5 min

Nov 12, 2024

Editor

Dynamic Stop-Losses: The Key to Effective Risk Management in Trading

Dynamic Stop-Losses: The Key to Effective Risk Management in Trading

In the volatile world of trading, risk management is often what separates profitable traders from those who lose money. According to a CFTC (Commodity Futures Trading Commission) study, nearly 89% of retail traders lose money, primarily due to poor risk management. One of the most powerful but often misused tools is the dynamic stop-loss, a technique that automatically adjusts exit levels based on market behavior.

Lucas Inglese

Lucas Inglese

Trading Instructor

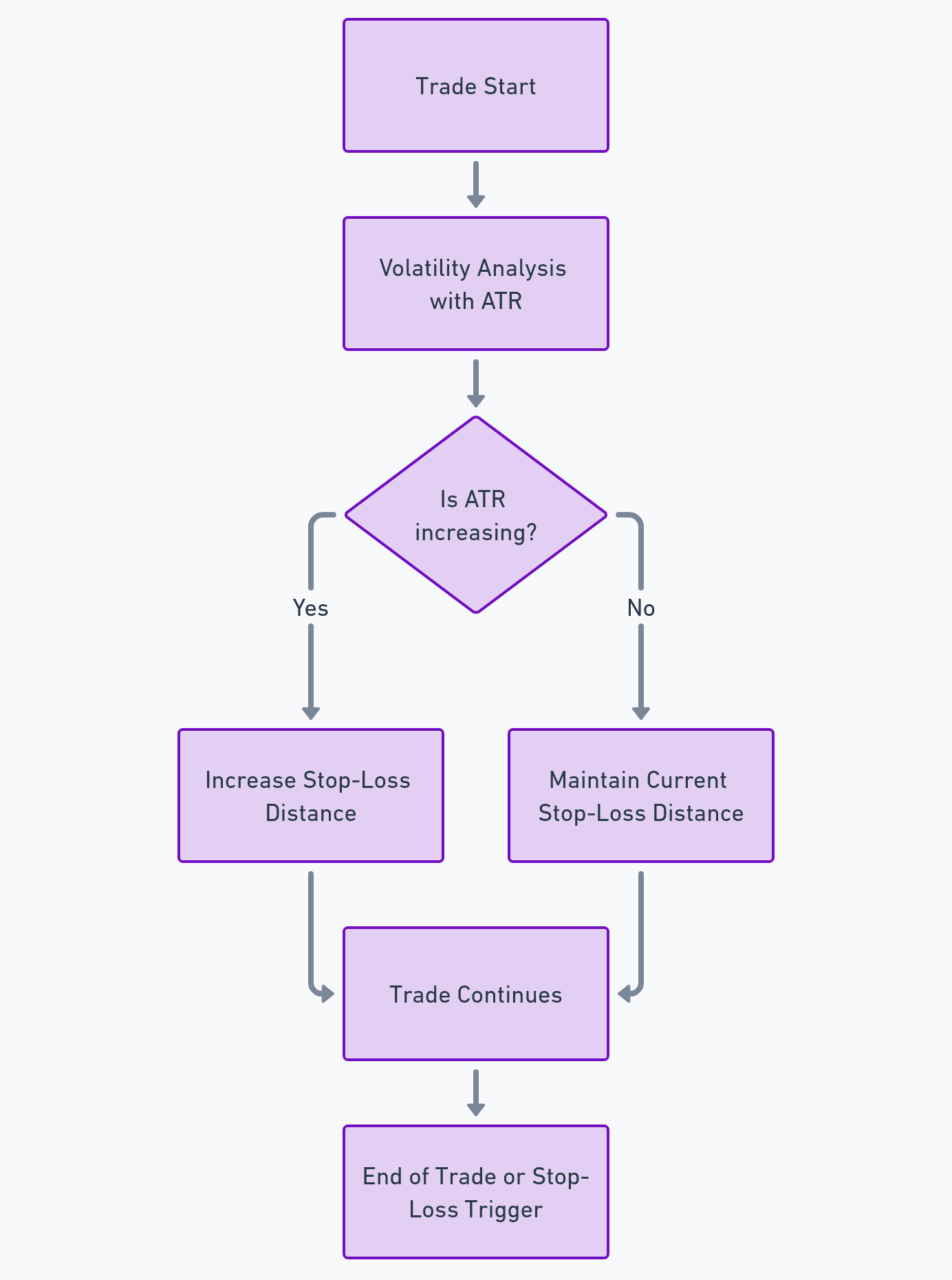

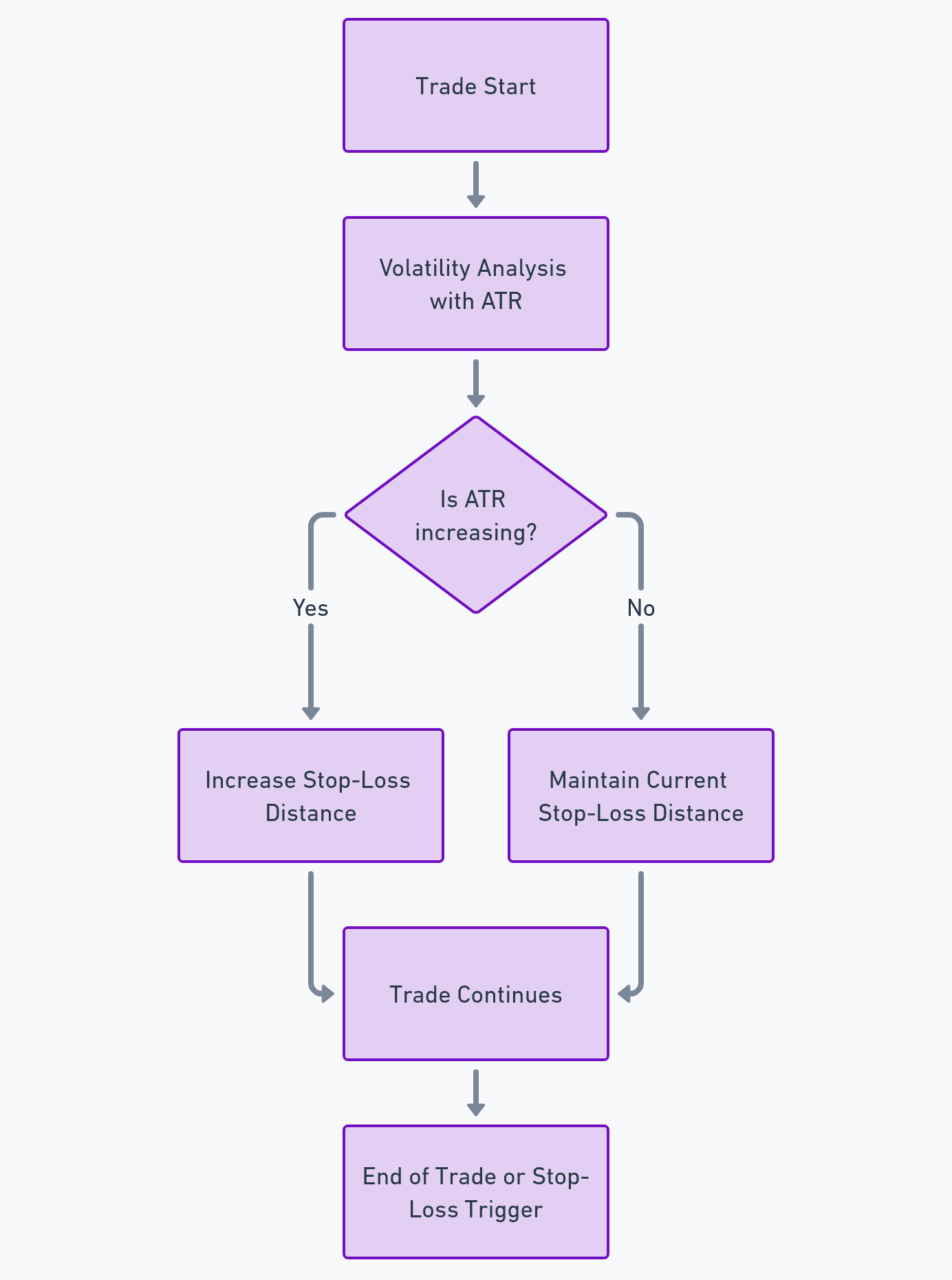

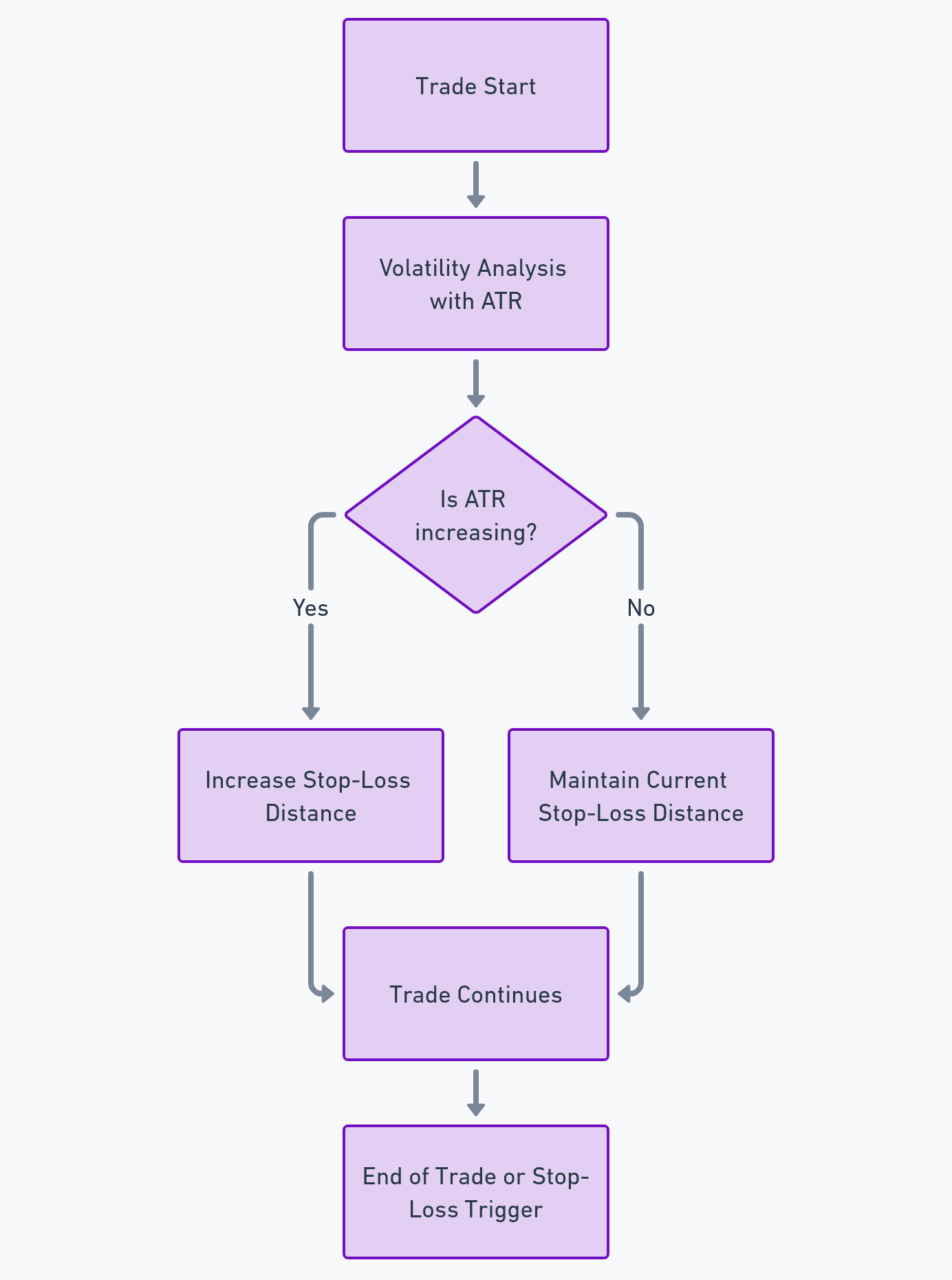

The Fundamentals of Dynamic Stop-Loss

Unlike fixed stop-losses, dynamic stop-losses evolve with the asset price. This approach helps protect gains while giving trades room to breathe. For example, using the Average True Range (ATR), a popular volatility indicator, the stop-loss can automatically adjust to market volatility. This method is particularly effective as it takes into account real market conditions rather than an arbitrary percentage.

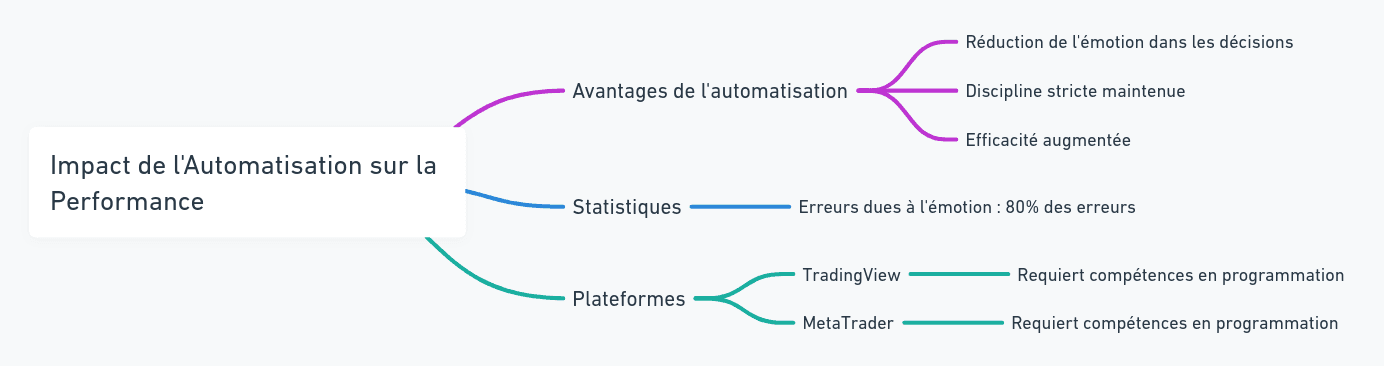

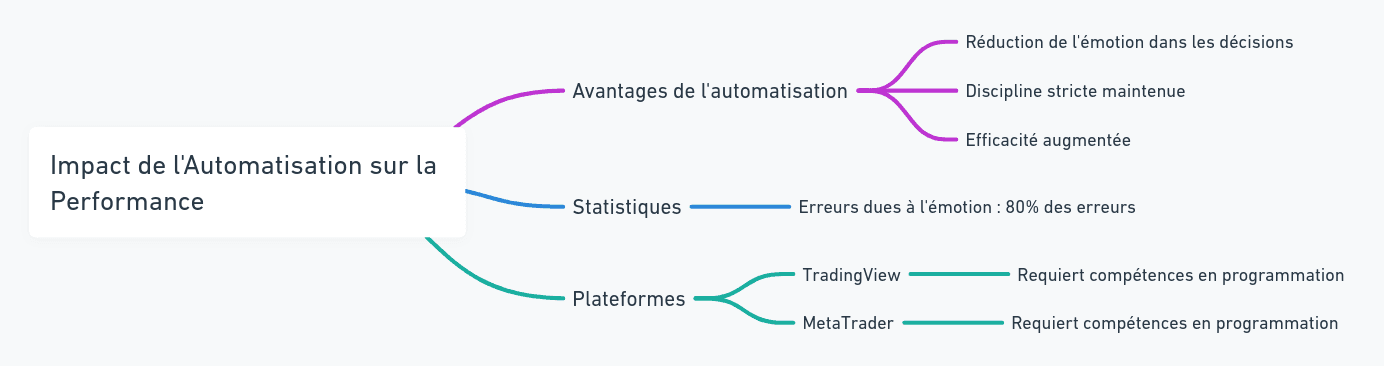

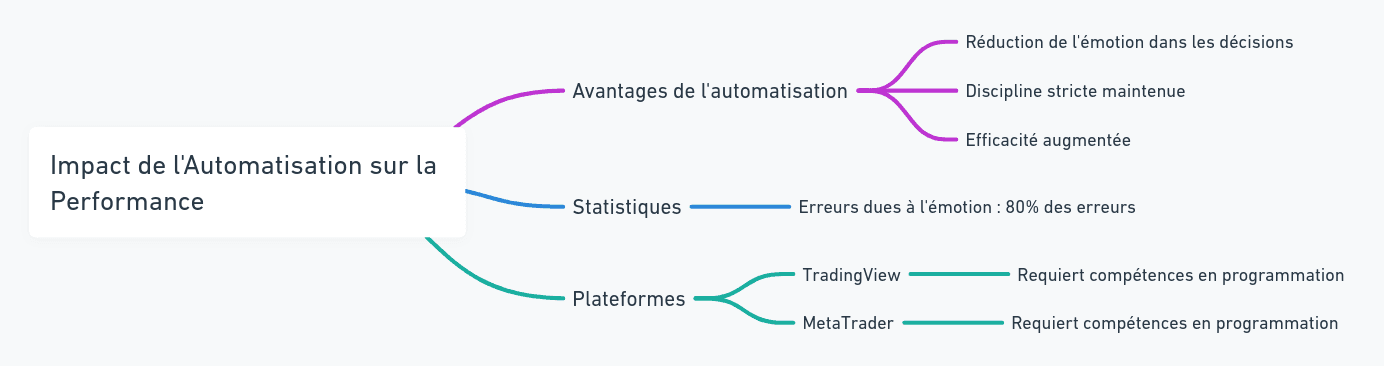

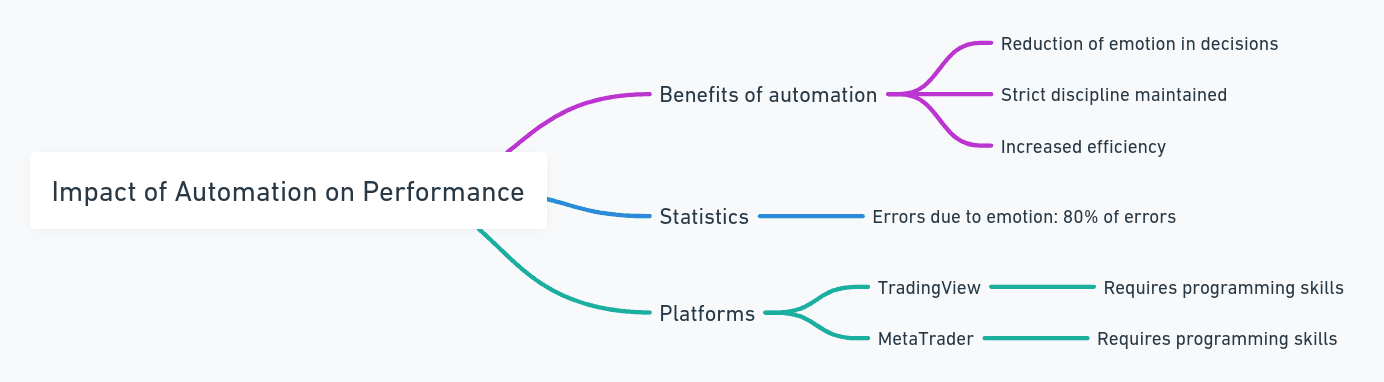

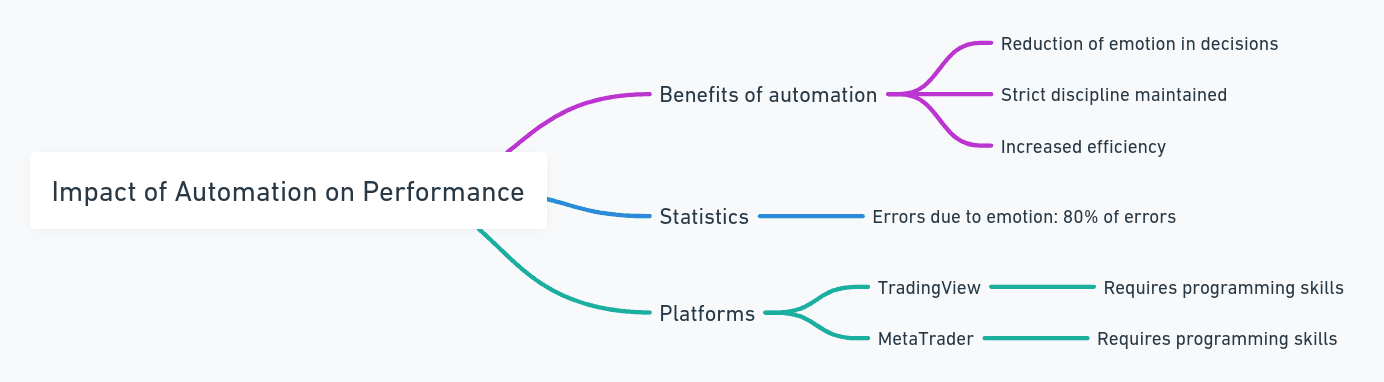

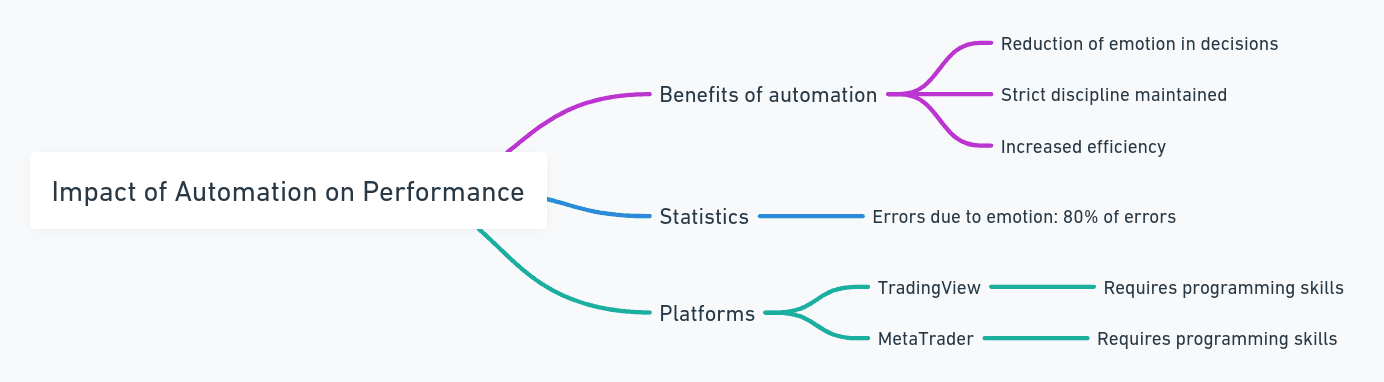

The Impact of Automation on Performance

The automation of dynamic stop-losses represents a significant advantage for traders. Studies show that emotion is responsible for 80% of trading errors (Source: "Trading in the Zone" by Mark Douglas). By automating stop-loss management, traders eliminate the emotional factor and maintain strict discipline. Platforms like TradingView or Metatrader offer this functionality but often require programming skills.

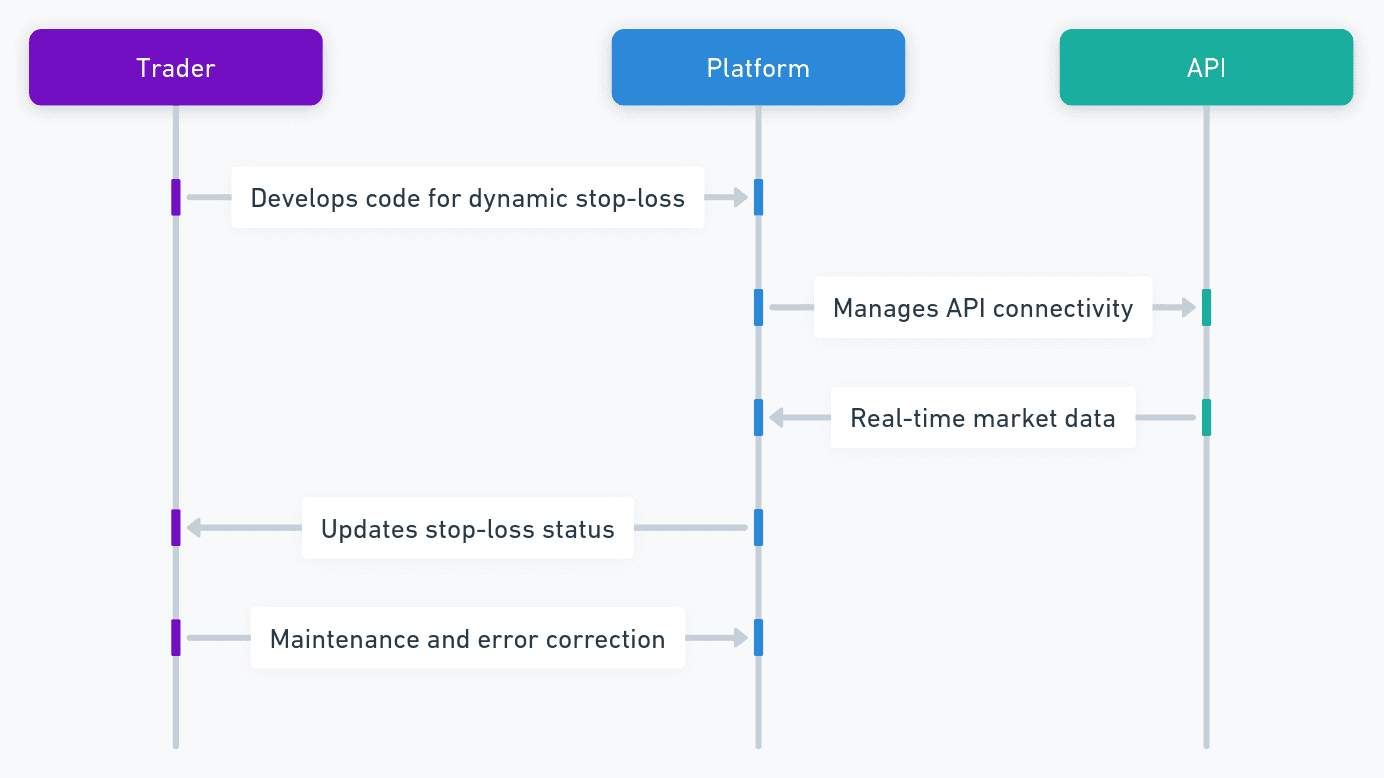

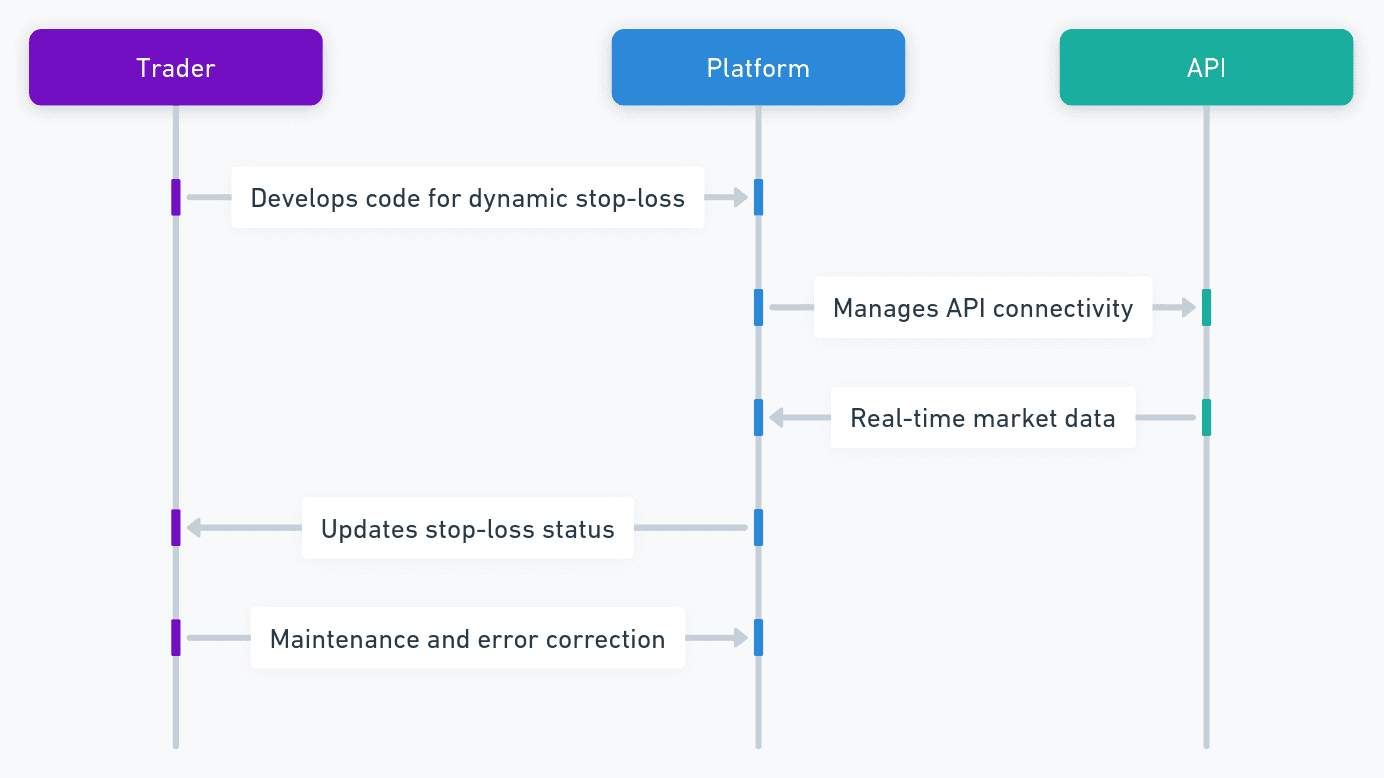

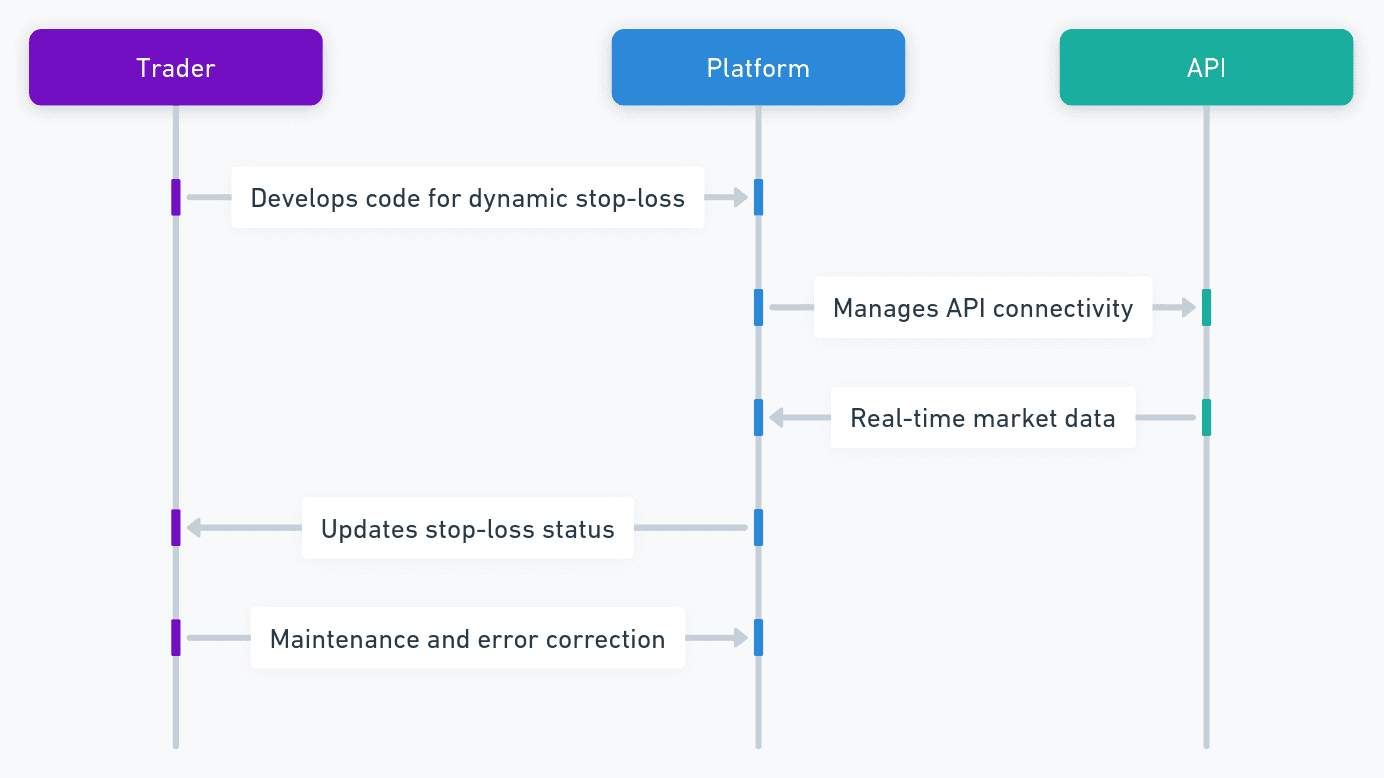

Implementation Challenges

Setting up dynamic stop-losses presents several technical challenges. Traditional programming on platforms like Metatrader or using Python requires advanced development skills. Traders must manage API connectivity, error handling, and code maintenance. Solutions like 3commas or Haasonline attempt to simplify this process but remain limited in terms of customization.

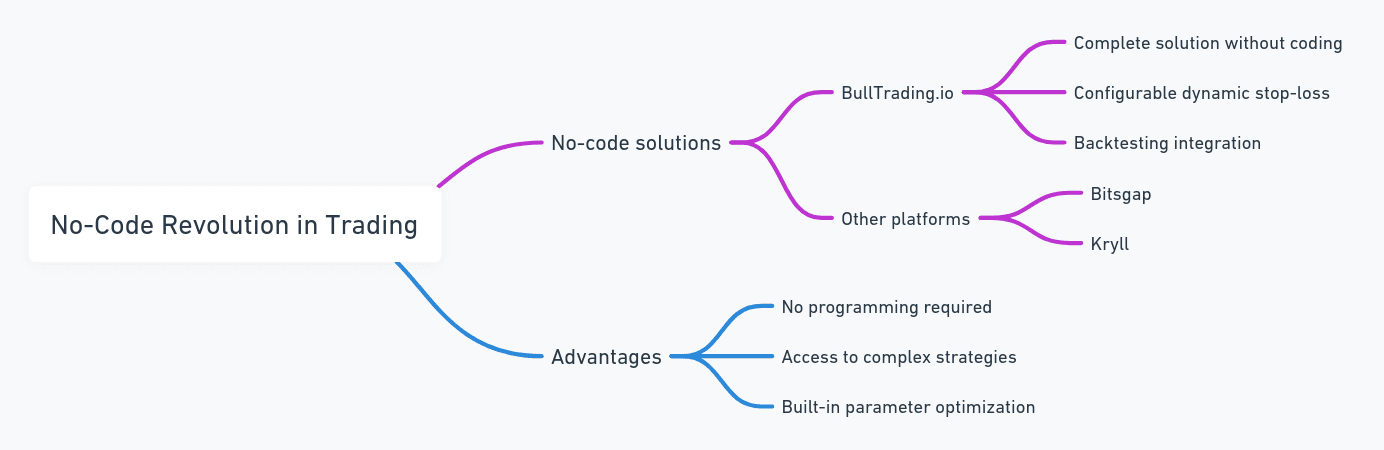

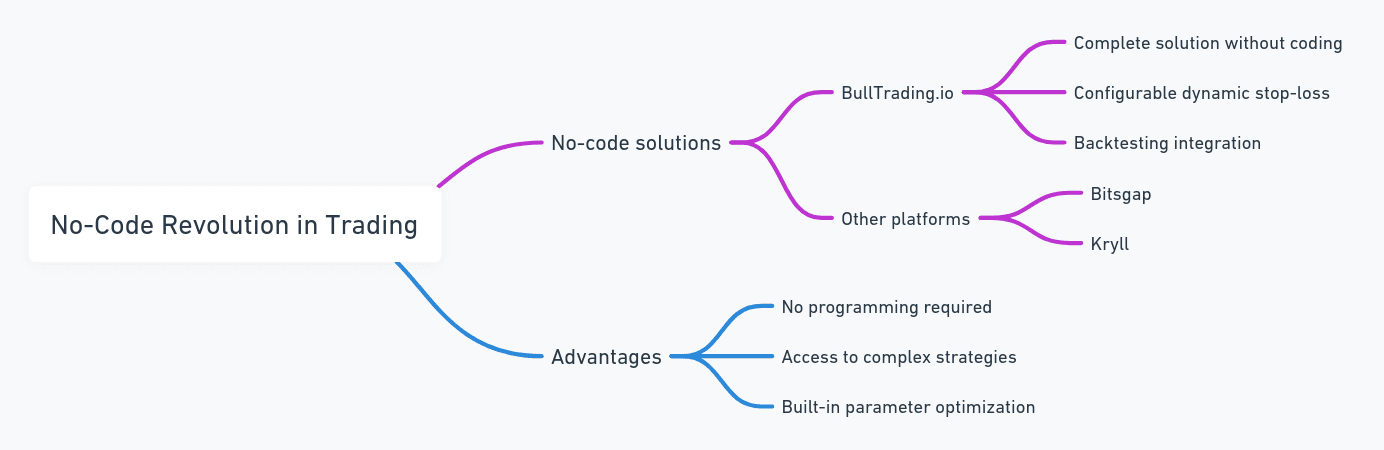

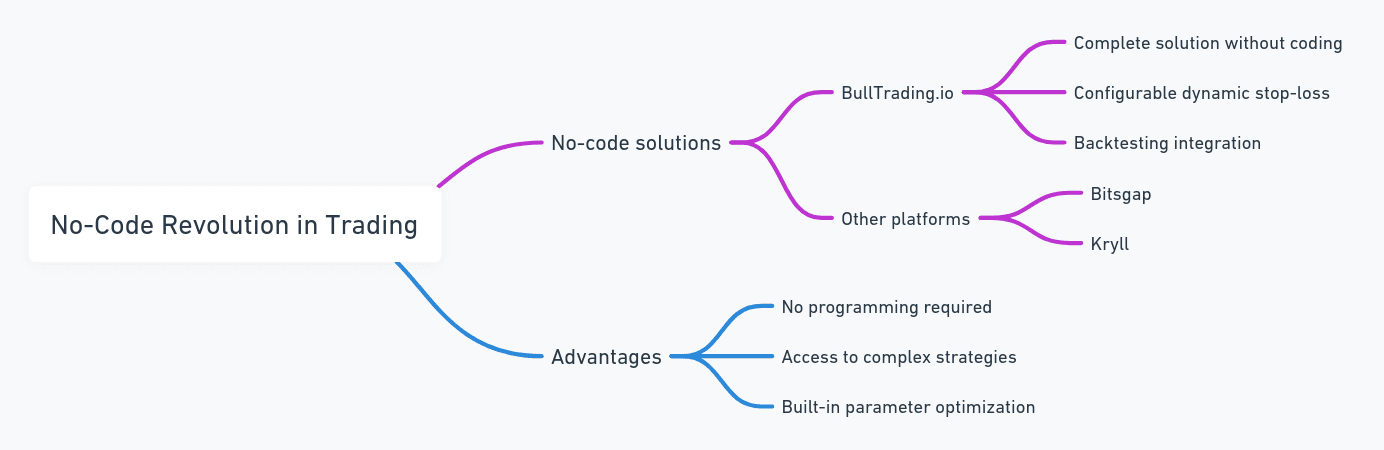

The No-Code Revolution in Trading

Facing these challenges, BullTrading.io stands out by offering a complete no-code approach. Unlike Bitsgap or Kryll, which offer partial solutions, BullTrading enables creating complex strategies including dynamic stop-losses without writing a single line of code. For an in-depth understanding of backtesting your strategies, I highly recommend watching the tutorial "Backtest your Trading strategy with BullTrading! (Complete Tutorial)".

Conclusion and Getting Started

Automated risk management is no longer a luxury but a necessity in modern trading. To deepen your understanding and start implementing these concepts, I invite you to discover the complete tutorial on creating trading bots without code on BullTrading: "Create your first trading bot without coding with BullTrading! (Complete Tutorial)".

The Fundamentals of Dynamic Stop-Loss

Unlike fixed stop-losses, dynamic stop-losses evolve with the asset price. This approach helps protect gains while giving trades room to breathe. For example, using the Average True Range (ATR), a popular volatility indicator, the stop-loss can automatically adjust to market volatility. This method is particularly effective as it takes into account real market conditions rather than an arbitrary percentage.

The Impact of Automation on Performance

The automation of dynamic stop-losses represents a significant advantage for traders. Studies show that emotion is responsible for 80% of trading errors (Source: "Trading in the Zone" by Mark Douglas). By automating stop-loss management, traders eliminate the emotional factor and maintain strict discipline. Platforms like TradingView or Metatrader offer this functionality but often require programming skills.

Implementation Challenges

Setting up dynamic stop-losses presents several technical challenges. Traditional programming on platforms like Metatrader or using Python requires advanced development skills. Traders must manage API connectivity, error handling, and code maintenance. Solutions like 3commas or Haasonline attempt to simplify this process but remain limited in terms of customization.

The No-Code Revolution in Trading

Facing these challenges, BullTrading.io stands out by offering a complete no-code approach. Unlike Bitsgap or Kryll, which offer partial solutions, BullTrading enables creating complex strategies including dynamic stop-losses without writing a single line of code. For an in-depth understanding of backtesting your strategies, I highly recommend watching the tutorial "Backtest your Trading strategy with BullTrading! (Complete Tutorial)".

Conclusion and Getting Started

Automated risk management is no longer a luxury but a necessity in modern trading. To deepen your understanding and start implementing these concepts, I invite you to discover the complete tutorial on creating trading bots without code on BullTrading: "Create your first trading bot without coding with BullTrading! (Complete Tutorial)".

The Fundamentals of Dynamic Stop-Loss

Unlike fixed stop-losses, dynamic stop-losses evolve with the asset price. This approach helps protect gains while giving trades room to breathe. For example, using the Average True Range (ATR), a popular volatility indicator, the stop-loss can automatically adjust to market volatility. This method is particularly effective as it takes into account real market conditions rather than an arbitrary percentage.

The Impact of Automation on Performance

The automation of dynamic stop-losses represents a significant advantage for traders. Studies show that emotion is responsible for 80% of trading errors (Source: "Trading in the Zone" by Mark Douglas). By automating stop-loss management, traders eliminate the emotional factor and maintain strict discipline. Platforms like TradingView or Metatrader offer this functionality but often require programming skills.

Implementation Challenges

Setting up dynamic stop-losses presents several technical challenges. Traditional programming on platforms like Metatrader or using Python requires advanced development skills. Traders must manage API connectivity, error handling, and code maintenance. Solutions like 3commas or Haasonline attempt to simplify this process but remain limited in terms of customization.

The No-Code Revolution in Trading

Facing these challenges, BullTrading.io stands out by offering a complete no-code approach. Unlike Bitsgap or Kryll, which offer partial solutions, BullTrading enables creating complex strategies including dynamic stop-losses without writing a single line of code. For an in-depth understanding of backtesting your strategies, I highly recommend watching the tutorial "Backtest your Trading strategy with BullTrading! (Complete Tutorial)".

Conclusion and Getting Started

Automated risk management is no longer a luxury but a necessity in modern trading. To deepen your understanding and start implementing these concepts, I invite you to discover the complete tutorial on creating trading bots without code on BullTrading: "Create your first trading bot without coding with BullTrading! (Complete Tutorial)".

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required