3 min

Aug 31, 2024

Indicators

The Stochastic RSI Indicator

The Stochastic RSI Indicator

The Stochastic RSI indicator is extremely similar to the RSI indicator. It also indicates overbought and oversold zones. However, instead of focusing on a single RSI value, it relates the current RSI value to the minimum and maximum RSI values over a specific period. As a result, you typically find similar thresholds to the RSI: A StochRSI above 0.8 (or 80) is generally considered overbought. A StochRSI below 0.2 (or 20) is generally considered oversold.

Lucas Inglese

Lucas Inglese

Trading Instructor

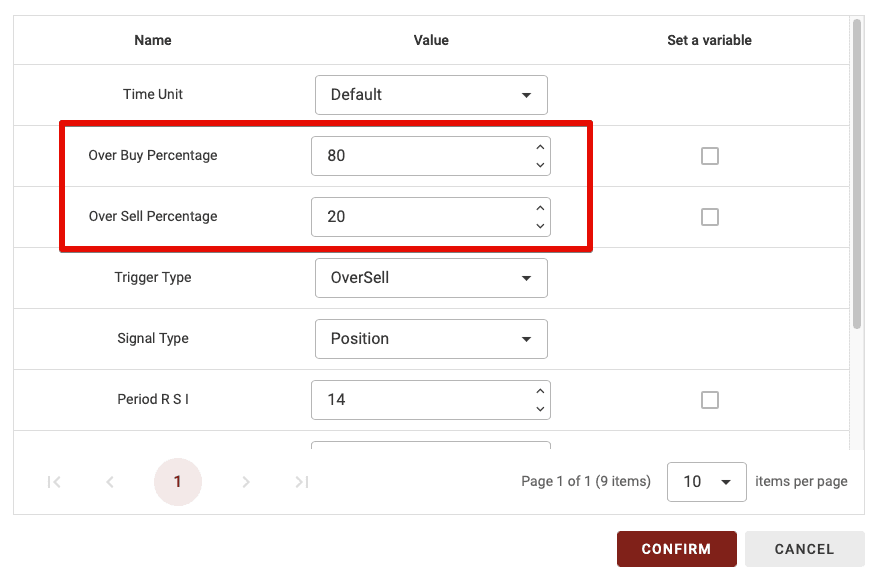

The Stochastic RSI Block Configuration

On BullTrading, you have several options to configure each block uniquely. In this block, you can set the time unit, thresholds, and more.

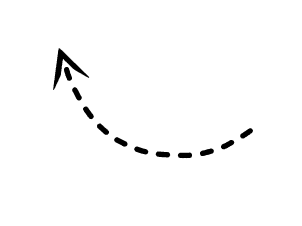

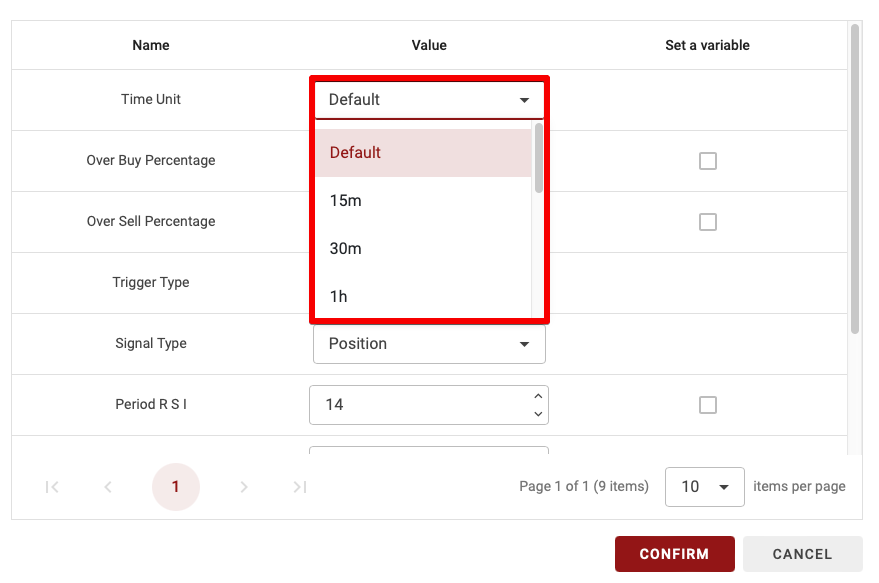

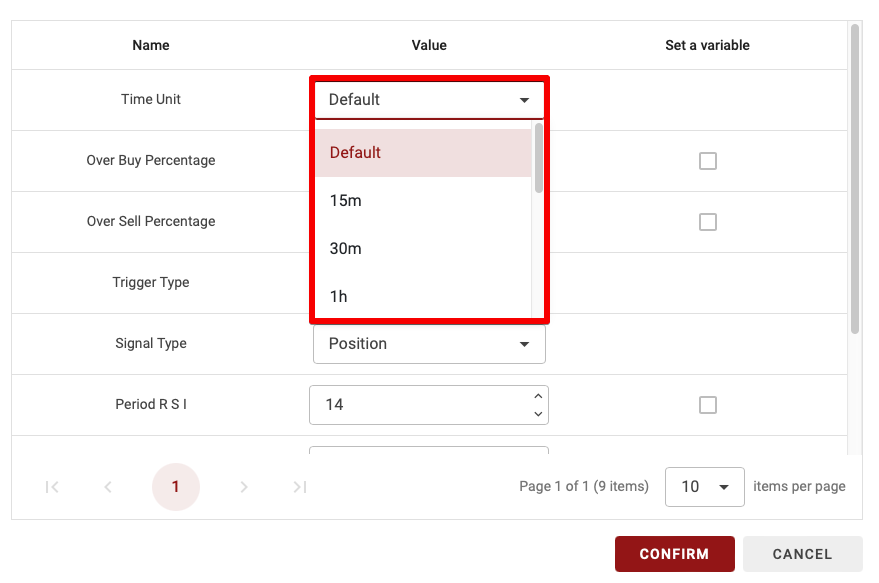

Time Unit

Since BullTrading allows for multi-timeframe strategies, you can select the time period for calculating this indicator. There are two options:

Default: If set to Default, the time unit will vary based on the timeframe used in the backtest.

15m, 30m, 1d, etc.: Choosing a specific time unit means this setting will apply regardless of the time unit used for backtesting your strategy.

TIPS: If you’re a beginner, it’s recommended to leave the time unit on Default.

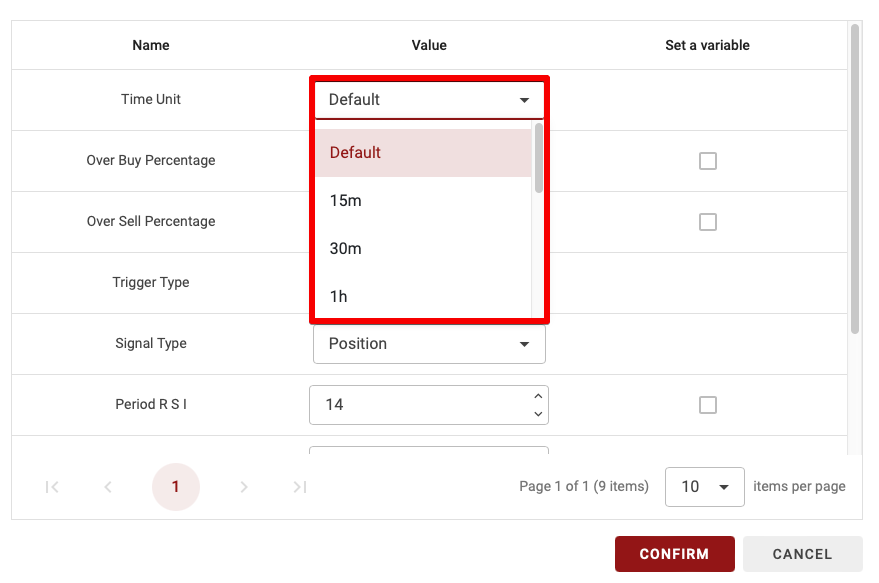

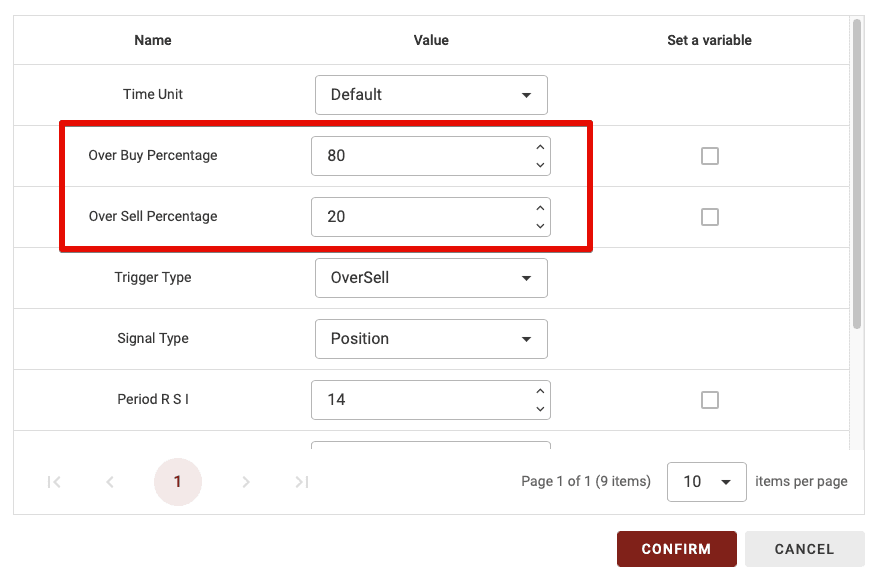

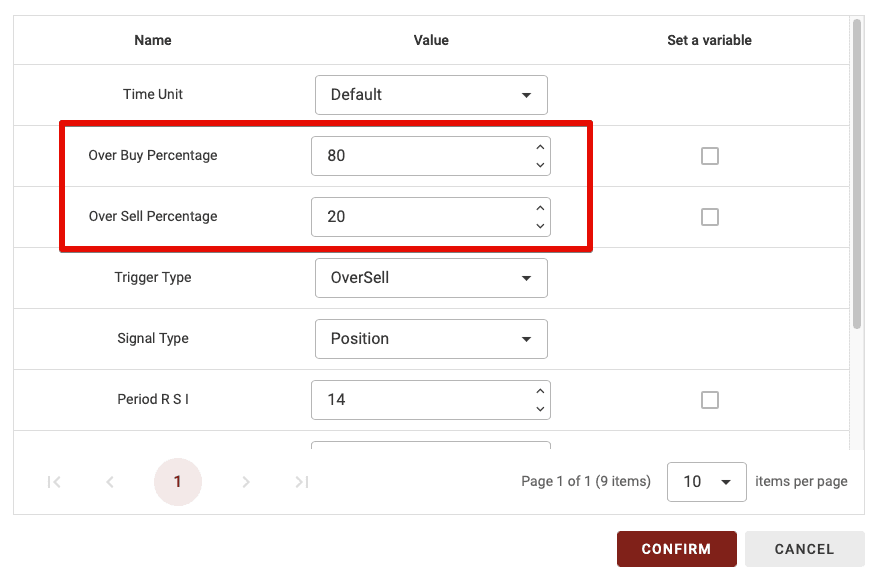

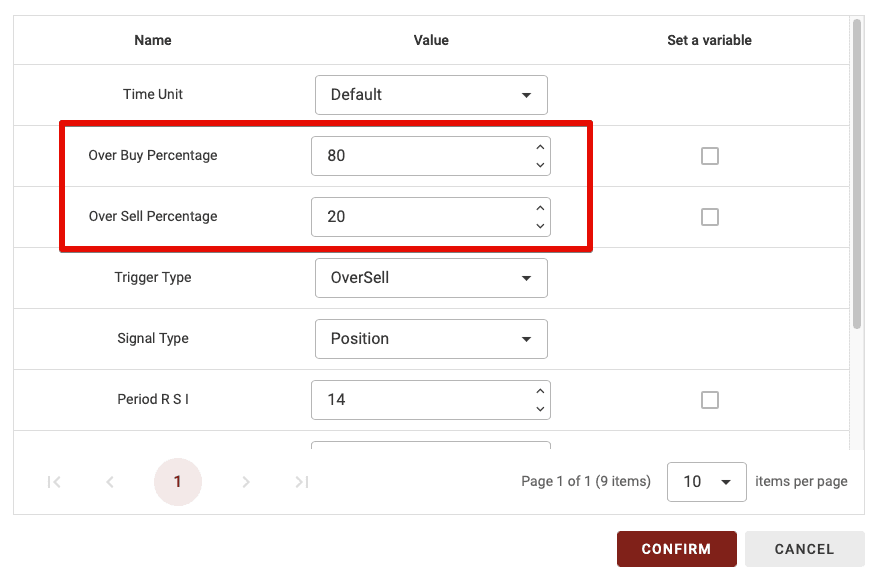

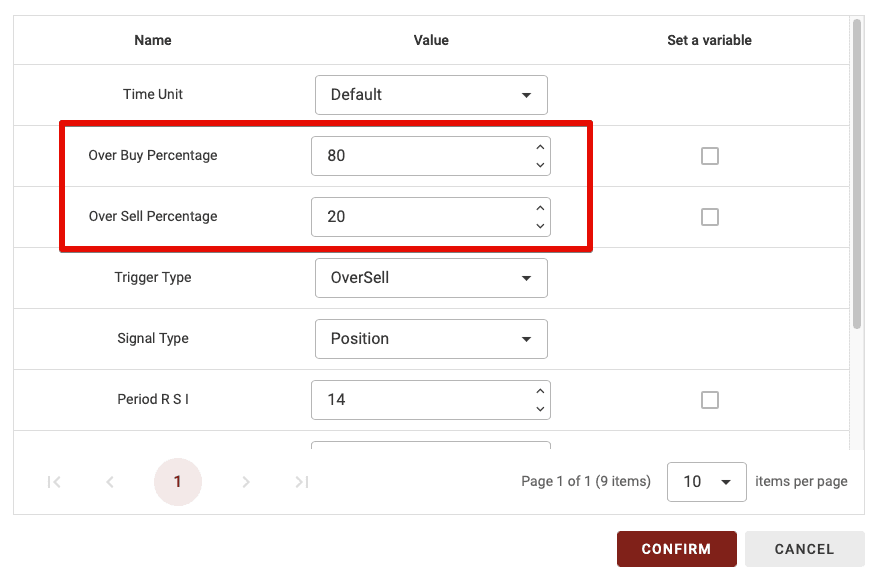

Over Buy & Over sell Percentages

Like the RSI, you need to define overbought and oversold thresholds for the Stochastic RSI. These thresholds determine whether you are in the oversold or overbought zones. By default, the Stochastic RSI uses 20 for the oversold threshold and 80 for the overbought threshold.

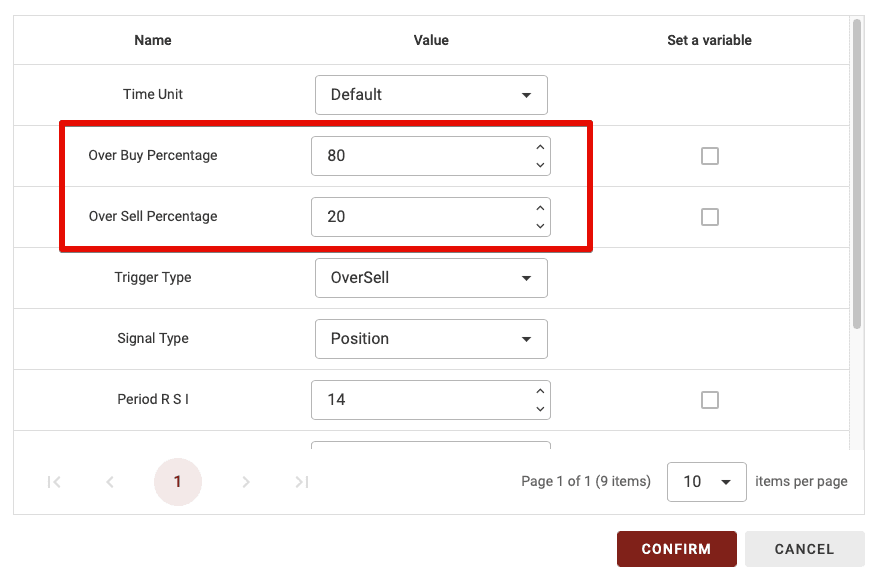

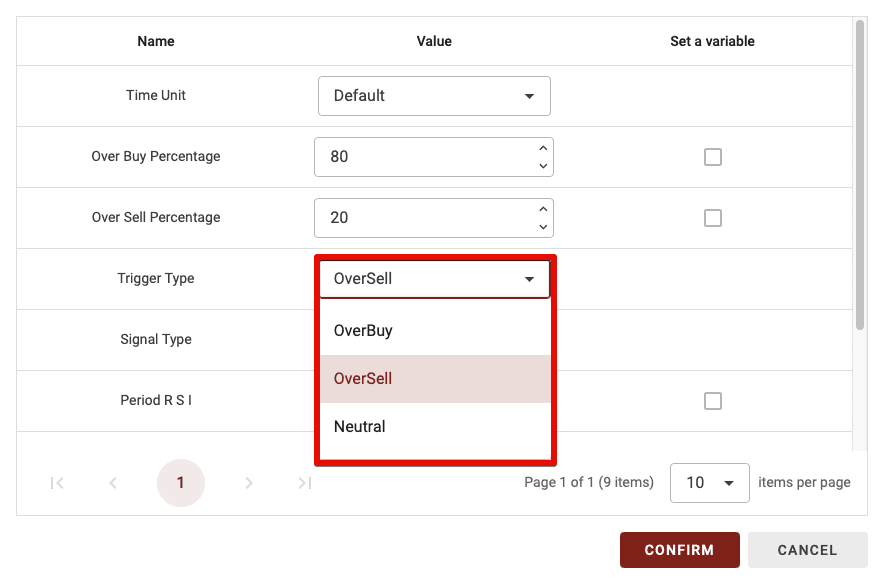

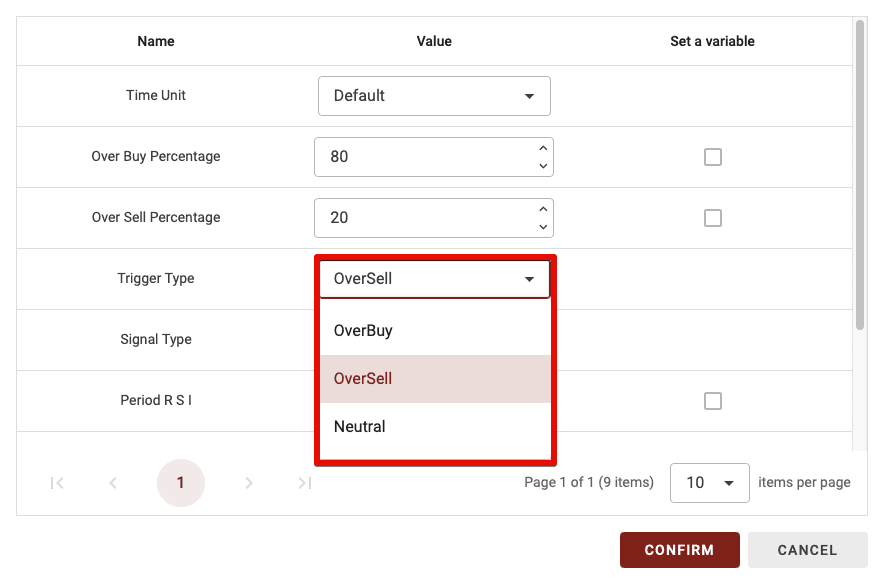

Trigger Type

This parameter has three options. Here’s the difference:

Overbuy: If you set the trigger type to Overbuy, the block is validated if the Stochastic RSI line is above the overbought threshold.

Oversell: If you set the trigger type to Oversell, the block is validated if the Stochastic RSI line is below the oversold threshold.

Neutral: If you set the trigger type to Neutral, the block is validated if the Stochastic RSI line is between the overbought and oversold thresholds.

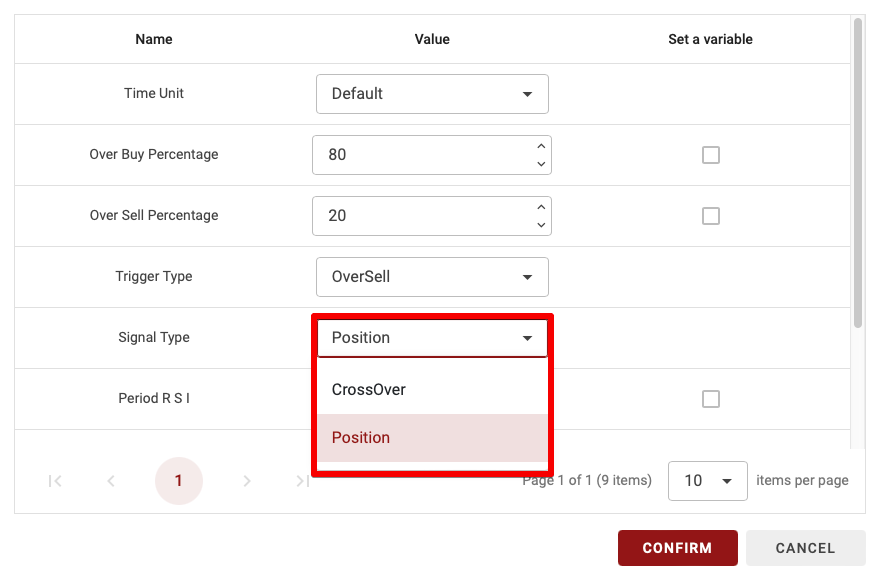

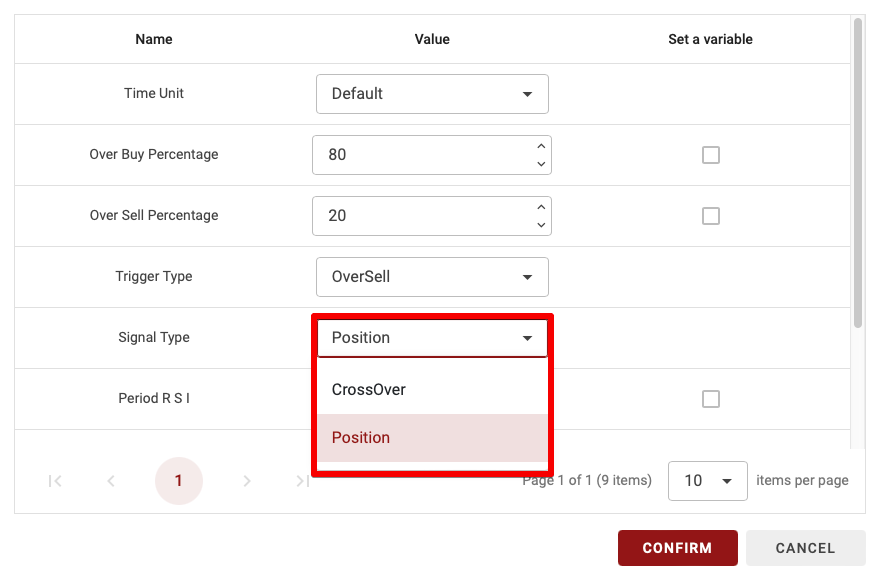

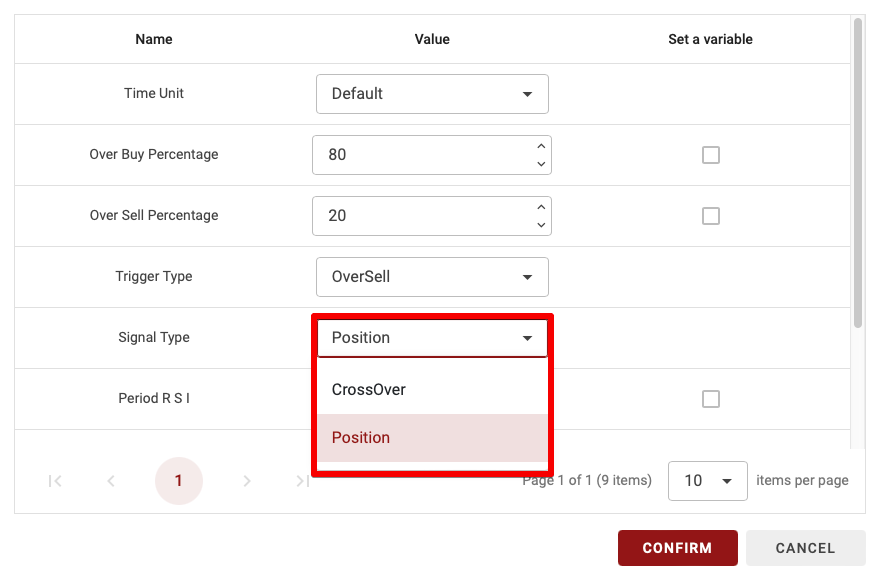

Signal Type

This parameter has two options: CrossOver and Position. Here’s the difference:

CrossOver: If you select CrossOver as the signal type, this block will validate only when you enter the desired zone (Oversell, Neutral, or Overbuy).

Position: With this option, the block is validated as long as you are in the selected Trigger Type (Oversell, Neutral, or Overbuy).

TIPS: The CrossOver parameter is more restrictive, making it useful when combining only one or two indicators. However, using too many blocks with CrossOver will significantly reduce the number of trades in your strategy, as it requires, for example, a crossover between the two MAs + a crossover at the RSI 70 threshold + a crossover in the Vortex indicator.

So, if you’re a beginner, avoid setting more than one or two blocks to CrossOver when combining multiple indicator blocks.

Period RSI & Period Stoch

As with most indicators, you need a period to calculate your indicators. By default, this will be set to 14 for both the RSI and the Stochastic RSI (which uses the RSI in its calculation).

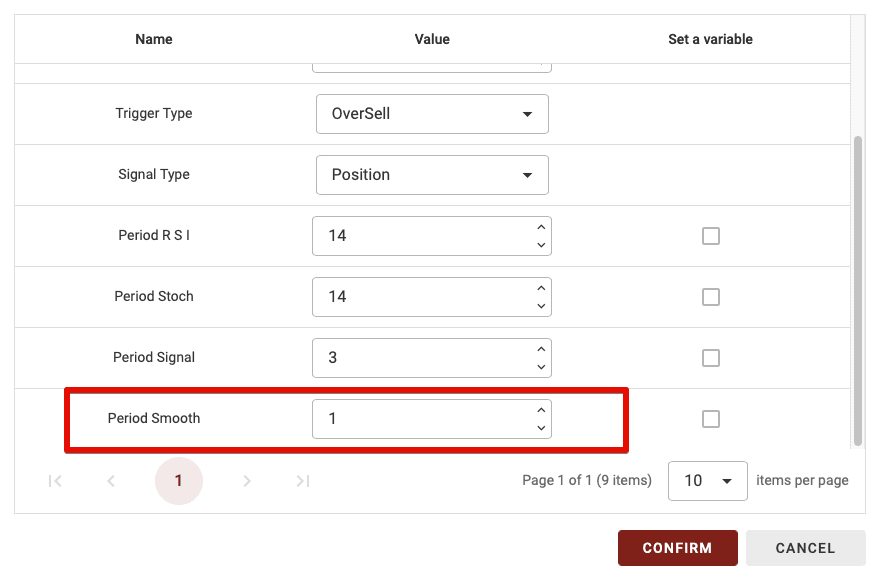

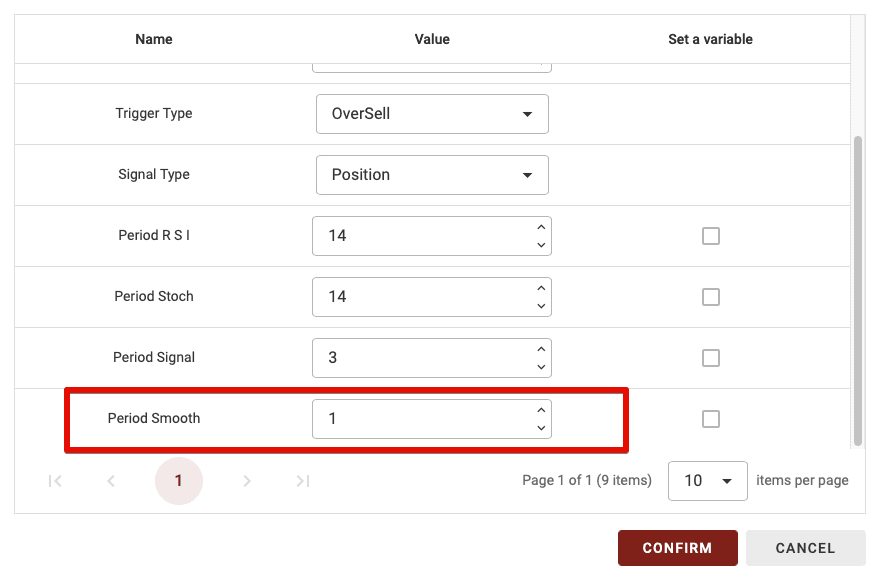

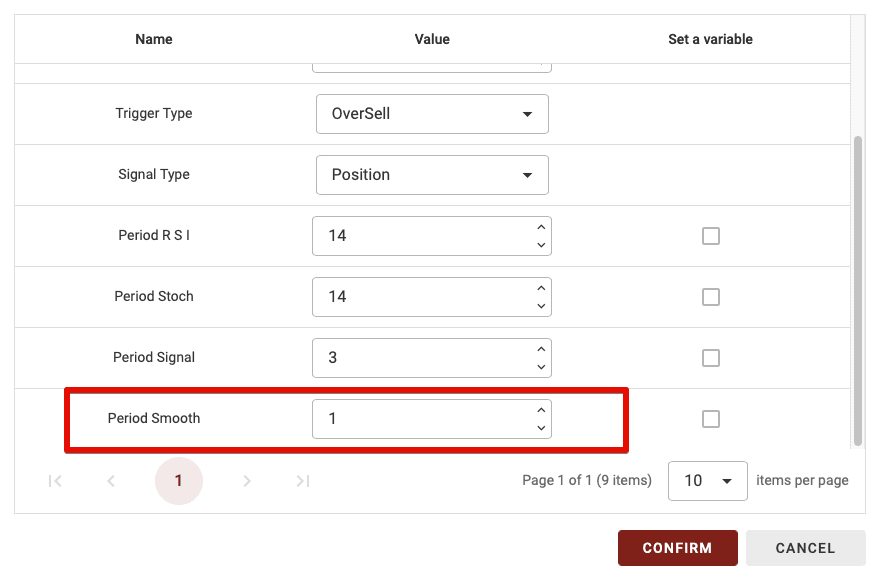

Period Smooth

After calculating the Stochastic RSI curve, you can choose to smooth it by applying a moving average. By default, this value is set to 1, meaning a moving average over 1 period, which represents no smoothing. However, if you increase the value, you will make the Stochastic RSI curve smoother.

The Stochastic RSI Block Configuration

On BullTrading, you have several options to configure each block uniquely. In this block, you can set the time unit, thresholds, and more.

Time Unit

Since BullTrading allows for multi-timeframe strategies, you can select the time period for calculating this indicator. There are two options:

Default: If set to Default, the time unit will vary based on the timeframe used in the backtest.

15m, 30m, 1d, etc.: Choosing a specific time unit means this setting will apply regardless of the time unit used for backtesting your strategy.

TIPS: If you’re a beginner, it’s recommended to leave the time unit on Default.

Over Buy & Over sell Percentages

Like the RSI, you need to define overbought and oversold thresholds for the Stochastic RSI. These thresholds determine whether you are in the oversold or overbought zones. By default, the Stochastic RSI uses 20 for the oversold threshold and 80 for the overbought threshold.

Trigger Type

This parameter has three options. Here’s the difference:

Overbuy: If you set the trigger type to Overbuy, the block is validated if the Stochastic RSI line is above the overbought threshold.

Oversell: If you set the trigger type to Oversell, the block is validated if the Stochastic RSI line is below the oversold threshold.

Neutral: If you set the trigger type to Neutral, the block is validated if the Stochastic RSI line is between the overbought and oversold thresholds.

Signal Type

This parameter has two options: CrossOver and Position. Here’s the difference:

CrossOver: If you select CrossOver as the signal type, this block will validate only when you enter the desired zone (Oversell, Neutral, or Overbuy).

Position: With this option, the block is validated as long as you are in the selected Trigger Type (Oversell, Neutral, or Overbuy).

TIPS: The CrossOver parameter is more restrictive, making it useful when combining only one or two indicators. However, using too many blocks with CrossOver will significantly reduce the number of trades in your strategy, as it requires, for example, a crossover between the two MAs + a crossover at the RSI 70 threshold + a crossover in the Vortex indicator.

So, if you’re a beginner, avoid setting more than one or two blocks to CrossOver when combining multiple indicator blocks.

Period RSI & Period Stoch

As with most indicators, you need a period to calculate your indicators. By default, this will be set to 14 for both the RSI and the Stochastic RSI (which uses the RSI in its calculation).

Period Smooth

After calculating the Stochastic RSI curve, you can choose to smooth it by applying a moving average. By default, this value is set to 1, meaning a moving average over 1 period, which represents no smoothing. However, if you increase the value, you will make the Stochastic RSI curve smoother.

The Stochastic RSI Block Configuration

On BullTrading, you have several options to configure each block uniquely. In this block, you can set the time unit, thresholds, and more.

Time Unit

Since BullTrading allows for multi-timeframe strategies, you can select the time period for calculating this indicator. There are two options:

Default: If set to Default, the time unit will vary based on the timeframe used in the backtest.

15m, 30m, 1d, etc.: Choosing a specific time unit means this setting will apply regardless of the time unit used for backtesting your strategy.

TIPS: If you’re a beginner, it’s recommended to leave the time unit on Default.

Over Buy & Over sell Percentages

Like the RSI, you need to define overbought and oversold thresholds for the Stochastic RSI. These thresholds determine whether you are in the oversold or overbought zones. By default, the Stochastic RSI uses 20 for the oversold threshold and 80 for the overbought threshold.

Trigger Type

This parameter has three options. Here’s the difference:

Overbuy: If you set the trigger type to Overbuy, the block is validated if the Stochastic RSI line is above the overbought threshold.

Oversell: If you set the trigger type to Oversell, the block is validated if the Stochastic RSI line is below the oversold threshold.

Neutral: If you set the trigger type to Neutral, the block is validated if the Stochastic RSI line is between the overbought and oversold thresholds.

Signal Type

This parameter has two options: CrossOver and Position. Here’s the difference:

CrossOver: If you select CrossOver as the signal type, this block will validate only when you enter the desired zone (Oversell, Neutral, or Overbuy).

Position: With this option, the block is validated as long as you are in the selected Trigger Type (Oversell, Neutral, or Overbuy).

TIPS: The CrossOver parameter is more restrictive, making it useful when combining only one or two indicators. However, using too many blocks with CrossOver will significantly reduce the number of trades in your strategy, as it requires, for example, a crossover between the two MAs + a crossover at the RSI 70 threshold + a crossover in the Vortex indicator.

So, if you’re a beginner, avoid setting more than one or two blocks to CrossOver when combining multiple indicator blocks.

Period RSI & Period Stoch

As with most indicators, you need a period to calculate your indicators. By default, this will be set to 14 for both the RSI and the Stochastic RSI (which uses the RSI in its calculation).

Period Smooth

After calculating the Stochastic RSI curve, you can choose to smooth it by applying a moving average. By default, this value is set to 1, meaning a moving average over 1 period, which represents no smoothing. However, if you increase the value, you will make the Stochastic RSI curve smoother.

Similar articles

You may also like

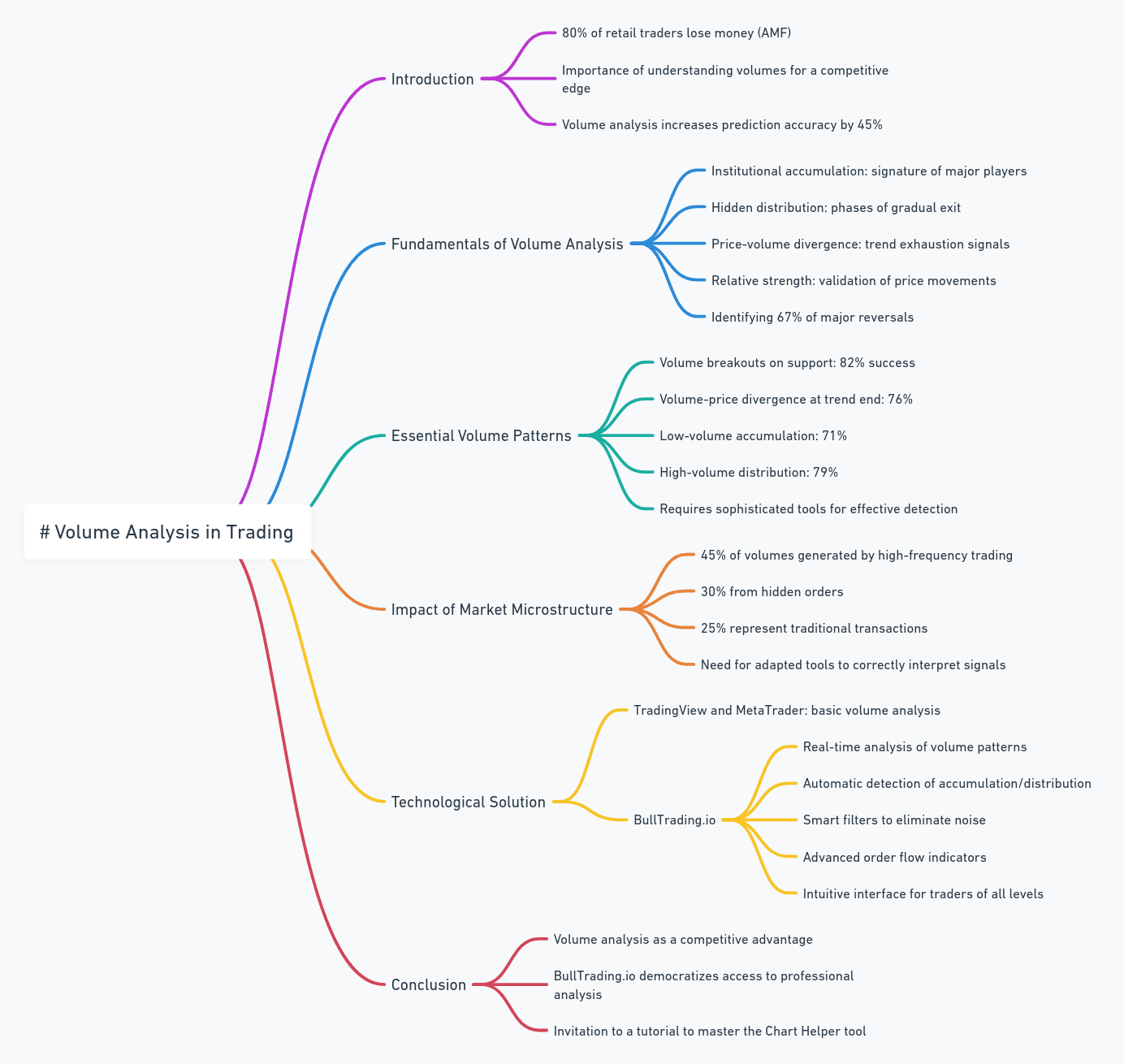

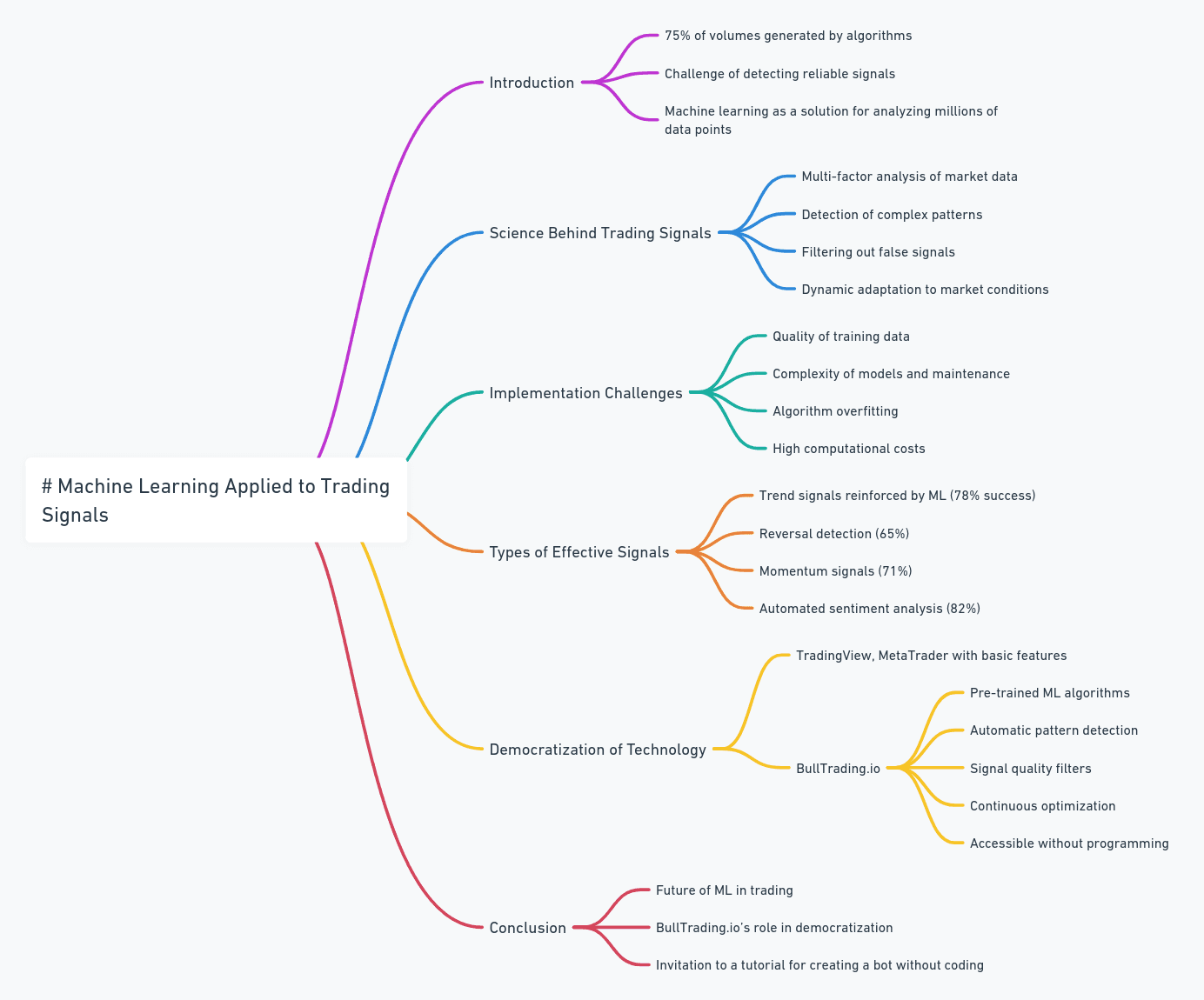

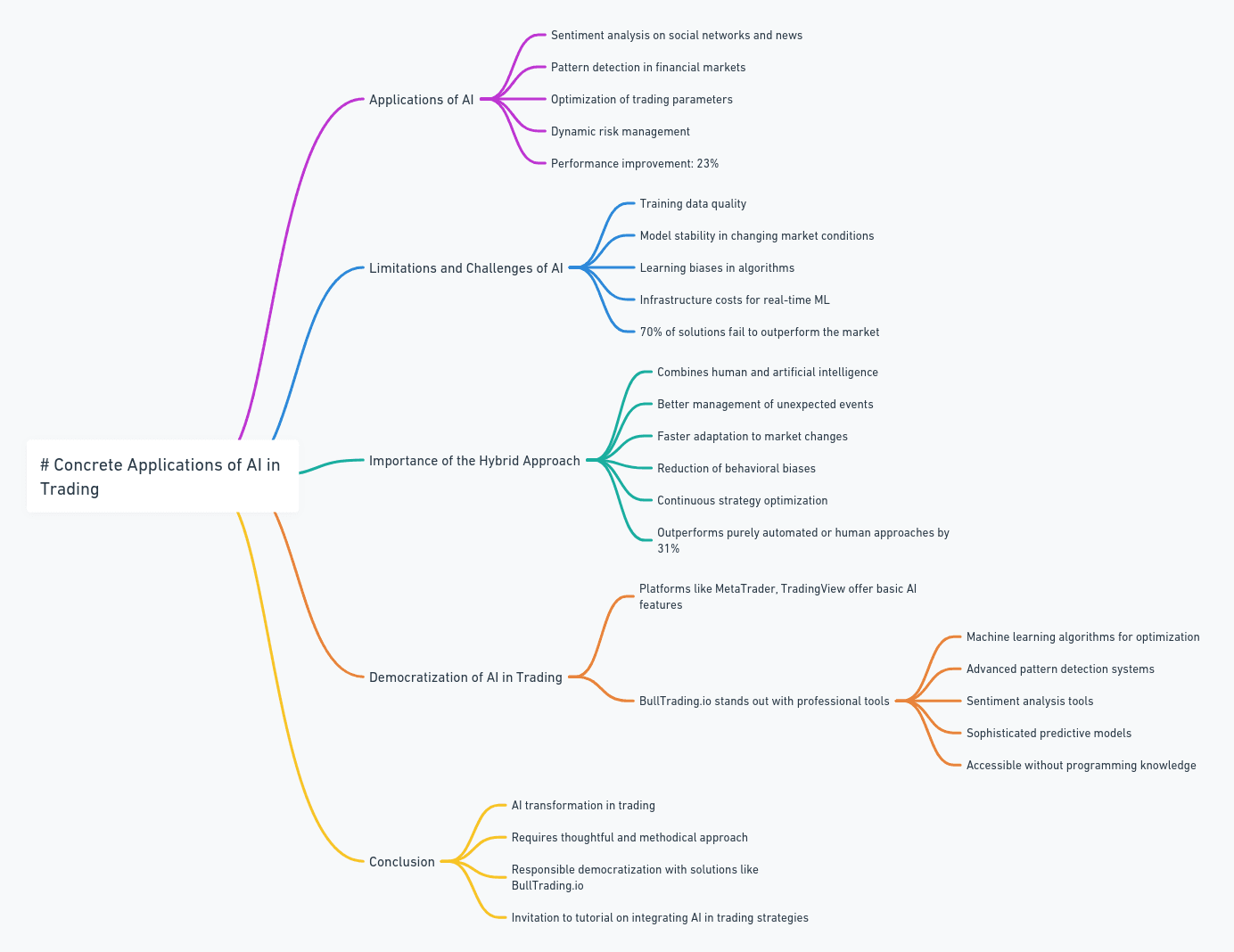

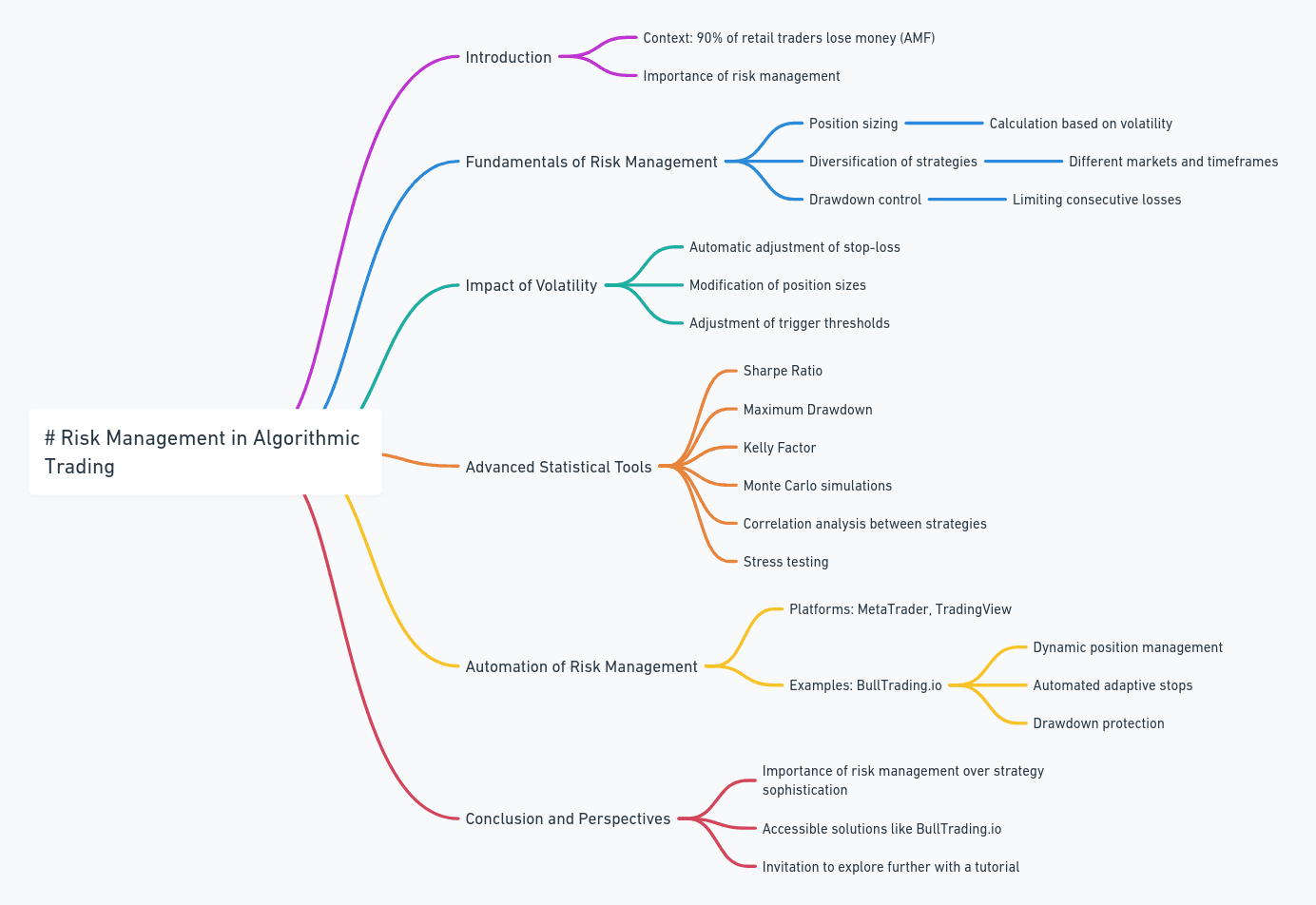

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Similar articles

You may also like

Master key indicators to optimize your trading strategies.

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required

Start Trading Today

Join over 11,000 traders worldwide on the ultimate platform for beginners and experienced traders.

Trading Bots

Custom strategies

No skills required