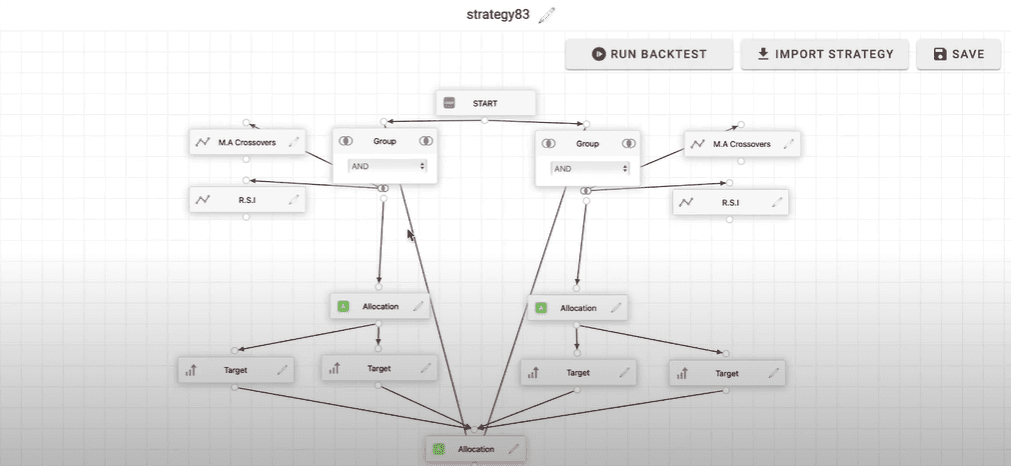

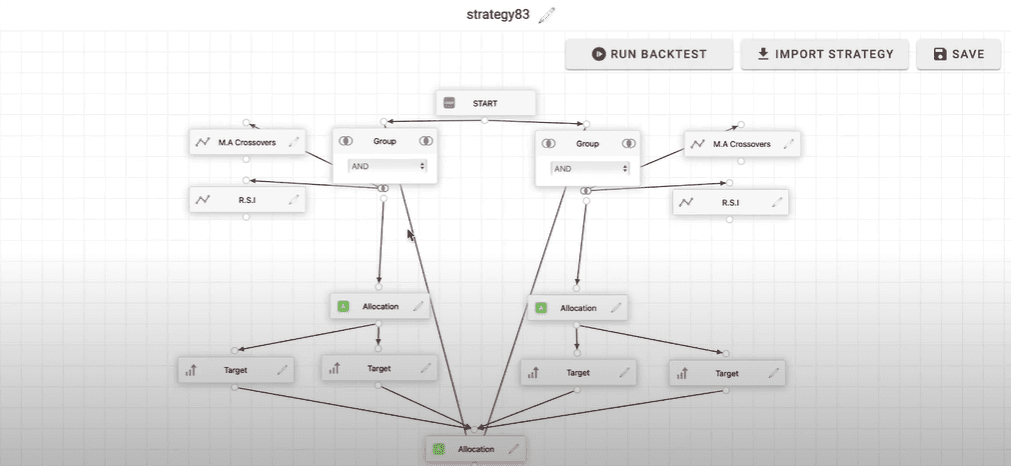

Creating a Trading Bot without Code with BullTrading

Creating a Trading Bot without Code with BullTrading

BullTrading is an innovative platform that allows you to create trading bots without programming. In this detailed guide, we will explore step by step how to create your first automated trading robot.

Lucas Inglese

Lucas Inglese

Trading Instructor

1. BullTrading Interface

Main Navigation

Designer: To create your strategies without coding

Editor: To add your own indicators in Pinescript

My strategies: To manage your existing strategies

Marketplace: To discover other indicators

Available Indicator Types

The interface offers several indicator categories:

All indicators: Overview of all indicators

Price trends: Trend indicators

Price channels: Price channels

Oscillators: Technical oscillators

Stop and reverse: Reversal indicators

Candlestick patterns: Chart patterns

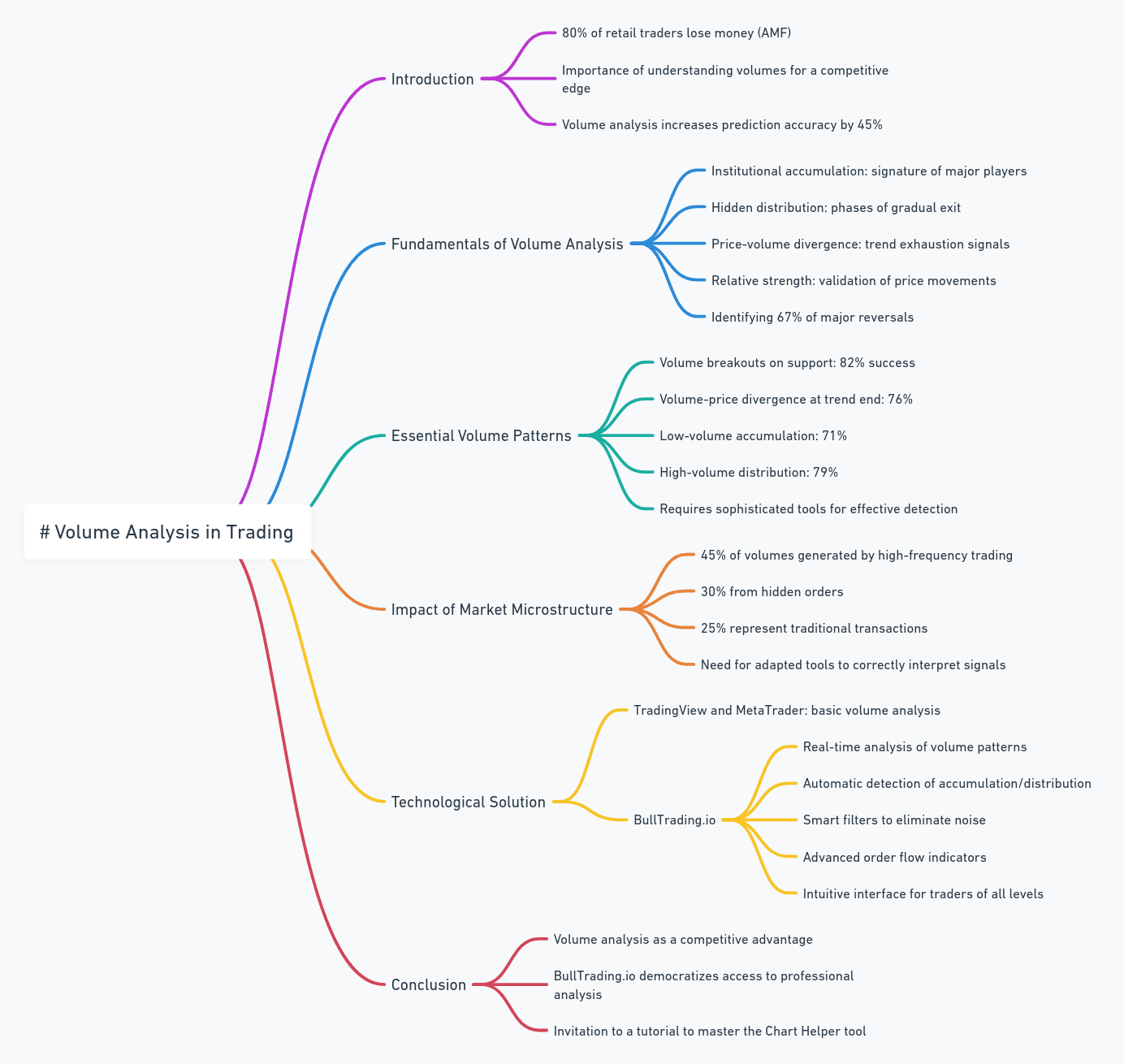

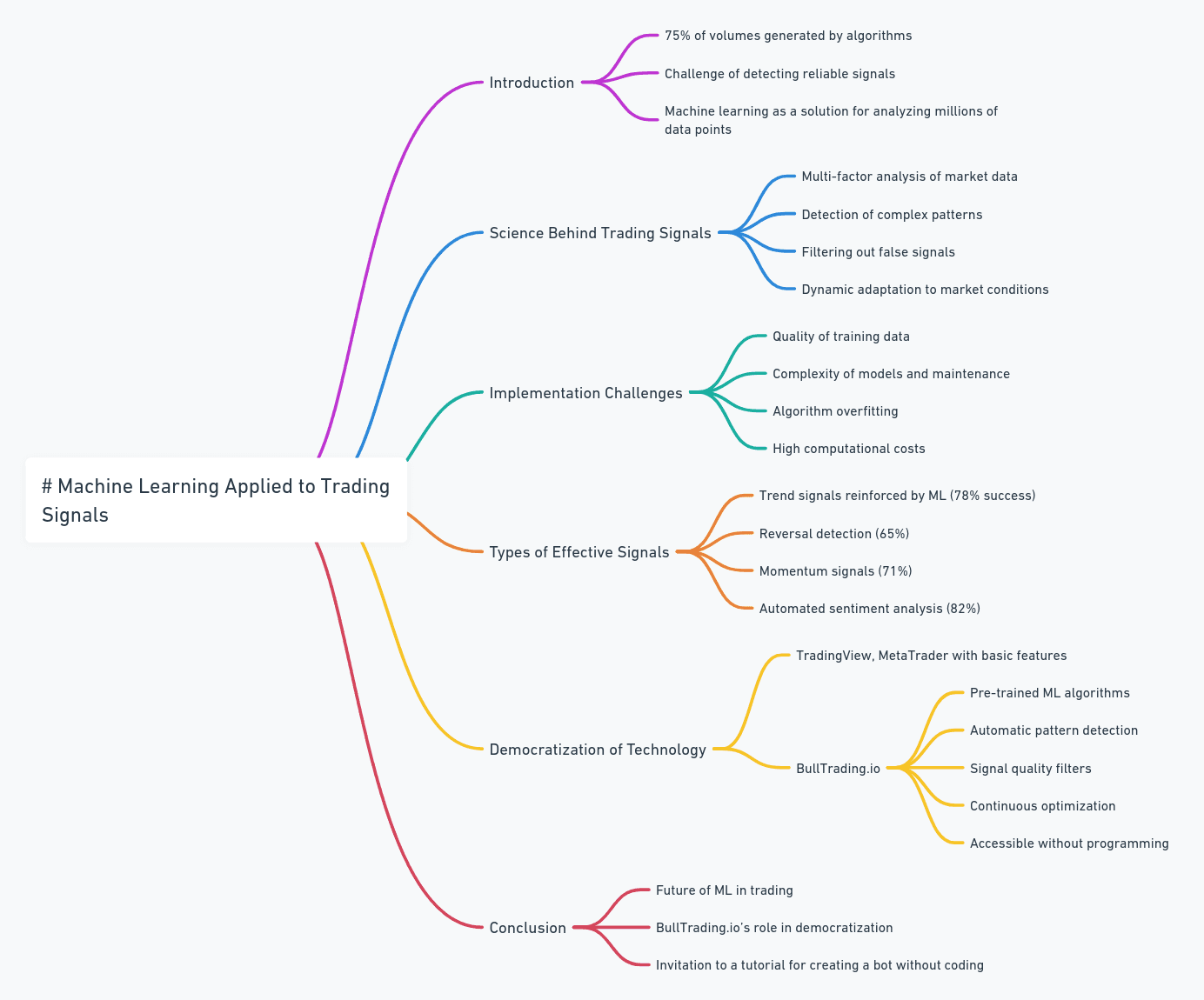

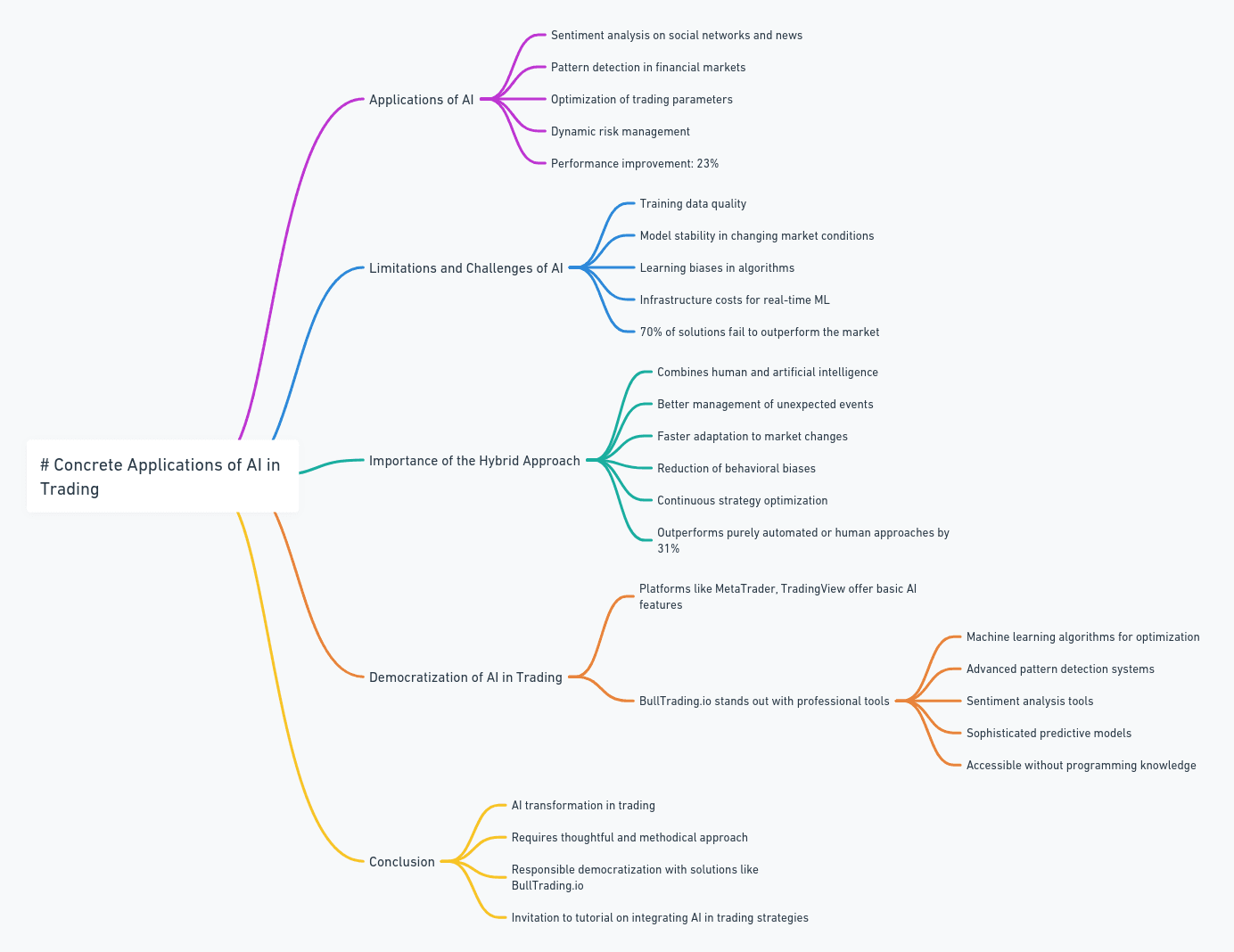

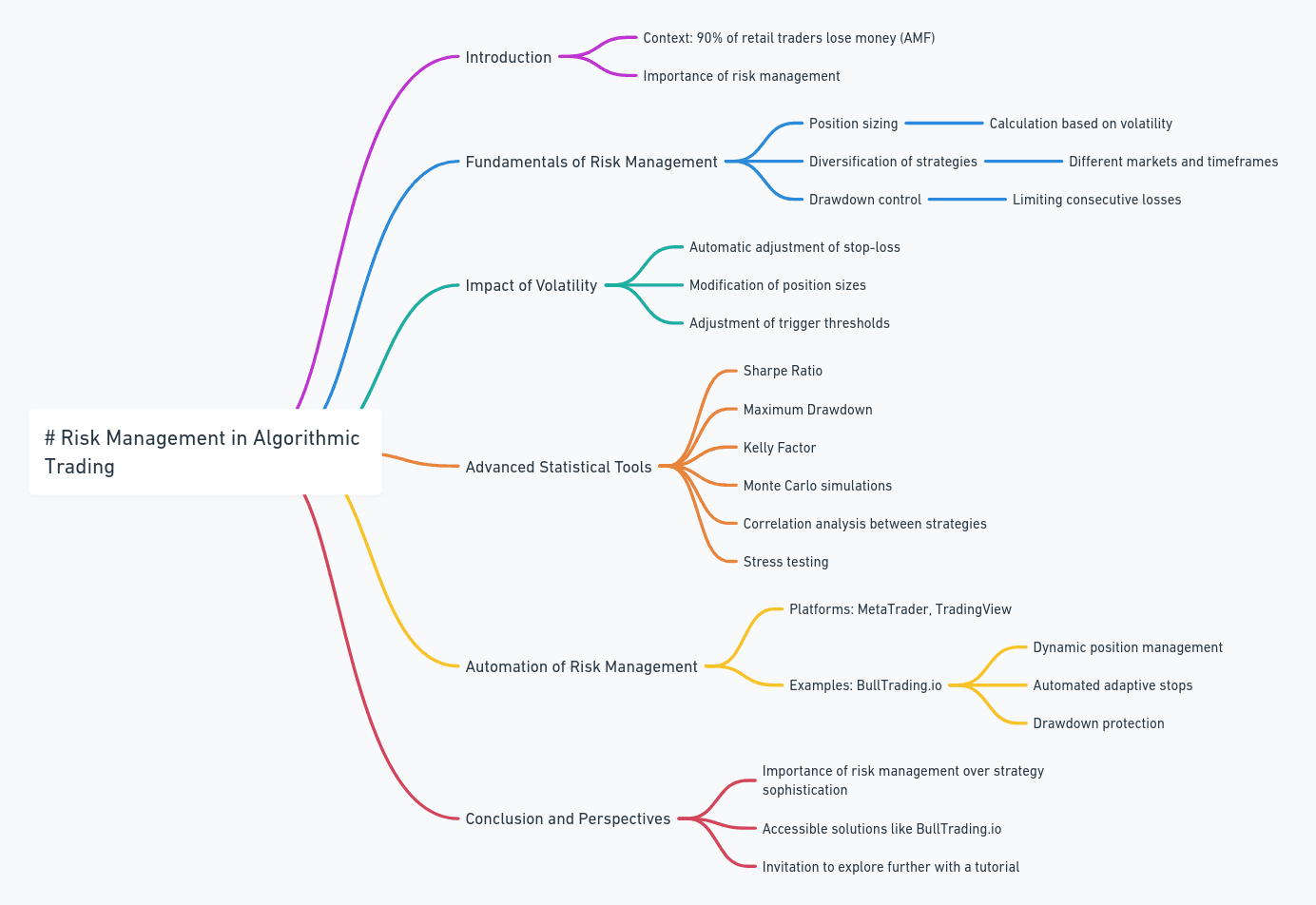

Volume-based: Volume-based indicators

Moving averages: Moving averages

Price transforms: Price transformations

Price characteristics: Price characteristics

Price action: Price action

Others: Other indicators

2. Creating a Trading Strategy

Moving Averages Configuration

Select "Moving Averages" from the indicators list

Choose "M.A Crossovers" to create a strategy based on moving averages crossing

In the configuration settings:

Time Unit: Default (uses backtest timeframe)

Period Slow Moving Average: 200 periods

Type Slow Moving Average: Simple_SMA

Period Fast Moving Average: 50 periods

Type Fast Moving Average: Simple_SMA

Signal Type: Position (or Crossover depending on your strategy)

Trigger Type: Bullish for long positions

Allocation Setup

Add an "Allocation" block after your indicator

Configure allocation:

Allocation Percentage: 100% for long position

Allocation Percentage: -100% for short position

Option to switch to "Incrementation" for advanced management

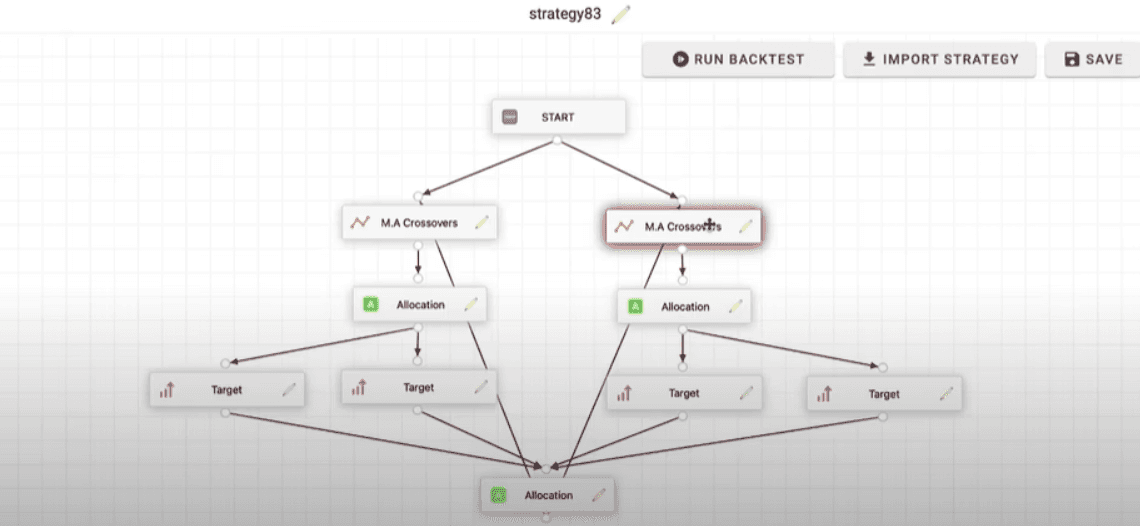

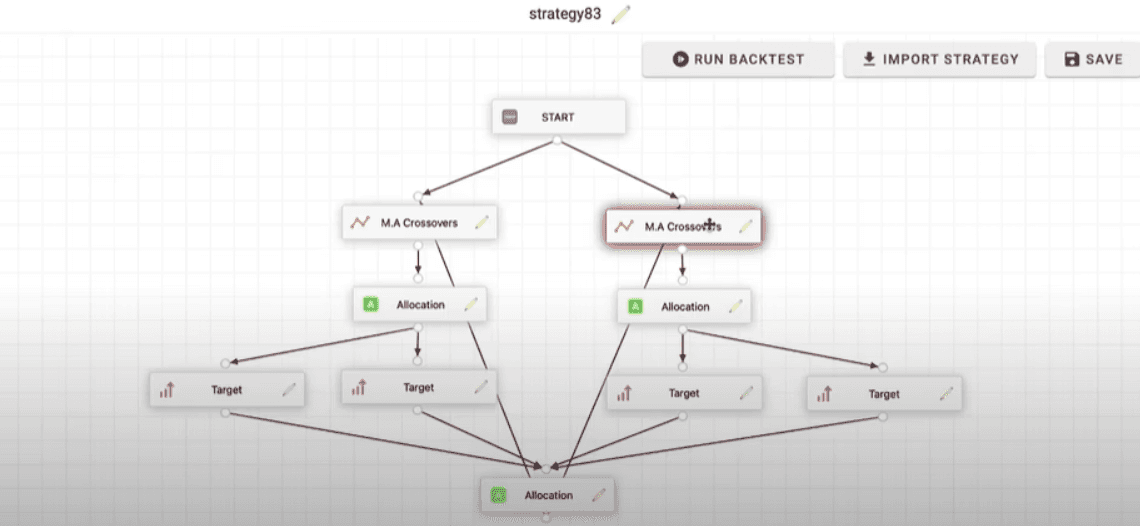

3. Connecting Blocks

Blocks must be connected sequentially:

Start → M.A Crossovers → Allocation

A second M.A Crossovers for the opposite direction

A new allocation for exit

Important Points

Use appropriate connectors between blocks

Verify that each block is properly connected

Ensure the last block connects to the start to form a loop

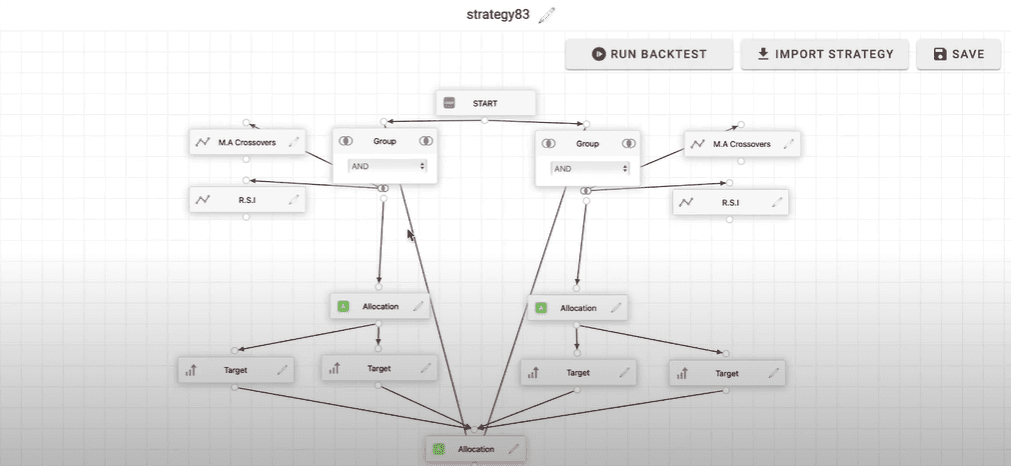

4. Adding Additional Indicators

Using Group Blocks

To combine multiple indicators:

Select the "Group" block

Choose combination type:

AND: All indicators must be validated

OR: At least one indicator must be validated

XOR: Only one indicator must be validated

RSI Configuration

Example settings:

Time Unit: 15 minutes

Default levels: 30/70

Signal type: Position/Crossover depending on your strategy

5. Finalizing the Strategy

Exit Management

Add "Target" blocks to define:

Take Profit: +5%

Stop Loss: -2%

Connect Target blocks to a 0% Allocation block for exit

Saving and Testing

Click "SAVE" to save your strategy

Use "RUN BACKTEST" to test your strategy

"IMPORT STRATEGY" allows importing existing strategies

Usage Tips

Best Practices

Start with simple strategies

Test each configuration before moving to the next

Document your parameters with "Mark flag"

Use the "Chart Helper" to visualize your indicators

Points of Attention

Always verify complete block connection

Test your strategy across different periods

Adjust parameters gradually

Monitor backtest performance before live trading

Conclusion

BullTrading offers a visual and intuitive approach to algorithmic trading. By following this guide and understanding each component well, you can create automated trading strategies without writing a single line of code.

Note: Trading involves risk of capital loss. Make sure you understand how markets work before investing.

Associate youtube video (fr) :

1. BullTrading Interface

Main Navigation

Designer: To create your strategies without coding

Editor: To add your own indicators in Pinescript

My strategies: To manage your existing strategies

Marketplace: To discover other indicators

Available Indicator Types

The interface offers several indicator categories:

All indicators: Overview of all indicators

Price trends: Trend indicators

Price channels: Price channels

Oscillators: Technical oscillators

Stop and reverse: Reversal indicators

Candlestick patterns: Chart patterns

Volume-based: Volume-based indicators

Moving averages: Moving averages

Price transforms: Price transformations

Price characteristics: Price characteristics

Price action: Price action

Others: Other indicators

2. Creating a Trading Strategy

Moving Averages Configuration

Select "Moving Averages" from the indicators list

Choose "M.A Crossovers" to create a strategy based on moving averages crossing

In the configuration settings:

Time Unit: Default (uses backtest timeframe)

Period Slow Moving Average: 200 periods

Type Slow Moving Average: Simple_SMA

Period Fast Moving Average: 50 periods

Type Fast Moving Average: Simple_SMA

Signal Type: Position (or Crossover depending on your strategy)

Trigger Type: Bullish for long positions

Allocation Setup

Add an "Allocation" block after your indicator

Configure allocation:

Allocation Percentage: 100% for long position

Allocation Percentage: -100% for short position

Option to switch to "Incrementation" for advanced management

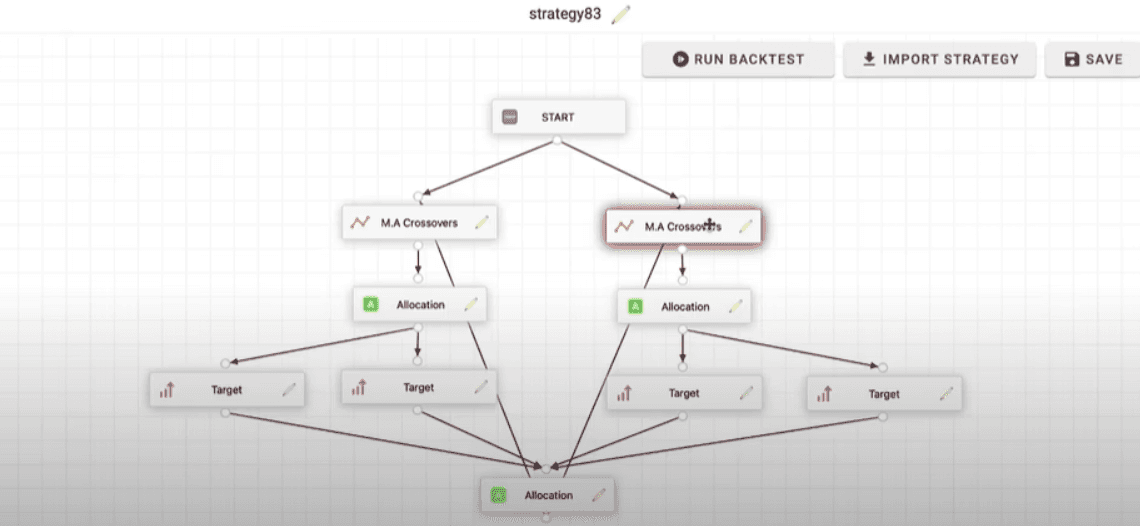

3. Connecting Blocks

Blocks must be connected sequentially:

Start → M.A Crossovers → Allocation

A second M.A Crossovers for the opposite direction

A new allocation for exit

Important Points

Use appropriate connectors between blocks

Verify that each block is properly connected

Ensure the last block connects to the start to form a loop

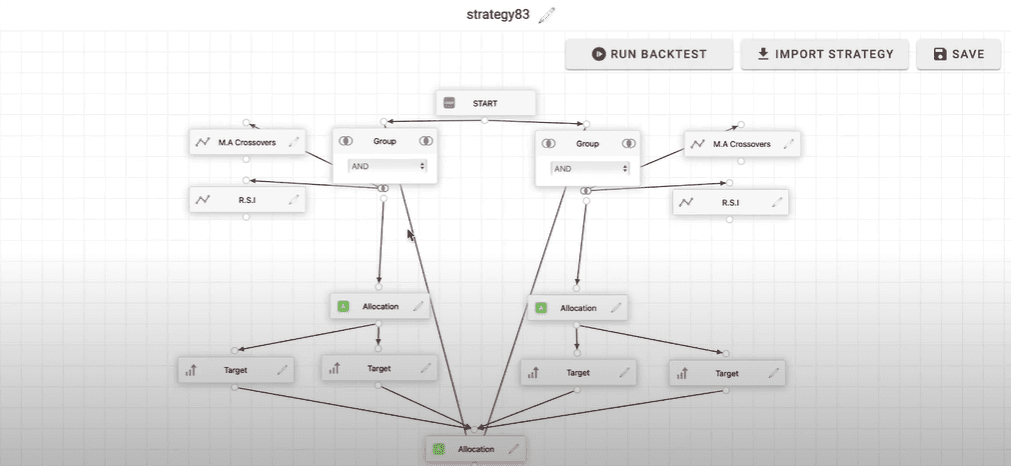

4. Adding Additional Indicators

Using Group Blocks

To combine multiple indicators:

Select the "Group" block

Choose combination type:

AND: All indicators must be validated

OR: At least one indicator must be validated

XOR: Only one indicator must be validated

RSI Configuration

Example settings:

Time Unit: 15 minutes

Default levels: 30/70

Signal type: Position/Crossover depending on your strategy

5. Finalizing the Strategy

Exit Management

Add "Target" blocks to define:

Take Profit: +5%

Stop Loss: -2%

Connect Target blocks to a 0% Allocation block for exit

Saving and Testing

Click "SAVE" to save your strategy

Use "RUN BACKTEST" to test your strategy

"IMPORT STRATEGY" allows importing existing strategies

Usage Tips

Best Practices

Start with simple strategies

Test each configuration before moving to the next

Document your parameters with "Mark flag"

Use the "Chart Helper" to visualize your indicators

Points of Attention

Always verify complete block connection

Test your strategy across different periods

Adjust parameters gradually

Monitor backtest performance before live trading

Conclusion

BullTrading offers a visual and intuitive approach to algorithmic trading. By following this guide and understanding each component well, you can create automated trading strategies without writing a single line of code.

Note: Trading involves risk of capital loss. Make sure you understand how markets work before investing.

Associate youtube video (fr) :

1. BullTrading Interface

Main Navigation

Designer: To create your strategies without coding

Editor: To add your own indicators in Pinescript

My strategies: To manage your existing strategies

Marketplace: To discover other indicators

Available Indicator Types

The interface offers several indicator categories:

All indicators: Overview of all indicators

Price trends: Trend indicators

Price channels: Price channels

Oscillators: Technical oscillators

Stop and reverse: Reversal indicators

Candlestick patterns: Chart patterns

Volume-based: Volume-based indicators

Moving averages: Moving averages

Price transforms: Price transformations

Price characteristics: Price characteristics

Price action: Price action

Others: Other indicators

2. Creating a Trading Strategy

Moving Averages Configuration

Select "Moving Averages" from the indicators list

Choose "M.A Crossovers" to create a strategy based on moving averages crossing

In the configuration settings:

Time Unit: Default (uses backtest timeframe)

Period Slow Moving Average: 200 periods

Type Slow Moving Average: Simple_SMA

Period Fast Moving Average: 50 periods

Type Fast Moving Average: Simple_SMA

Signal Type: Position (or Crossover depending on your strategy)

Trigger Type: Bullish for long positions

Allocation Setup

Add an "Allocation" block after your indicator

Configure allocation:

Allocation Percentage: 100% for long position

Allocation Percentage: -100% for short position

Option to switch to "Incrementation" for advanced management

3. Connecting Blocks

Blocks must be connected sequentially:

Start → M.A Crossovers → Allocation

A second M.A Crossovers for the opposite direction

A new allocation for exit

Important Points

Use appropriate connectors between blocks

Verify that each block is properly connected

Ensure the last block connects to the start to form a loop

4. Adding Additional Indicators

Using Group Blocks

To combine multiple indicators:

Select the "Group" block

Choose combination type:

AND: All indicators must be validated

OR: At least one indicator must be validated

XOR: Only one indicator must be validated

RSI Configuration

Example settings:

Time Unit: 15 minutes

Default levels: 30/70

Signal type: Position/Crossover depending on your strategy

5. Finalizing the Strategy

Exit Management

Add "Target" blocks to define:

Take Profit: +5%

Stop Loss: -2%

Connect Target blocks to a 0% Allocation block for exit

Saving and Testing

Click "SAVE" to save your strategy

Use "RUN BACKTEST" to test your strategy

"IMPORT STRATEGY" allows importing existing strategies

Usage Tips

Best Practices

Start with simple strategies

Test each configuration before moving to the next

Document your parameters with "Mark flag"

Use the "Chart Helper" to visualize your indicators

Points of Attention

Always verify complete block connection

Test your strategy across different periods

Adjust parameters gradually

Monitor backtest performance before live trading

Conclusion

BullTrading offers a visual and intuitive approach to algorithmic trading. By following this guide and understanding each component well, you can create automated trading strategies without writing a single line of code.

Note: Trading involves risk of capital loss. Make sure you understand how markets work before investing.

Associate youtube video (fr) :

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required